Global net zero commitments rise, even as US retreats

John Lang

12 years: Sustainability and Net Zero

Net Zero Tracker lead, John Lang, introduces the 2025 Net Zero Stocktake 2025.

Net Zero Tracker lead, John Lang, introduces the 2025 Net Zero Stocktake 2025 — which busts the myth of a ‘net zero recession’ — showing corporate commitments continuing to climb in the US, Asia and beyond.

- US companies with net zero targets jump 9% in one year, now representing $12 trillion in global annual revenue — 64% of the revenue of assessed US companies.¹

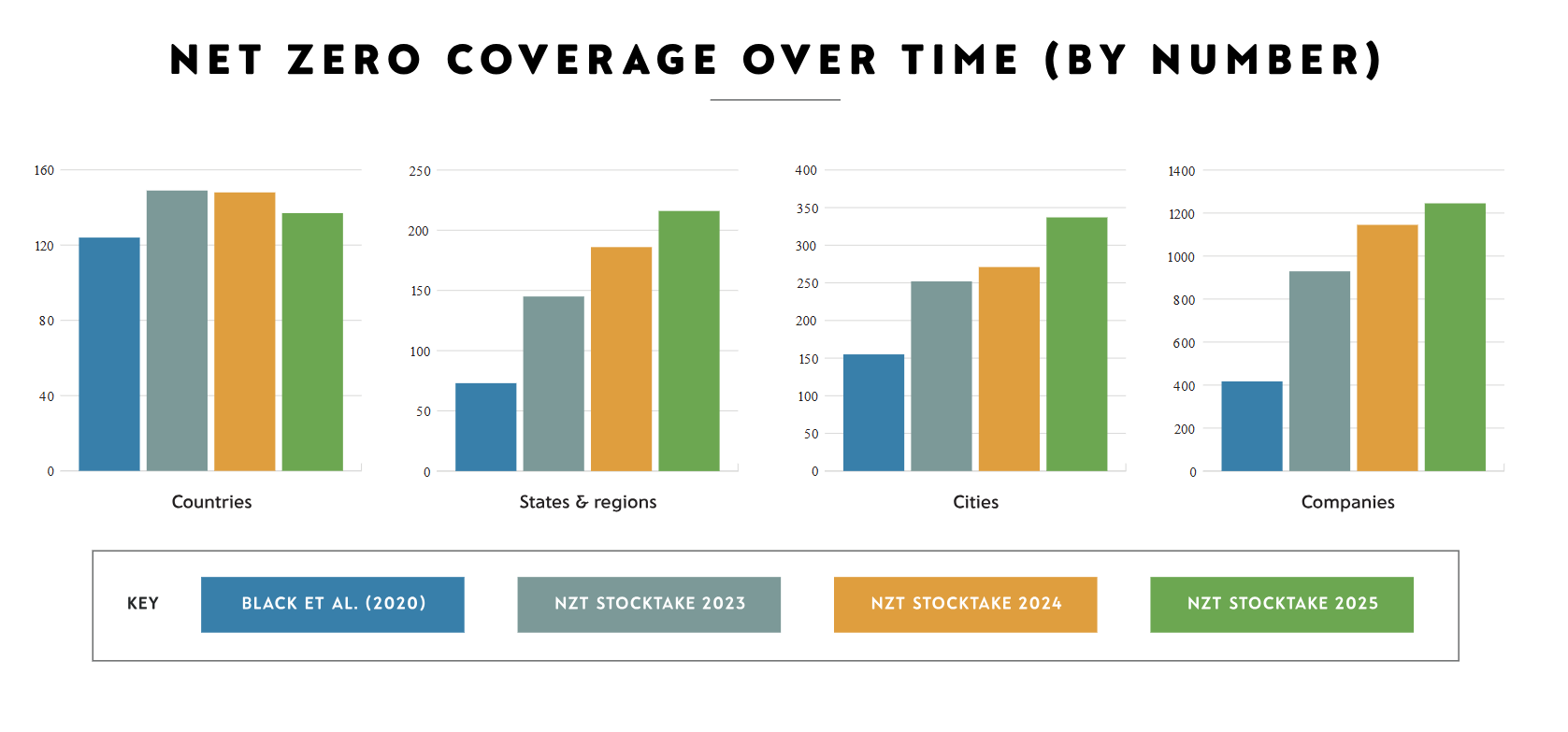

- Globally, target-setting is expanding across companies, regions and cities, but country-level target coverage dips following US federal retreat.

- Nearly half of subnational governments and companies assessed still lack a public emissions reduction target.

- There is modest progress in the quality of company targets, but the overwhelming majority still need to improve to meet best-practice minimum standards.

- One-third of companies plan to rely on nature-based carbon removals, while only 4% have set clear, separate targets for removals.

Net Zero Stocktake 2025, released at New York Climate Week, revealed that net zero target-setting continues to expand across companies, regions and cities, even as country-level coverage dips following the US federal retreat. Nearly half of subnational governments and companies assessed still lack a public emissions reduction target.

Corporate net zero is maturing

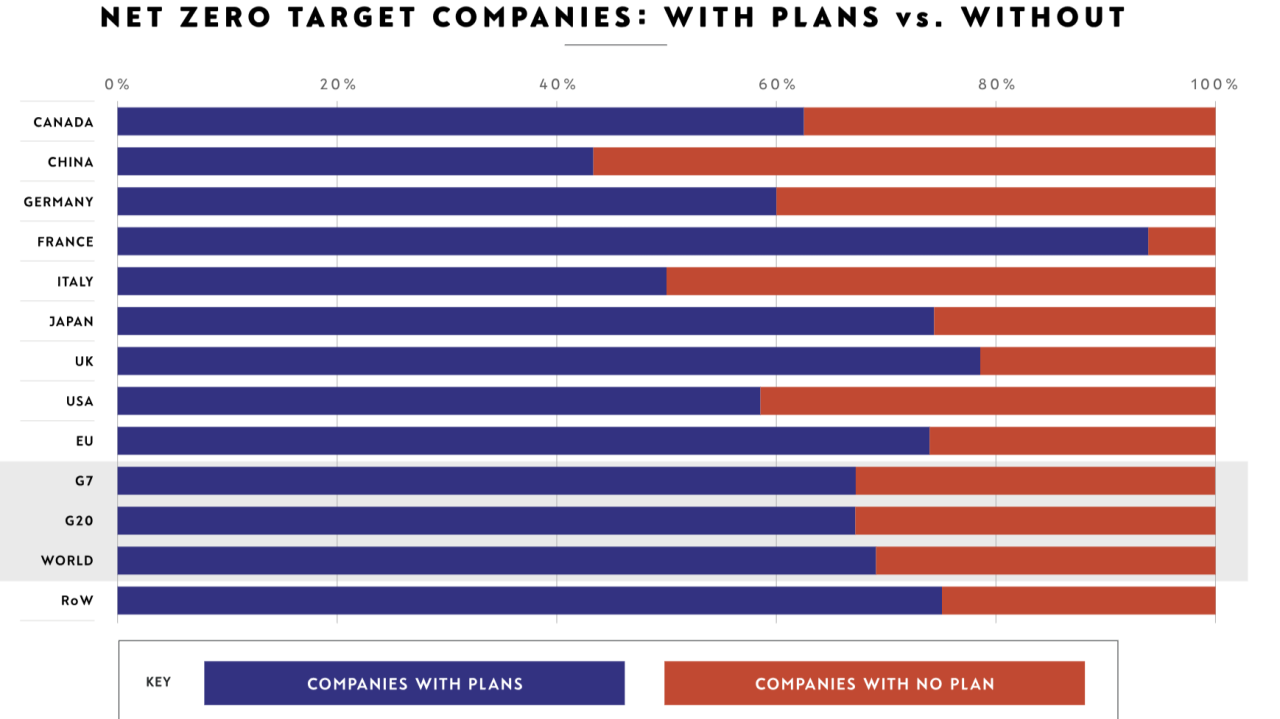

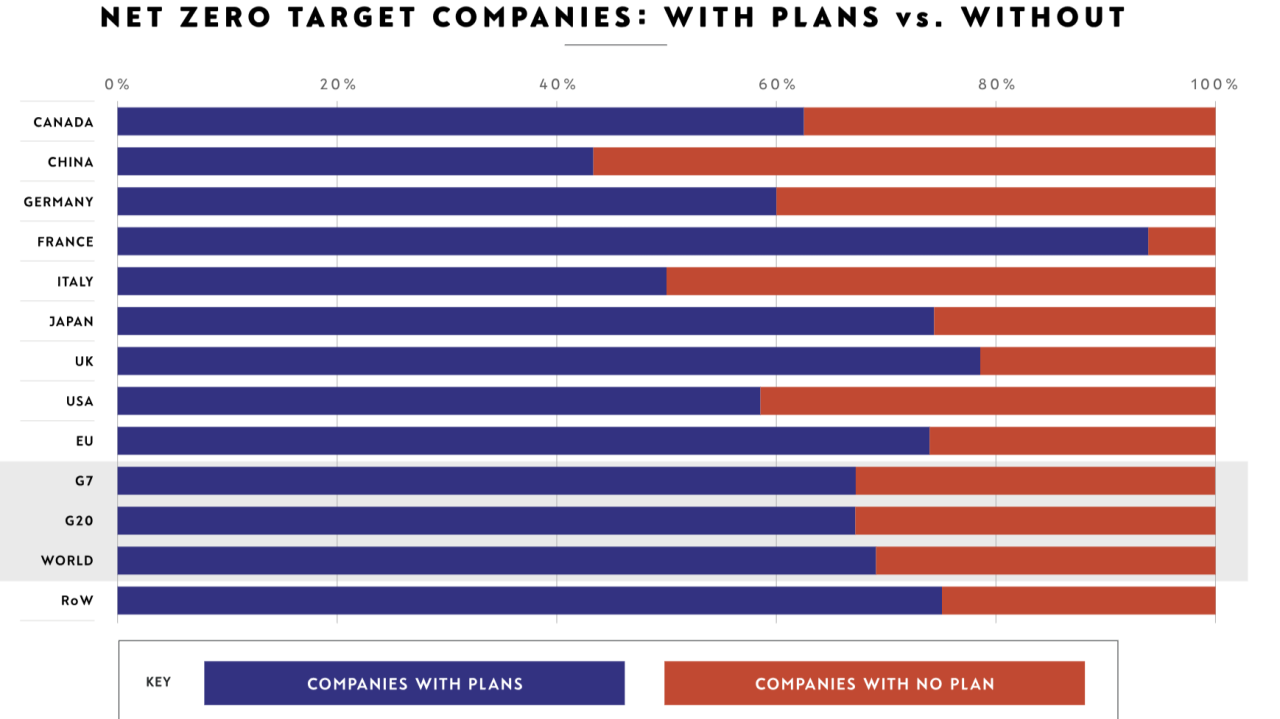

Net zero targets remain a defining feature of the global economy, with a clear majority of the largest listed companies within the Global Forbes 2000 having set targets and most backing them up with plans.

- 70% of the revenue of Forbes Global 2000 companies, representing $36.6 trillion, is covered by listed companies’ net zero targets.

- Target-setting continues to increase in Asia, notably in China (48 to 60), India (29 to 34), Japan (from 184 to 199), South Korea (41 to 48), Taiwan (26 to 35) and Thailand (11 to 15).

- Worldwide, over two thirds of Forbes Global 2000 companies with net zero targets (860/1,245) back these up with plans.

The Stocktake shows that clearer standards, a steady rise in national climate regulation, and companies’ determination to protect their investments are together driving the continued rise in net zero targets.

US subnational action sustains domestic — and global — momentum

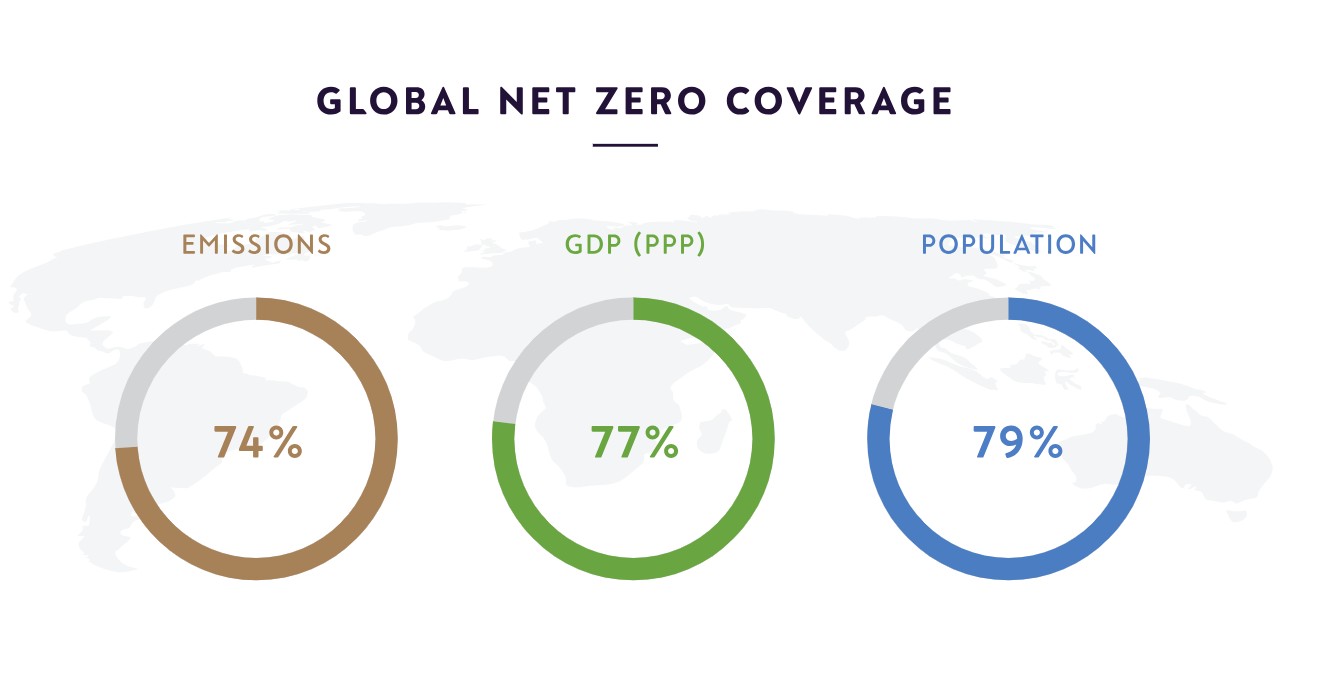

The US’s abandonment of its federal net zero target saw global net zero coverage, by national-level commitments, fall from 93% to 77% of GDP. But subnational and company leaders have sustained momentum:

- 19 US states remain committed to net zero. If state targets are included, worldwide net zero coverage jumps to 83% of global GDP.

- Net zero commitments by US headquartered companies grew 9% in the last year — from 279 to 304, including new commitments from eBay, Merck & Co, and Goodyear.

- These 304 companies account for $12 trillion in global revenue — 64% of US corporate revenue assessed, the largest absolute share worldwide.

- Over half (52%) of America’s largest companies now have net zero targets.

Talk of a ‘net zero recession’ is overblown. Backtracking is confined to fossil fuels and their financiers, while more companies are moving from box-ticking to real emission cuts — a long-overdue reset.

More entities join net zero race, but still few are ready to run it

While commitments continue to rise, the quality of net zero strategies continues to lag. Our review against the ‘Starting Line’ integrity criteria² shows minimal progress over the past year:

- 7% of company net zero targets (90/1,245) meet the integrity criteria, though the number of companies at the ‘Starting Line’ doubled in 12 months, from 45.

- 4% of city net zero targets (13 of 337) meet integrity criteria — unchanged since 2024, although net zero coverage increased from 271 cities to 337.

- 6.5% of regions (14/216) meet the integrity criteria, up from 3.5% since 2024, although net zero coverage increased from 186 to 216 regions.

Net zero excuse — nearly half still missing

The Stocktake also shows that nearly half (1,548/3,885) of subnational governments and companies assessed still have yet to set an emissions reduction target — 424 companies are operating without any emission reductions target.

Nature — A growing focus, but risks remain

Net zero cannot be achieved without investing in, protecting and restoring nature — but some current corporate practice risks turning nature into a loophole.

The 2025 Stocktake includes a special focus on nature and land use, highlighting corporate reliance on nature-based solutions and trends in food and agriculture.

- Around one-third of companies with net-zero targets plan to use nature-based carbon removals such as reforestation or peatland restoration.

- Yet only 4% set clear, separate targets for carbon removals — a key transparency measure that can help prevent overreliance on scarce removals and show how serious a company is about reducing emissions directly.

- Amongst the world’s 30 largest food and agriculture firms, the number of climate targets has remained stable in 2025, but their focus is shifting:

- Short-term targets are being dropped or delayed.

- Longer-term pledges — often aligned with the SBTi’s new FLAG (Forest, Land and Agriculture) guidance — are becoming more common.

- An increasing number of companies are planning to meet their targets via land-based removals. These bring co-benefits for biodiversity and ecosystems, but cannot substitute for deep, structural reductions in emissions from fossil fuels.

The path forward

Most governments and companies are persisting — and in many cases strengthening — their net zero commitments. The US federal retreat is an outlier; momentum across Asia continues to build, and no other major emitter has followed Washington's withdrawal.

Several oil, gas and financial firms have weakened or abandoned targets, but the broader trend is one of resilience.

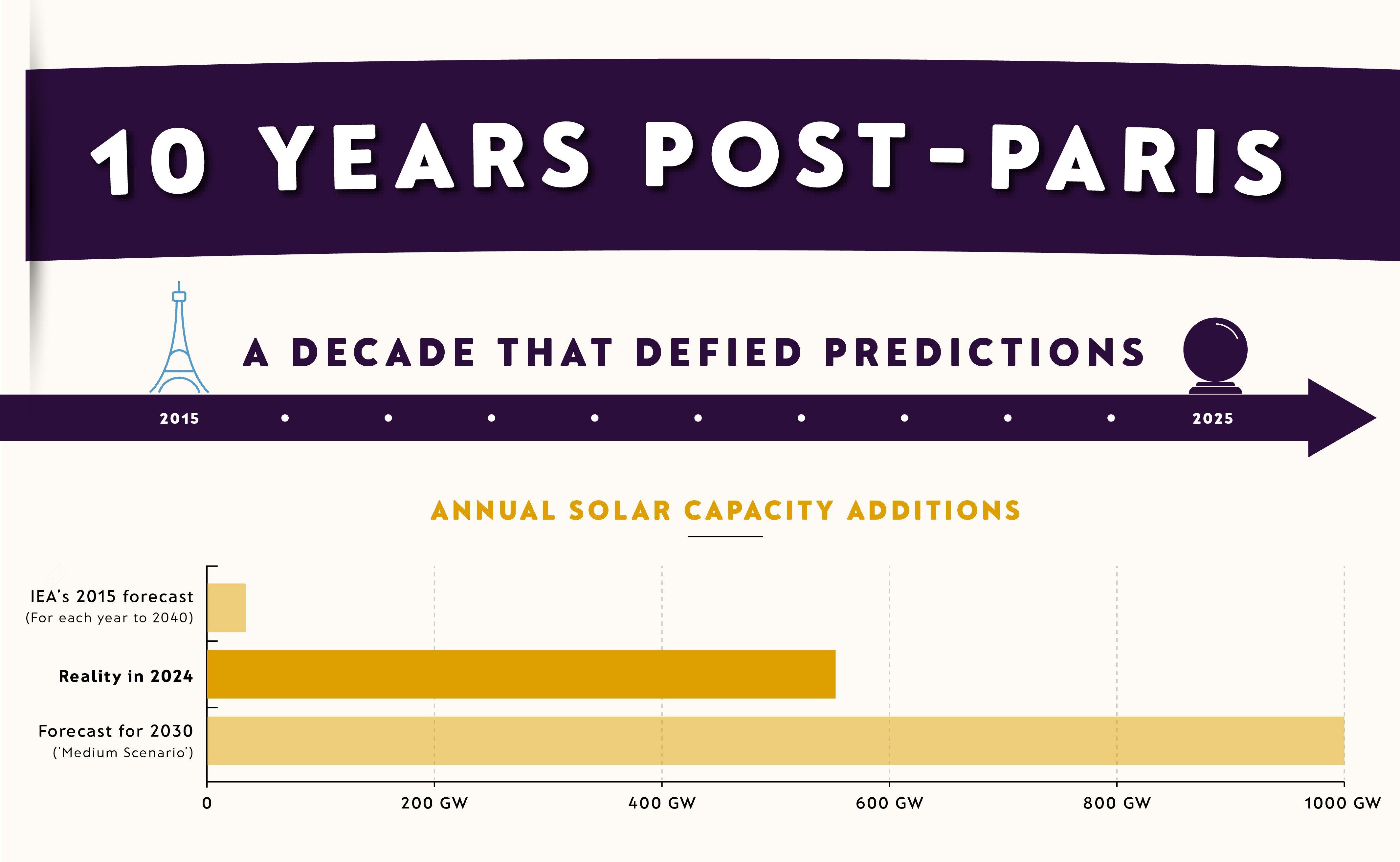

Net zero targets have continued to grow in number, even in 2025 — the most contested year yet — because they remain tied to prosperity, security and competitiveness. Low-carbon sectors are booming, fossil fuel demand is nearing structural decline, and clean energy is attracting investment at twice the rate of fossil fuels.

Net zero is not inevitable, but its resilience through the turbulence of 2025 is itself a powerful signal. The challenge now is to ensure that the next generation of targets, plans and policies is resilient enough to survive political turbulence and deliver deep decarbonisation.

To zoom in on the details, please see Net Zero Stocktake 2025.

References

- ¹ Additions or removals of targets typically reflect either changes by the entity to its target status or enhanced data collection and broader coverage of major languages beyond English.

- ² The ‘Starting Line’ criteria, set out by the UN-founded Race to Zero campaign, comprise:setting a specific net zero target; coverage of all greenhouse gases; (+ all emission scopes for companies); clear conditions for the use of offsets; a published plan; implementation of immediate emission-cutting measures; and annual progress reporting on both interim and longer term targets).

John Lang

Share "Global net zero commitments rise, even as US retreats" on