Beyond COP30: Beyond greenwashing

Maria Coronado Robles

How businesses can, and must, prove credible action on the sustainability challenges ahead

This year’s COP30 in Belém, Brazil, may be over. But the stakes we now face could not be higher. Leading climate expert Johan Rockström used the summit to warn that the world must remove around 10 billion tons of carbon dioxide every year to keep global heating at no more than 1.7 degrees above pre-industrial levels, already an overshoot on the 1.5-degree ceiling set in the Paris Agreement.

Fossil fuels will need to be phased out by mid-century, carbon removal technologies will have to scale at unprecedented speed, and political pressure will need to be maintained every year until ambition meets action.

The weight of expectation is daunting. And yet, the contradictions of the global climate effort were plain to see at the summit, and not just because of the notable absence of a single US delegate.

Activists, for example, accused the summit’s new AgriZone — sponsored by agribusiness giants such as Nestlé and Bayer — of being a greenwashing exercise, giving high-emission industries a platform to pose as climate champions while driving deforestation and ecological loss across the Amazon.

This is a familiar conflict, pointing to an insistent and consistent gap between message and action that haunts every conversation from corporate boardrooms to political debates and global summits. With President Trump only recently calling climate science a ‘con job’, the real danger is we leave another COP with the view that it is at best pointless, and at worst, a total fake.

But the charge of greenwashing is in many ways testament to how important sustainability has become. There is broad acknowledgement of the need to appear sustainable even if you are not — ie, glossing over the facts, and hoping to get away with it.

And it reveals a far deeper, systemic problem: greenwashing persists because too many organisations and leaders still view sustainability as messaging.

It’s not. Sustainability is about people. It’s about capability. And the businesses that understand this will not only generate enormous value for themselves; they will lead the global transformation ahead.

The credibility crisis in sustainability

For all the progress of the past decade, greenwashing has become the Achilles’ heel of corporate sustainability.

According to RepRisk’s 2025 Greenwashing and Biodiversity Report, nearly 300 financial institutions were flagged for greenwashing this year — more than any other sector. The data also shows that greenwashing risk is rising fastest where biodiversity risk is highest.

The report findings included:

- Biodiversity accounted for 38% of environmental risk incidents in the year ending June 2025, making it the most frequently flagged environmental issue, followed by pollution (33%), and waste (17%).

- The US, Brazil, Italy, France and Germany ranked among the top ten for both biodiversity and greenwashing risk incidents, while both the US and UK experienced notable increases in greenwashing risk over the past year.

- The largest share of reported biodiversity risk incidents – one in every ten – occurred in the US.

- Italy, France, and Germany, were found to be more likely to surface high risk incidents due to high levels of monitoring and reporting that expose organisations whose commitments are misaligned with actions.

These issues can no longer be hidden. They are public. Widespread reporting of protesters breaking through security lines at COP30, carrying signs saying “our forests are not for sale”, underlines the credibility crisis. When the world’s flagship climate conference becomes a battleground over authenticity, it’s a warning sign for every boardroom. Firms can no longer rely on climate-friendly rhetoric divorced from evidence.

And for those that do, increased regulatory scrutiny and enforcement actions will step in to show how risky greenwashing can now be:

- DWS Group (Germany) – fined €25 million for making misleading statements about its environmental and social investing credentials.

- HSBC and Lloyds (UK) – adverts banned for breaching the UK advertising watchdog’s rules against greenwashing, by promoting climate-friendly policies while omitting to communicate their significant contribution to carbon emissions.

It’s not just about avoiding penalties either. Firms are increasingly at risk of losing opportunities too. Dutch asset manager PGGM, for example, recently terminated €14.5 billion of mandates with BlackRock and €15 billion with Legal & General over what it considered weak sustainability governance. This follows in the steps of the People’s Pension, which earlier this year moved £28 billion out of State Street, due to concerns over its stance on climate.

Meanwhile, the world moves on. After a decade of climate finance pledges, including COP29's $300 billion annual goal by 2035, the focus is now shifting toward concrete and credible ways to actually deploy those funds for real climate and resilience outcomes. COP30 heralds new policies such as Brazil’s proposed national sustainable taxonomy — a “dictionary of sustainability” defining which economic activities genuinely qualify as sustainable. With stricter emissions thresholds than the EU’s framework, and the integration of social factors like gender and racial equity, it could become a new global benchmark for credibility.

In addition, the Baku–Belém Climate Finance Roadmap aims to mobilise USD 1.3 trillion per year by 2035 in climate finance (more than four times the previous target), with biodiversity and carbon removal as core pillars. This represents a further structural shift in capital allocation — from speculative ESG narratives toward measurable, science-aligned impact.

What next? Keeping up with progress on climate action

Some firms understand the magnitude of the change. They know sustainability matters, even if they don’t own the solutions. Take outdoor clothing and equipment retailer Patagonia. It has just published its first sustainability report that attempts to put authenticity at the heart of its approach.

It doesn’t shy away from the considerable difficulties the business, or the wider retail sector, faces in becoming sustainable. It states up top, “Nothing we do is sustainable”, and says it will never be possible to give back more than it takes.

But it still details the ways in which it is trying to mitigate the impact of its actions, from the way it sources cotton to how it addresses the welfare of workers. And it is specific about its plans, how it will measure success, and the progress it has, or hasn’t made, in the context of the scale of the challenge it faces — for instance, in using secondary waste sources (materials made from textile waste or ocean-bound nets) to make synthetic fabrics.

It reflects the growing determination to make good on a journey to sustainability already well underway. Christiana Figueres, a leader on climate change and one of the architects of the Paris deal, shared this sentiment at COP30, saying decarbonisation of the global economy is irreversible. “Momentum is building into the point where it is simply unstoppable, with or without the United States,” she said.

We saw this ourselves first hand at Climate Week NYC, from where Henry White, CEO of xUnlocked, wrote his recent insight, Lights in the fog: Positive signals for sustainability investment. The piece explored the positive conversations coming out of the event, underpinned by a continuing growth of the sustainable finance market, surpassing $8.2 trillion in 2024 — up 17 percent from 2023 — and a record issuance of green and sustainability-linked bonds over $1 trillion.

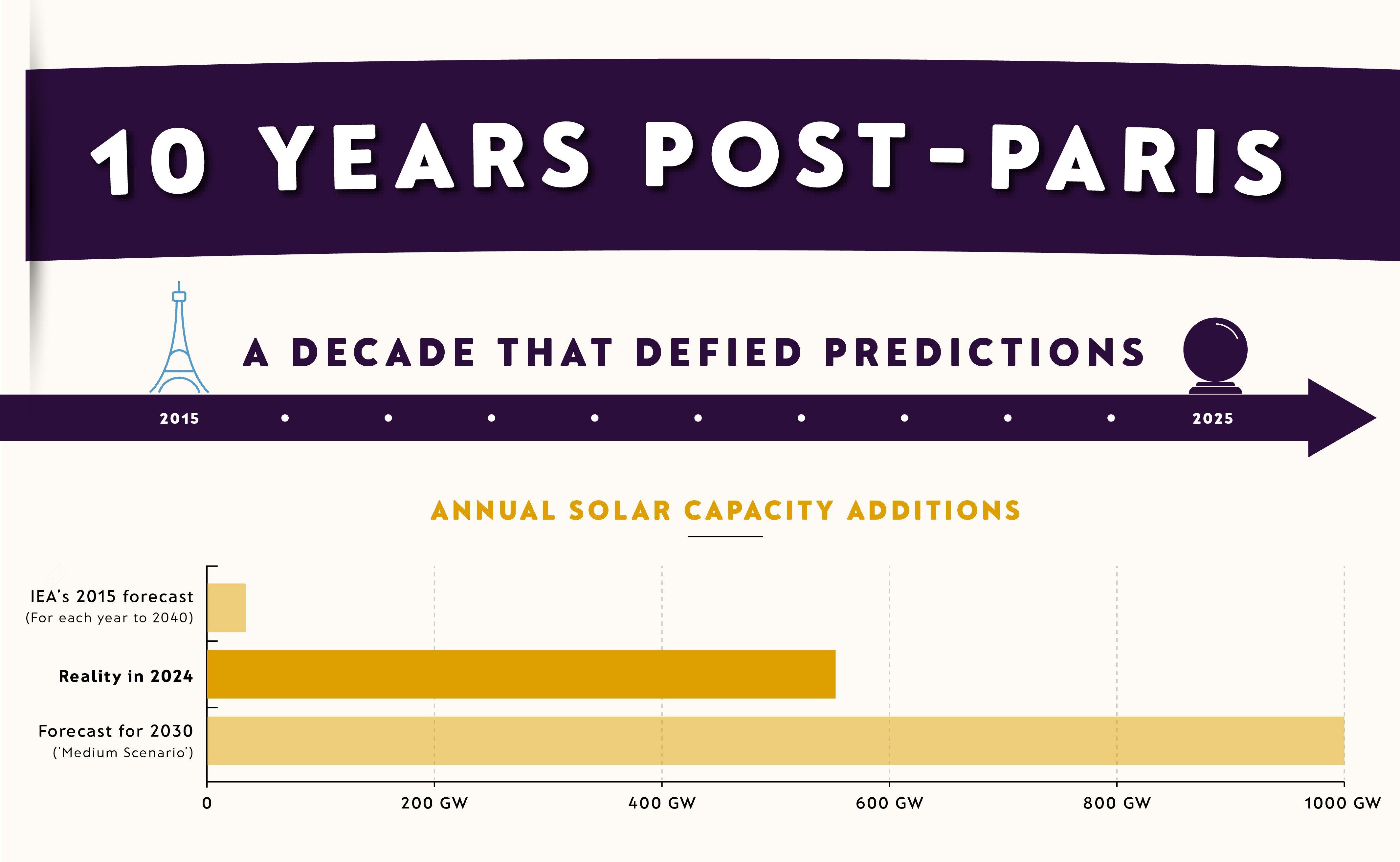

This is translating to unmistakable results. According to a recent report from the Energy & Climate Intelligence Unit (ECIU), the world is now in a markedly different place to 10 years ago when the Paris Agreement was made. Clean energy investment is now double that of fossil fuels. EVs have surged to 20% of global new car sales and are on track to reach 40% by 2030, a decade ahead of IEA’s 2015 projections. And In China and the UK, the clean energy economy is growing three times faster than the broader economy.

Whatever the current levels of political cynicism, this is real change happening right now, on a global scale.

So why is greenwashing still a problem?

Greenwashing arises because companies still make the mistake of thinking sustainability is about ambition, without taking the far more difficult but necessary steps of executing actual change across their organisations, supply chains, and client/customer relationships.

Businesses are at risk of greenwashing because of:

- Fragmented ownership of sustainability — ESG, risk, and finance operate in silos. Nobody understands or actively manages the sustainability strategy across functions and teams.

- Data inconsistency — conflicting or fragmented metrics compound the silo mentality, and plug in even more confusion. Even the most sophisticated ESG platforms cannot fix the underlying structural issues blocking effective reporting.

- Capability gaps — employees end up approving messaging and disclosures they barely understand on an organisation-wide, risk or policy level.

- One-off compliance — policies are updated yearly instead of being understood and applied continuously at a cultural level.

Even if a company avoids direct penalties, it cannot safeguard its credibility. This can only be achieved through integrated governance, data literacy and fluency, and consistent learning and development at every level of decision-making.

How to avoid greenwashing: The credibility objective

Firms that thrive in this new era will view sustainability not as risk mitigation, but as an operating principle, a way of doing business that embeds credibility and trust at every level. This isn’t about polishing a narrative; it’s about equipping people with the skills and capabilities to make that narrative true.

The companies that lead in this field will:

1. Embed sustainability into governance, not marketing

Too many green claims still originate in isolated corners of the business — comms teams, product teams, or standalone ESG groups — without the governance rigour that ensures those claims reflect reality. Organisations that get this right anchor sustainability inside core decision-making structures:

- Product approvals include mandatory credibility checks.

- Claims are benchmarked against recognised standards and taxonomies.

- Cross-functional teams own sustainability claims together.

- Leaders understand the science, the regulations, and the risks of getting it wrong.

This integrated approach to governance equips people with a deep understanding of what sustainability means, why it matters, and how to embed it in everyday decisions.

2. Build capability at scale

Greenwashing is not usually malicious. It’s often the outcome of a capability gap. People are being asked to interpret ESG metrics, nature impacts, or supply chain disclosures without the foundational knowledge to assess credibility.

Avoiding greenwashing therefore becomes a learning challenge — not a legal one. Workforces need to:

- Understand the fundamentals of climate science, biodiversity, human rights, and material ESG risks.

- Distinguish between real sustainability performance and misleading impressions.

- Spot inconsistencies in data and narratives before they become liabilities.

- Engage confidently with regulators, clients, auditors, and internal stakeholders.

Capability at scale reduces organisational blind spots. When people across the business — not just sustainability specialists — understand the issues, credibility becomes a collective strength.

3. Connect data and decision-making

Credibility collapses when data lives in silos. ESG data in one system, supply chain data in another, financial data somewhere else — and no shared language knitting them together.

Systems may track performance, but only people can interpret meaning and translate it into decisions. Leading firms build governance that connects:

- Environmental data — emissions, land use, biodiversity impacts.

- Financial data — capital allocation, cost of risk, sustainable finance performance.

- Strategic data — transition pathways, regulatory obligations, stakeholder expectations.

More importantly, they ensure the workforce has the capability to interpret this data with confidence, understanding how these datasets interact — and how, for example, a biodiversity risk becomes a legal, financial or reputational risk.

This is where greenwashing is truly prevented: when every claim, every product, every disclosure is rooted in integrated evidence, understood and owned by the people who make decisions every day.

The opportunity ahead

As global summits and regulations converge, the message will consistently come back to credibility. Do your stakeholders — customers, clients, regulators, investors and wider society — believe what you say you will do? And how are you going to prove it?

Firms that continue to treat sustainability as another marketing ploy or compliance exercise will quickly fall behind. But those that prioritise honesty, set a strategy to create long-term value over only short-term profit, and build the right capabilities — across people, data, and decision-making — will not only survive these changing times but define and lead the next era of sustainability.

Because at its core, greenwashing is a people and capability problem, and our response will not only determine the fate of our own businesses, but define the future for every generation to come.

And as COP30 in Belém reminds us, the world is watching.

Maria Coronado Robles

Share "Beyond COP30: Beyond greenwashing" on