Financing Climate Adaptation and Resilience

Meggie Eloy

5 years: Technical analysis

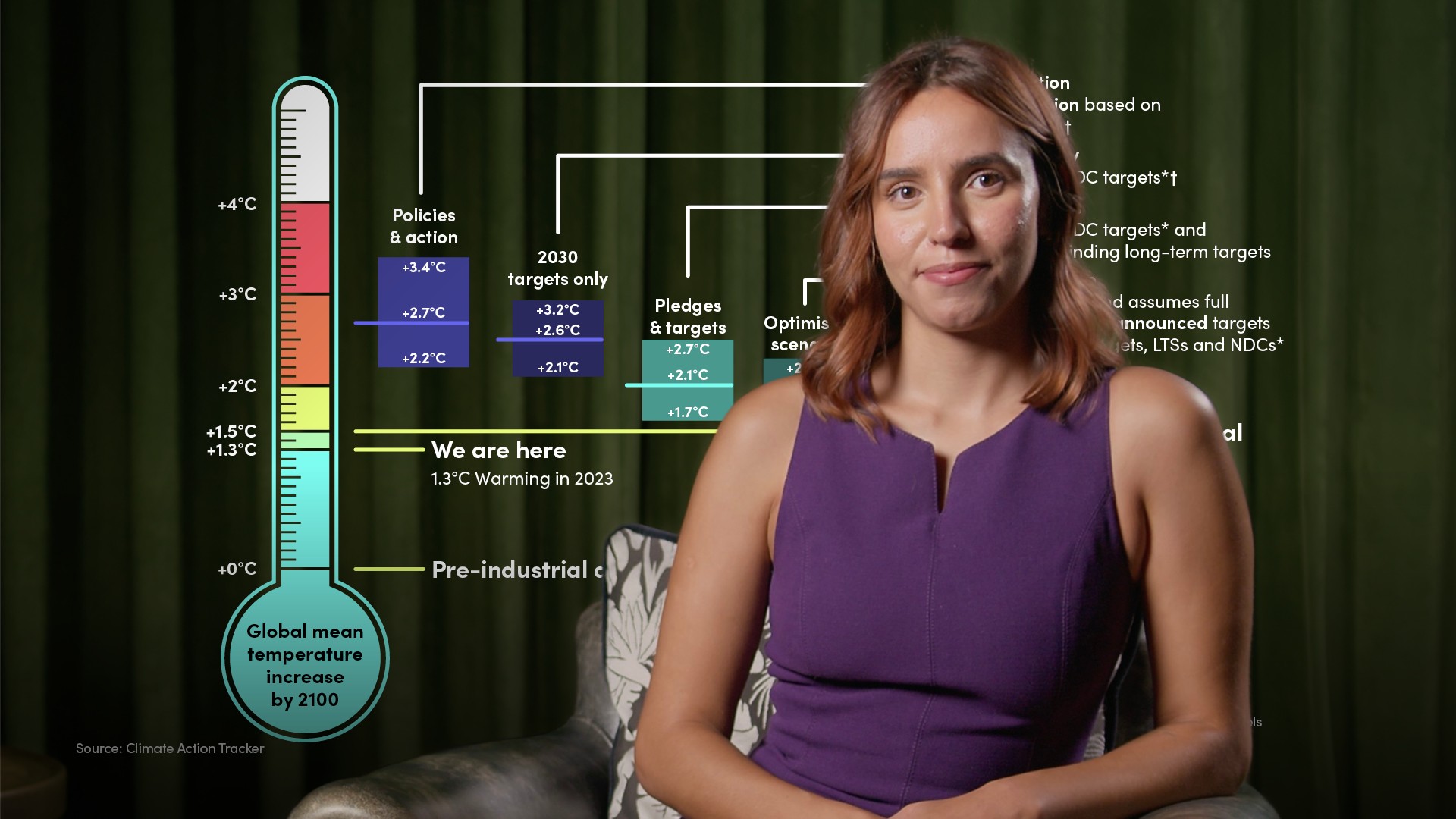

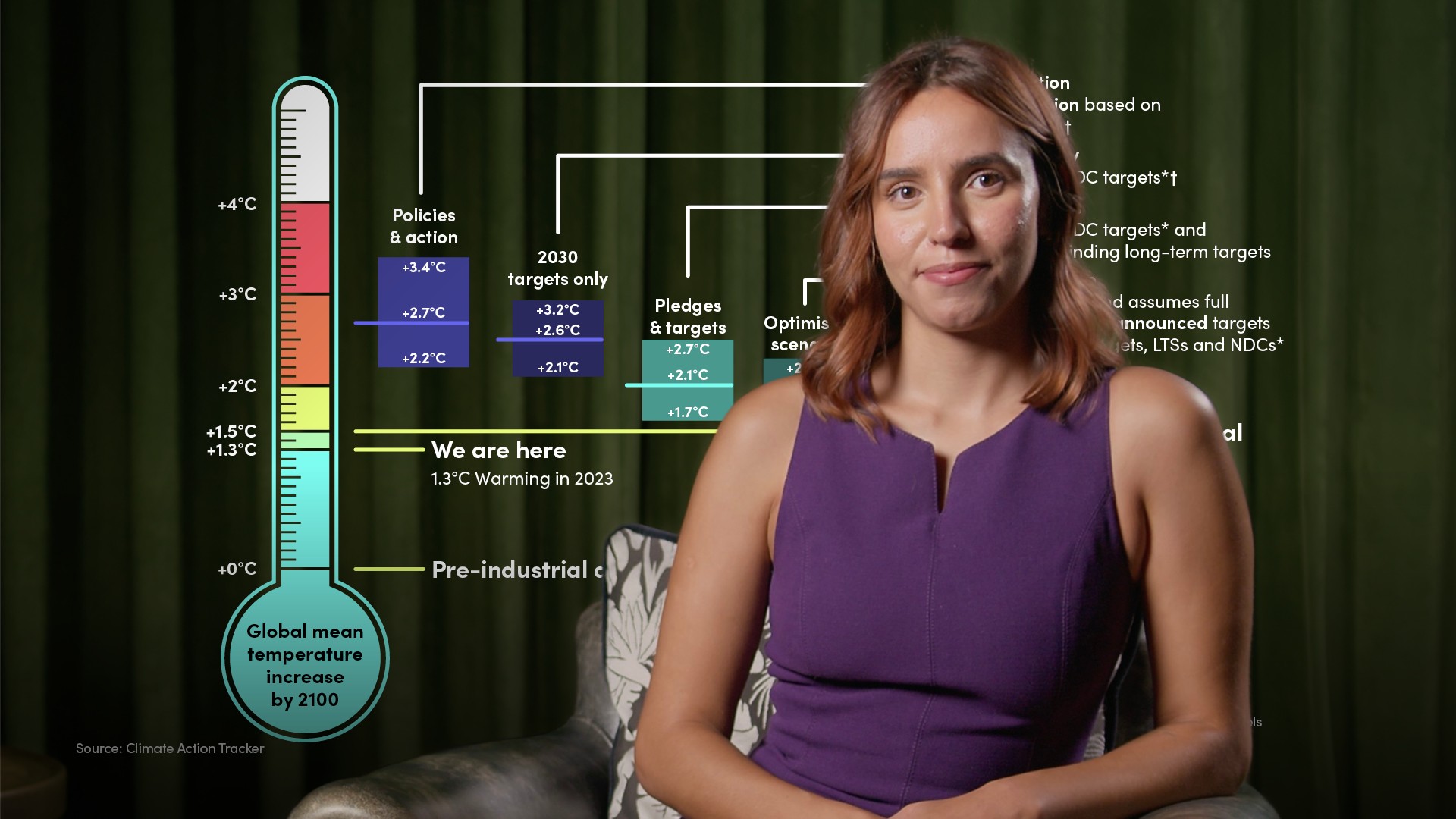

In this video, Meggie explores why adapting to climate change is just as vital as cutting emissions. She breaks down the key differences between adaptation and resilience, highlighting why investment in climate-proof infrastructure, food systems, and public health is essential for long-term stability.

In this video, Meggie explores why adapting to climate change is just as vital as cutting emissions. She breaks down the key differences between adaptation and resilience, highlighting why investment in climate-proof infrastructure, food systems, and public health is essential for long-term stability.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Financing Climate Adaptation and Resilience

4 mins 40 secs

Key learning objectives:

Understand adaptation and resilience (A&R) and why they are essential

Recognise the scale of financing needed for A&R projects

Identify key principles for credible resilience investments

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

- Substantial contribution to climate resilience: Projects must meaningfully reduce risks (e.g., flood defences) or address climate stressors (e.g., water efficiency in drought-prone regions)

- Avoiding maladaptation: Investments must not worsen climate vulnerability, such as creating social inequities while reducing emissions

- Avoiding significant harm: Projects should not undermine other sustainability goals, like biodiversity loss from large-scale renewable energy projects

- Resilient agrifood systems: Strengthening food security amid climate shifts

- Resilient industry and commerce: Making supply chains and production more climate-proof

- Resilient cities: Designing urban spaces that withstand extreme weather

- Resilient health: Protecting public health from climate-related risks

- Resilient infrastructure: Building durable energy, transport, and water systems

- Resilient nature and biodiversity: Enhancing ecosystems to mitigate climate impacts

- Resilient societies: Strengthening social structures and governance for climate adaptation

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Meggie Eloy

There are no available Videos from "Meggie Eloy"