Global Sustainable Finance Initiatives I

Simon Thompson

Managing Director and Author

The finance sector is given a leading role in tackling climate change and the transition to a green and sustainable, low-carbon world. In this video Simon explains how the transition requires cooperation and interaction between many of the key institutions and policy, regulatory and market initiatives active in green and sustainable finance.

The finance sector is given a leading role in tackling climate change and the transition to a green and sustainable, low-carbon world. In this video Simon explains how the transition requires cooperation and interaction between many of the key institutions and policy, regulatory and market initiatives active in green and sustainable finance.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Global Sustainable Finance Initiatives I

11 mins 24 secs

Key learning objectives:

Understand the three major agreements focused on limiting global warming

Identify the two key international initiatives that all green and sustainable finance professionals should be aware of

Outline the European Initiatives for a Sustainable Finance Taxonomy

Overview:

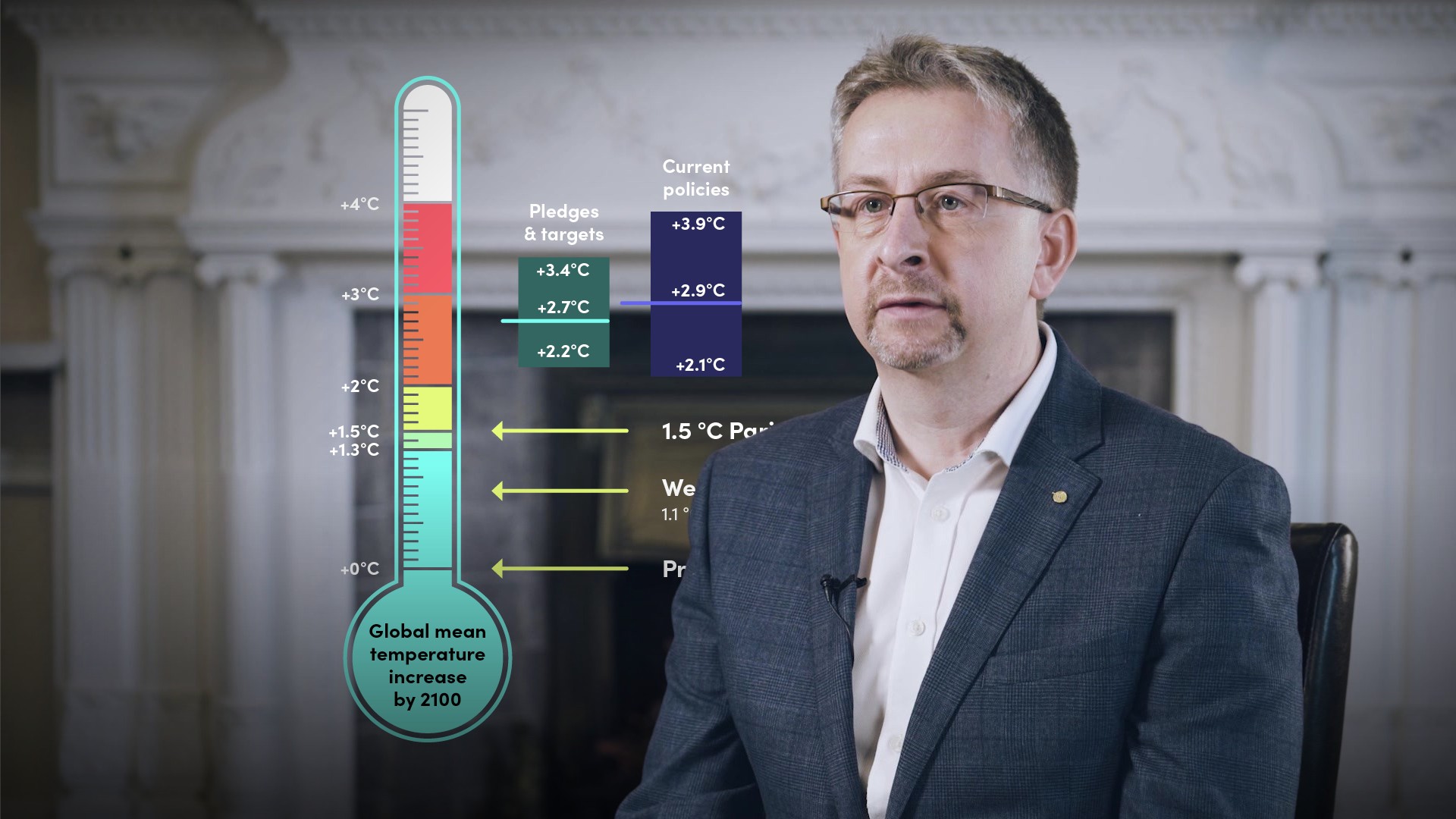

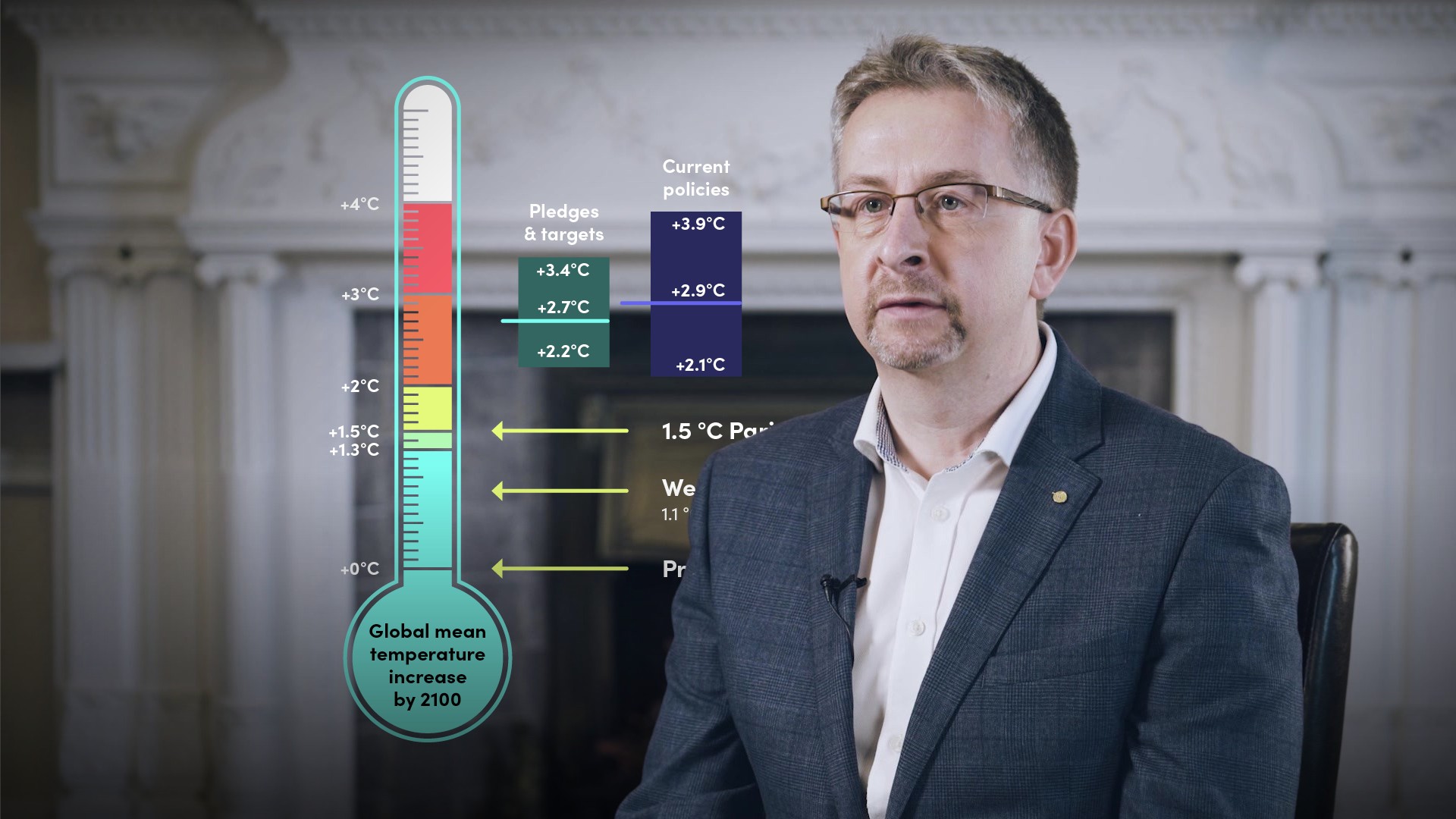

The finance sector has been given a leading role in tackling climate change and the transition to a green and sustainable, low-carbon environment. The climate emergency is a global problem, and immediate action is needed by all of us — governments, regulators, banks, businesses, activists and citizens — to prevent potentially disastrous and irreversible changes to our planet. Several international policies have been launched, including the UNFCCC, the Kyoto Protocol and the Paris Agreement, as well as other initiatives such as the PRI, PSI, PRB as well as the TCFD and NGFS to name a few.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are the three major agreements focused on limiting global warming?

- United Nations Framework Convention on Climate Change (UNFCCC) - It essentially provides the framework, and secretariat, for subsequent global agreements on climate change

- Kyoto Protocol - It was the main global framework for cutting greenhouse gas emissions

- Paris Agreement - The first, universal, legally binding global climate agreement to provide a way to reduce global temperature rises

What is the focus of UNEP FI?

The United Nations Environment Programme Finance Initiative (UNEP FI) was established between the UN and the financial system, with the aim of setting global frameworks to encourage the development of sustainable finance.

The three major initiatives launched by the UNEP FI for the insurance, investments and banking sector are:

- Principles for Responsible Investment

- Principles for Sustainable Insurance

- Principles for Responsible Banking

What two key international initiatives should all Green & Sustainable Finance Professionals be familiar with?

- Task Force on Climate-related Financial Disclosures (TCFD)

- Network for Greening the Financial System (NGFS)

How are European initiatives driving the push towards a Sustainable Taxonomy?

At the European level, the EU’s 2018 Sustainable Finance Action Plan commits the EU to, amongst other things:

- Establish an EU Taxonomy - a common language and framework - for sustainable finance Creating EU labels for ‘green’ financial products to help investors to easily identify investments that comply with agreed criteria, based on the EU Taxonomy

- Clarify the duty of asset managers and institutional investors to take sustainability into account in their investment processes

- Require insurance and investment firms, and other financial advisers to provide advice taking into account clients’ preferences on green and sustainable outcomes

- Incorporate sustainability in prudential requirements for banks and insurers, including considering a “green supporting factor” that might reduce capital requirements for green investments

- Enhance transparency in corporate disclosure and reporting to align them with the TCFD

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Simon Thompson

There are no available Videos from "Simon Thompson"