A distinctly private pursuit: Not going net zero

John Lang and Camilla Hyslop

A new report from the Net Zero Tracker examines how net zero targets and mitigation efforts differ between the world’s largest public and private companies

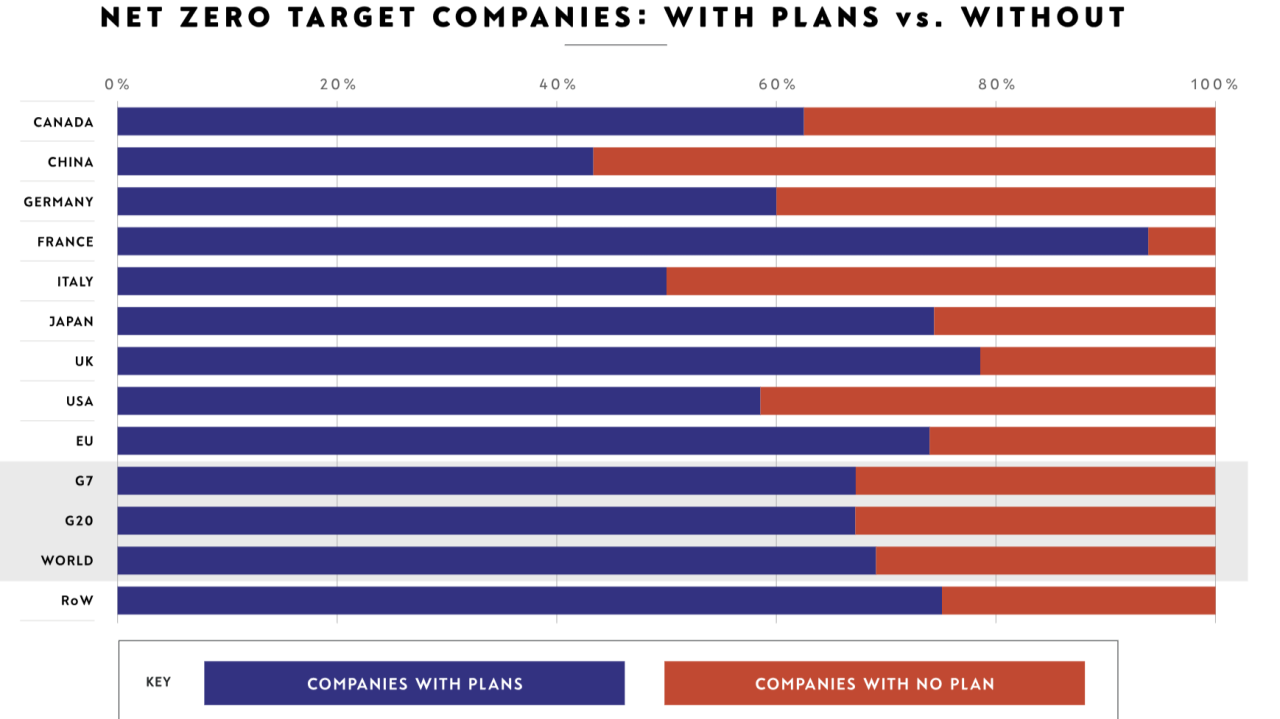

Weighted by annual revenue, net zero targets now cover nearly 80% of the world’s largest 2,000 publicly listed companies, up from less than 20% in 2020. The integrity and clarity of these targets are weak to say the least, but voluntary target-setting at the publicly listed level continues to reach new heights.

The picture at the private company level is starkly different. As the net zero world for corporates increasingly moves from being defined by voluntary efforts to mandatory rules, private firms trail behind their publicly listed peers by around half on net zero target-setting. They also trail behind on the integrity of their strategies to achieve these targets.

Our latest report A Distinctly Private Pursuit: Not going net zero compares the net zero targets and other mitigation efforts of the world’s largest 100 private companies with the world’s largest 100 public companies. If ‘sunlight is the best disinfectant’ for climate inaction, most private firms are operating nocturnally — beyond the glare of the civil scrutiny, investor pressure and disclosure requirements faced by listed companies.

Key findings

- Two-fifths (40) of the largest private companies have set net zero targets, compared with seven-tenths (70) of the world’s largest public companies.

- More than half (52) of the world’s largest private companies have set net zero or emission reduction targets. This compares with 82 of the world’s largest public companies.

- The combined annual revenue of private companies with net zero targets is $2.2 trillion. The combined revenue of private companies without any mitigation measures is $1.7 trillion. For those without net zero targets, it is a staggering $2.8 trillion.

- Only four of the world's largest 10 private companies have set net zero targets, compared with nine of the world's 10 largest public companies.

As the corporate world of net zero moves from being defined by bottom-up voluntary efforts to top-down mandatory rules, private companies not only continue to trail behind their publicly owned counterparts by around half on net zero intent, they trail behind on the integrity of their strategies to get there.

Of the 40 net zero targets, we found:

- Only eight (20%) private companies have published plans to deliver on their pledges, compared with 56 (80%) of the 70 public companies with net zero targets.

- Only two (5%) — IKEA (Netherlands) and Bechtel (US) — rule out the use of carbon credits to achieve their net zero goals.

From a geographic perspective across all 100 private companies:

- Of the 28 headquartered in the EU and the UK, 21 (75%) have net zero targets. But only a small minority have published plans to achieve these targets.

- Of the 50 headquartered in the US, only 11 (22%) have net zero targets, substantially less (in absolute and relative terms) than US-based public companies, where 28 of 43 (65%) have net zero targets.

- Of the 16 headquartered in China, four have net zero targets, up from just one in 2022.

These findings of underscore the mounting transition risks faced by those private firms neglecting to address their emissions and/or ignoring the regulatory landscape that is increasingly seeking to mandate climate action.

The brightening torchlight of climate regulation - The CSRD and CSDDD

For those that have no net zero or mitigation target, mandatory regulation is beginning to knock at their doors. For large EU-based private companies, the door is effectively being beaten down. And for large non-EU-based private companies with substantial operations in the EU, that will soon become the case.

- The Corporate Sustainability Reporting Directive (CSRD), which creates a ‘duty to disclose’, does not differentiate between publicly-listed and private companies. Almost 50,000 EU and non-EU companies will ultimately have to report their emissions and climate impacts, including many large private companies from 1 January 2025.

- The Corporate Sustainability Due Diligence Directive (CSDDD), which will create a ‘duty to act’,requires the largest private companies to adopt time-bound transition plans and ensure their business strategies are compatible with the transition to net zero.

These two directives represent new ‘rules of the game’ for a substantial proportion of the world’s largest public and private companies, and are especially relevant for, but not limited to, private companies based in the EU.

Dozens of private companies in the largest markets in the world — the EU, the US and China — still do not have net zero or emission reduction targets in place. As regulatory systems ramp up, staying silent on net zero increases transition risks for themselves, and undermines genuine emission cutting efforts by nations and other non-state entities.

The countdown is on for all nations to submit new emission-cutting plans (NDCs) in early 2025 - so-called 'NDC 3.0'. The reluctance of private companies to sign on to net zero or strengthen the integrity of their often vacuous emission reduction strategies hamstrings the ability of governments to deliver on their own decarbonisation goals.

John Lang and Camilla Hyslop

Share "A distinctly private pursuit: Not going net zero" on