What is a Sustainability-Linked Bond or Loan?

Matthew MacGeoch

In this video, Matthew explains sustainability-linked bonds and loans, financial instruments that tie interest rates to companies' progress on sustainability goals like reducing greenhouse gas emissions. He highlights how they differ from green bonds, key challenges such as weak or irrelevant targets, and the importance of setting ambitious goals aligned with a 1.5℃ climate pathway. He also shares best practices for issuers, including focusing on sector-specific KPIs, engaging third-party verifiers, and ensuring transparency to build trust and drive meaningful impact.

In this video, Matthew explains sustainability-linked bonds and loans, financial instruments that tie interest rates to companies' progress on sustainability goals like reducing greenhouse gas emissions. He highlights how they differ from green bonds, key challenges such as weak or irrelevant targets, and the importance of setting ambitious goals aligned with a 1.5℃ climate pathway. He also shares best practices for issuers, including focusing on sector-specific KPIs, engaging third-party verifiers, and ensuring transparency to build trust and drive meaningful impact.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is a Sustainability-Linked Bond or Loan?

7 mins 12 secs

Key learning objectives:

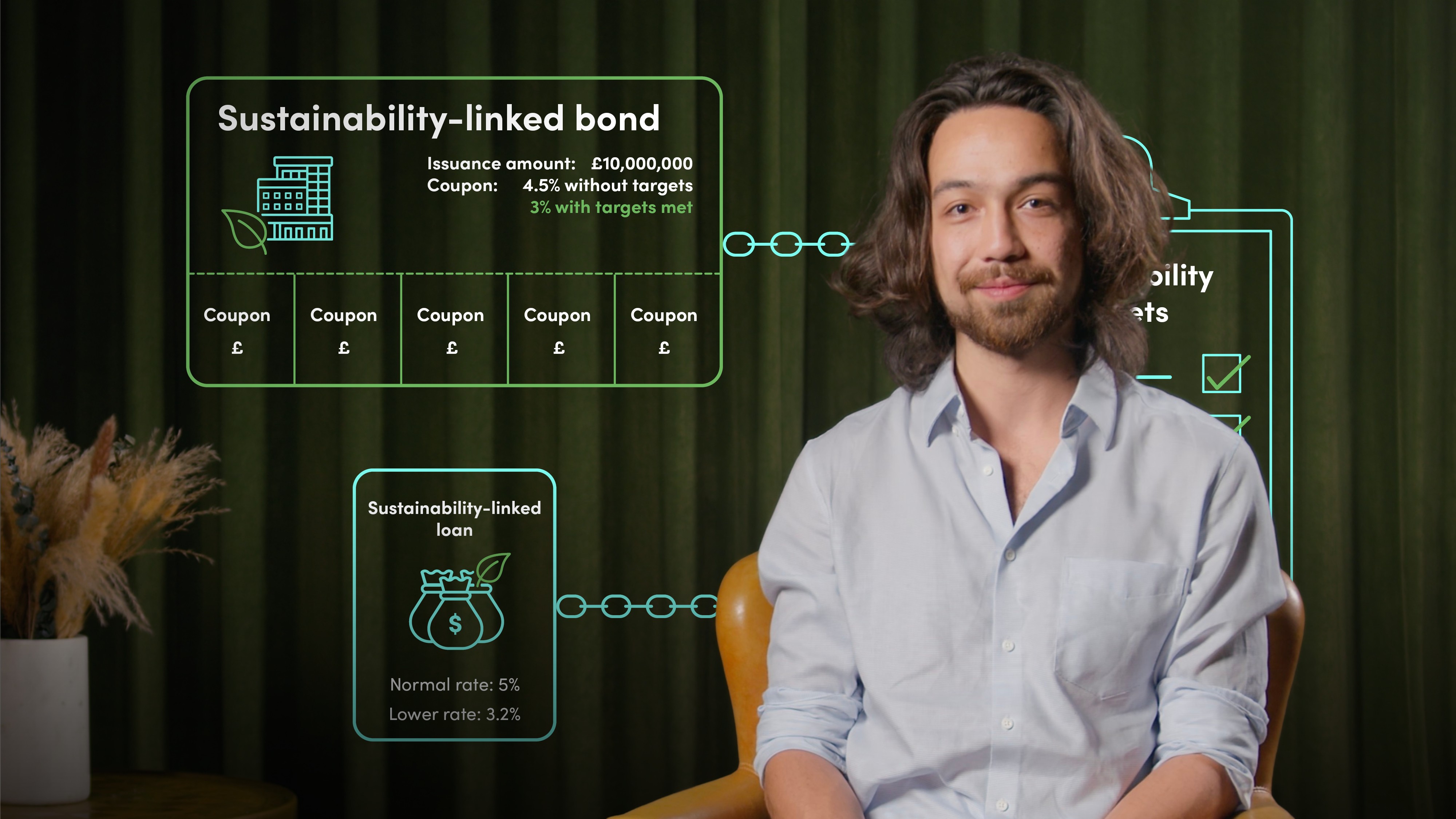

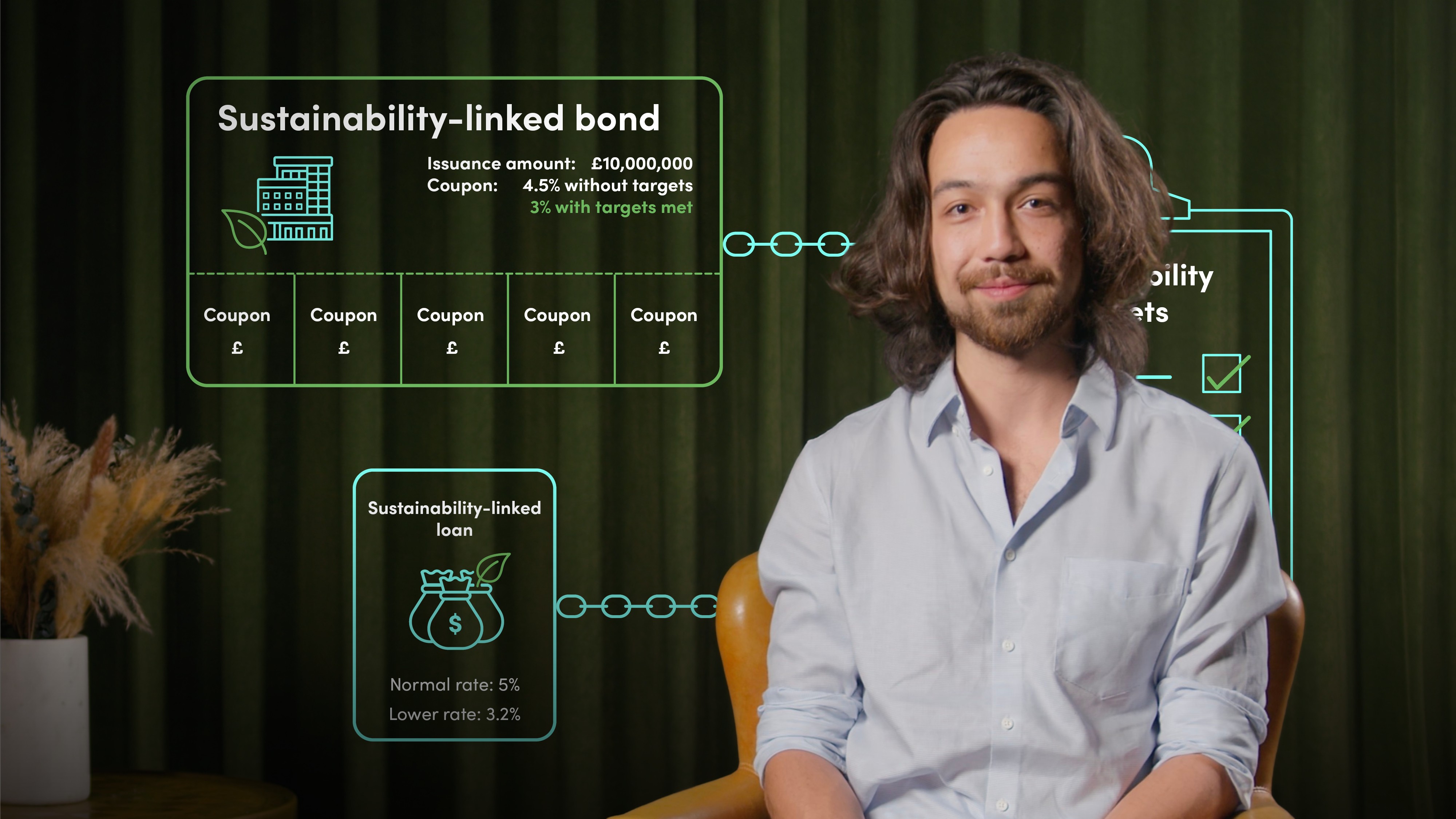

Understand what sustainability-linked loans and bonds are

Understand the importance of setting credible and ambitious targets

Outline some development issues in the sustainability-linked market

Outline best practices for when issuing sustainability-linked debt

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How do sustainability-linked bonds and loans differ from other sustainable debt instruments like green bonds?

What are the key challenges facing the development of the sustainability-linked debt market?

One major challenge is issuers using too many non-GHG KPIs, which dilutes comparability between deals and makes it harder for investors to assess the quality and ambition of the targets. Another issue is the lack of material GHG targets relevant to the issuer's sector, leading to concerns about the credibility of the sustainability commitments. These factors can result in greenwashing perceptions and reduce investor confidence. The diversity in KPI selection and insufficiently ambitious targets hinder the standardisation and growth of the market, making it crucial to address these issues for the market to mature effectively.

Why is it important to set credible and ambitious sustainability performance targets (SPTs), and how can issuers achieve this?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Matthew MacGeoch

There are no available Videos from "Matthew MacGeoch"