What is ESRS E3 and why is it important?

ESRS E3 is the water and marine resources standard under the EU’s Corporate Sustainability Reporting Directive (CSRD). It’s crucial because water scarcity is becoming an increasingly urgent issue, exacerbated by climate change and population growth. The standard aims to ensure transparency about how companies use and impact water resources, both freshwater and marine. By disclosing this information, stakeholders can understand the risks and opportunities associated with water management.

What are the key components of ESRS E3?

The standard covers freshwater (rivers, lakes, groundwater) and marine resources (oceans, seaweeds, fish, other organisms), as well as water quality. It differentiates between water consumption (water used up), water withdrawals (water used and returned), and discharges (wastewater). The standard requires companies to identify and assess impacts, risks, and opportunities (IROs), establish policies, set actions and targets, and disclose anticipated financial effects.

How are water characteristics addressed in ESRS E3?

The standard focuses on both water availability and quality. Water availability is often a matter of location and type, with only 3% of the planet's water being available for use. Water quality is defined by physical (temperature, dissolved solids), chemical (pH, contaminants), and biological (living organisms) parameters. The standard emphasises the need to understand and report on these characteristics to assess impacts accurately.

What are the disclosure requirements for identifying and assessing impacts?

Companies must describe their process for identifying material impacts, risks, and opportunities (IROs) related to water and marine resources. This includes using resources like the World Resources Institute’s water risk atlas (Aqueduct) to identify areas of water risk. The LEAP approach (Locate, Evaluate, Assess, Prepare) should be followed in order to conduct a materiality assessment.

What policies and targets need to be disclosed under ESRS E3?

Companies must detail the policies adopted to manage significant impacts, risks, and opportunities. This includes policies on water management (use, sourcing, treatment, pollution prevention), product and service design, and commitments to reduce water consumption, particularly in areas of water risk, across the value chain.

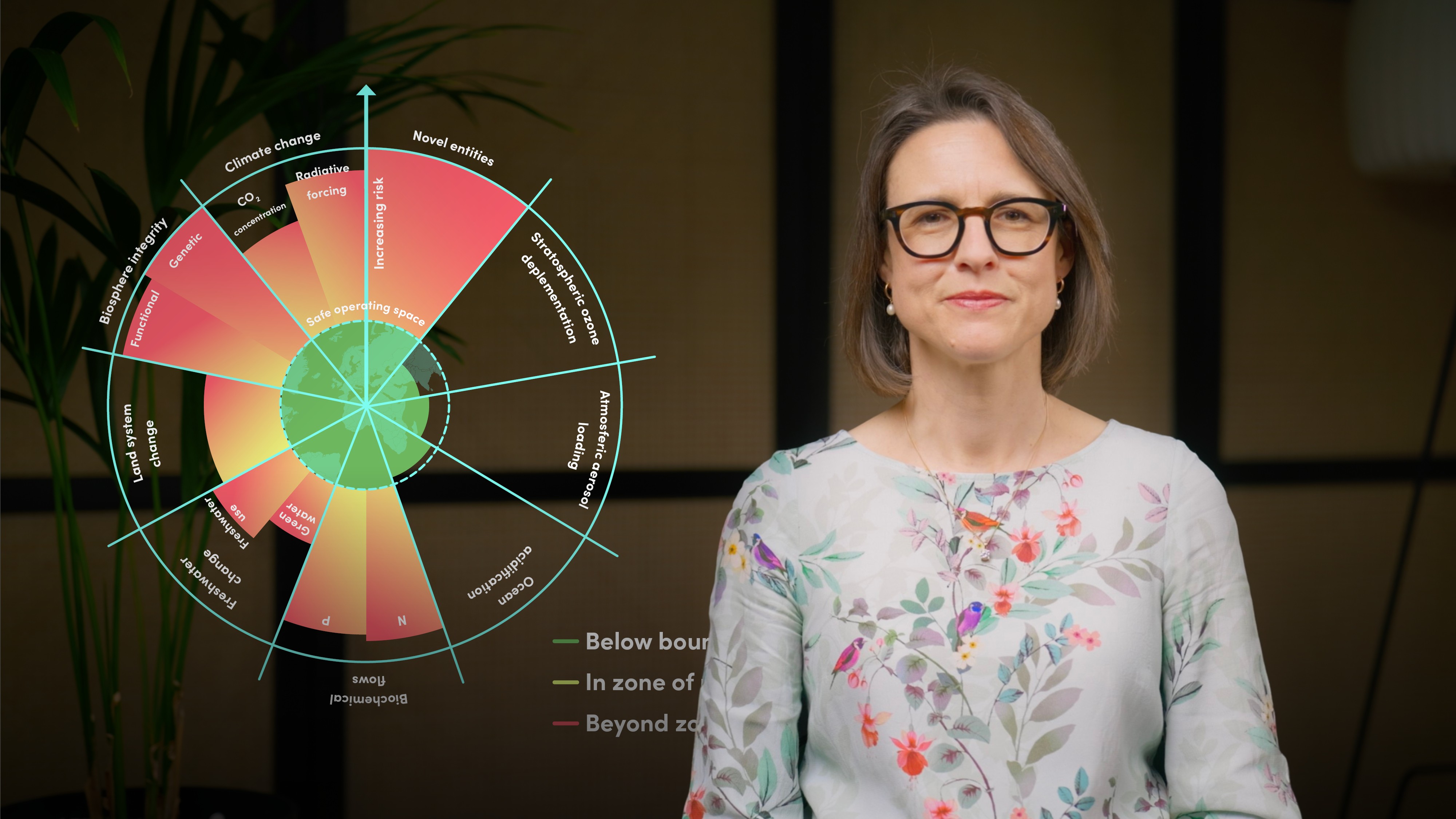

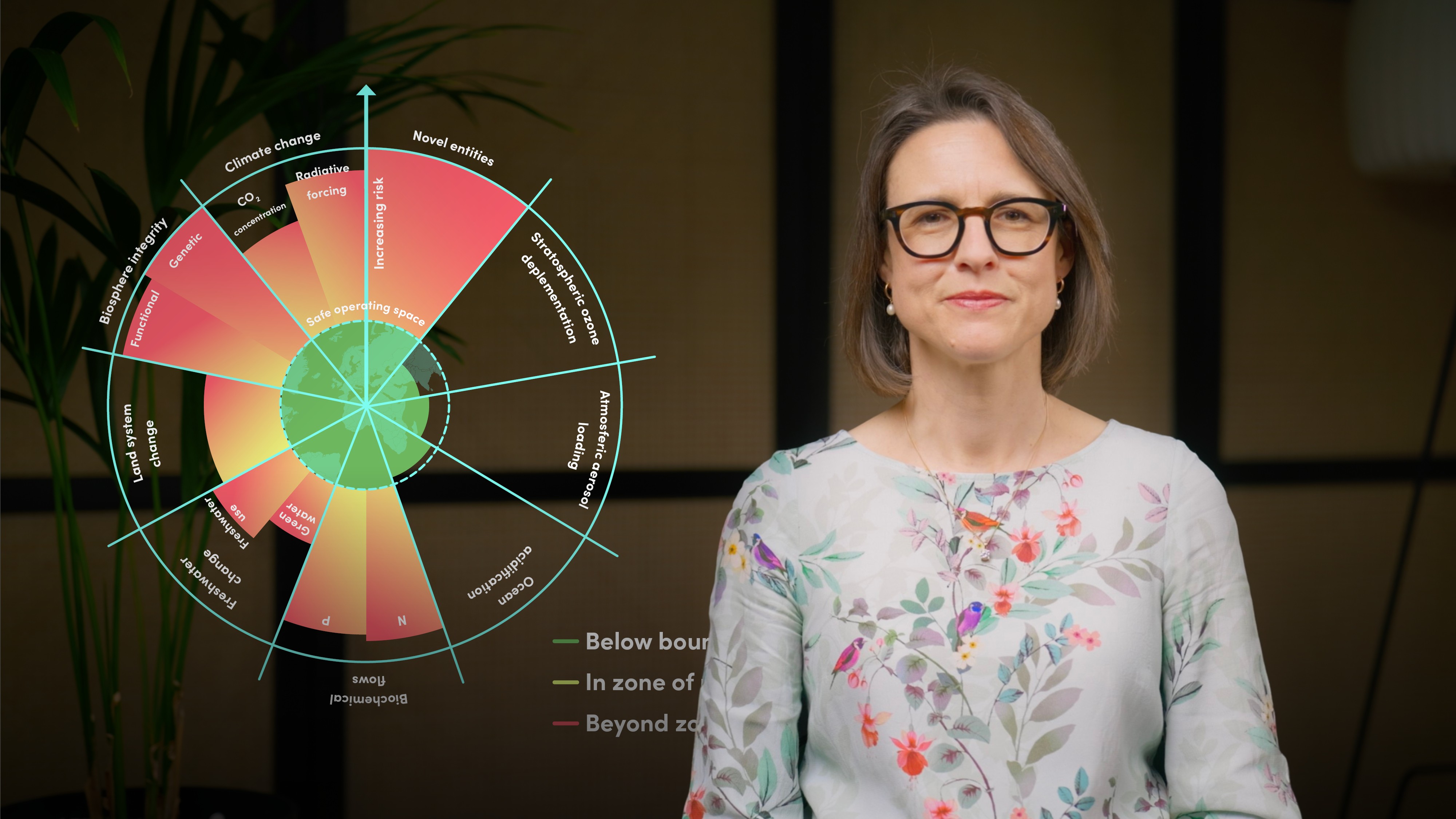

Companies must disclose actions taken to achieve policy objectives, resources allocated to water management, and targets set, including whether ecological thresholds and planetary boundaries were considered. They must also report on water use in cubic meters, recycled water, stored water, and water intensity (water consumption per million euros of net revenue). Contextual information about water quality in the basin and data compilation methods is also required.

What are the anticipated financial effects disclosure requirements?

Companies must translate material impacts, risks, and opportunities (IROs) into financial effects, providing quantitative data where applicable. In cases where it is not possible, they need to provide qualitative context. They must list assumptions, sources, and levels of uncertainty involved. This includes detailing dependencies on freshwater and marine resources and assessing the potential financial effects of water-related risks and opportunities.