What is the Voluntary Carbon Market (VCM)?

The voluntary carbon market (VCM) is a market where individuals or organisations can buy carbon credits in order to offset their greenhouse gas emissions.

Why is VCM governance important?

It is important that the VCM is governed in a responsible and effective way in order to ensure the integrity and effectiveness of carbon offset projects. Users must be confident that the credit they purchase represents one tonne of greenhouse gas emissions removed or prevented to allow them to make an offset claim in confidence.

What role do standard bodies play in VCM governance?

Standard bodies play a vital role in providing governance in the VCM. They set the framework of rules, procedures, and methodologies for generating and issuing verified carbon credits. Additionally, governments can also develop or support the development of carbon standards, such as the Woodland Carbon Code in the UK.

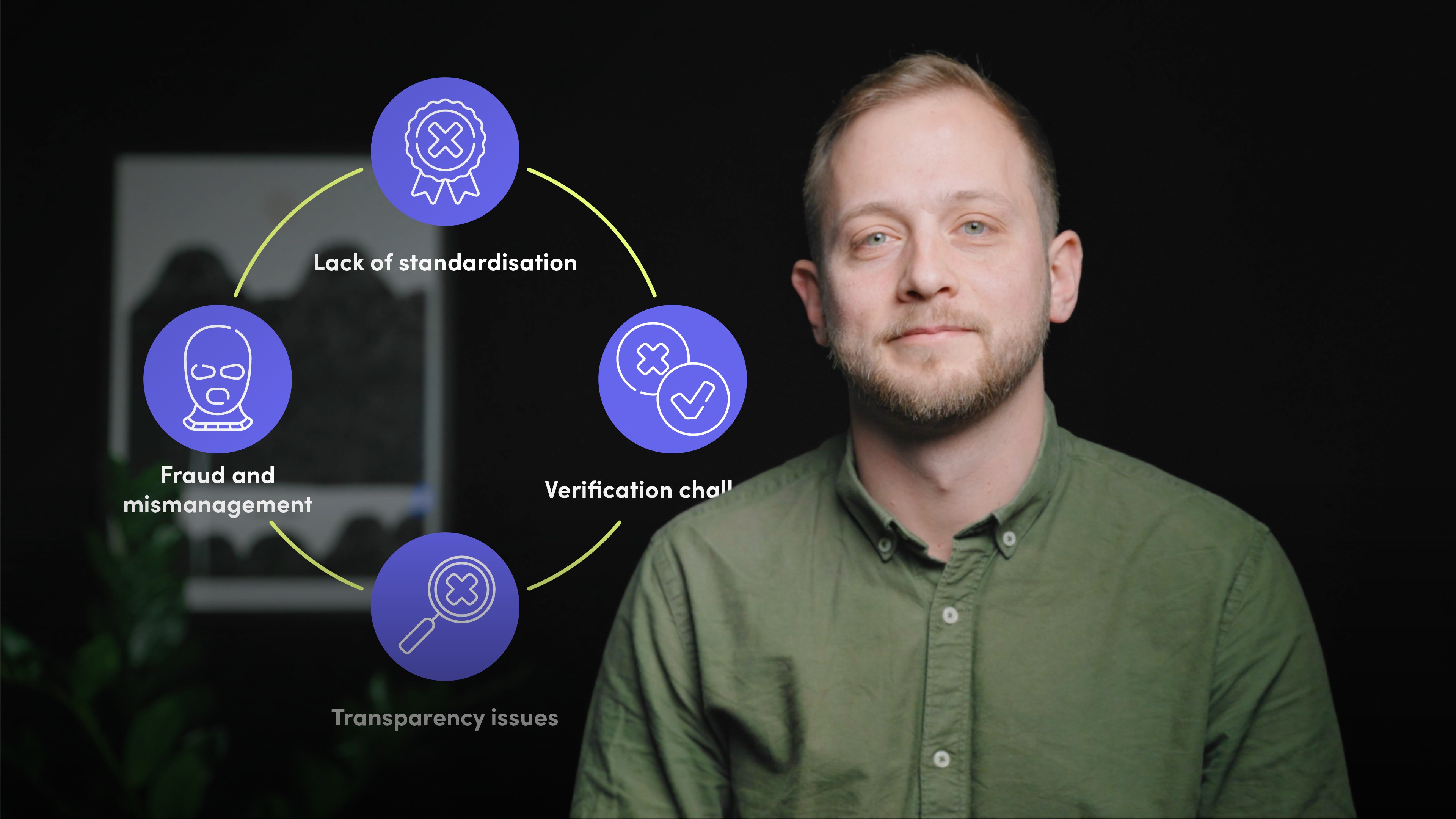

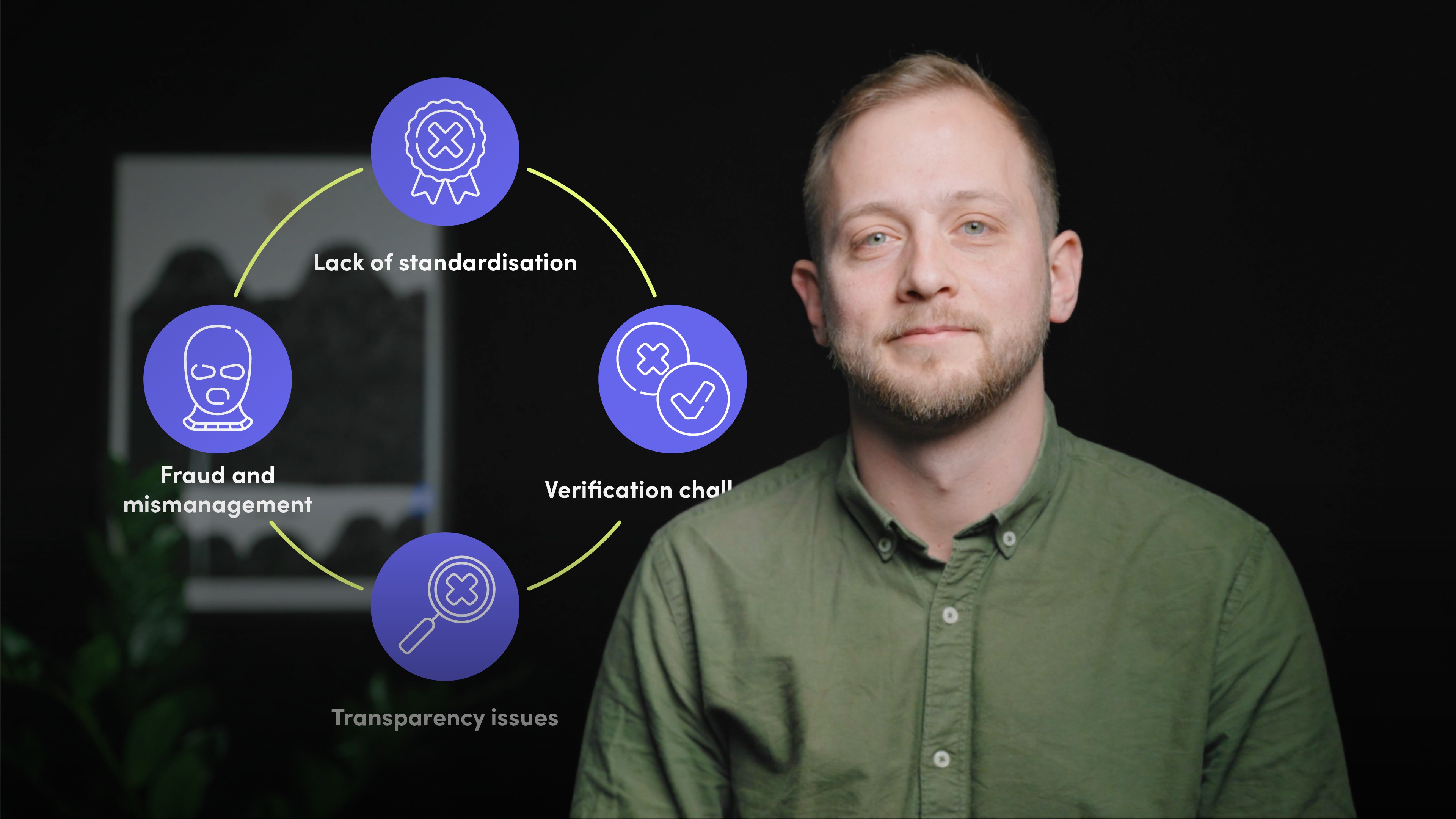

What are the major challenges faced by the VCM?

1. Lack of standardisation

The voluntary carbon market is made up of a wide range of carbon offset projects and standards, which can make it difficult for buyers to understand and compare different credits. This can undermine confidence in the market and make it harder for buyers to identify high integrity offsets.

2. Verification challenges

Verifying the impact of carbon offset projects can be complex and time-consuming, and may not always be accurate. This can lead to disputes over the validity of carbon credits and undermine confidence in the market.

3. Transparency issues

The voluntary carbon market has been criticised for a lack of transparency, with buyers and sellers operating in an opaque manner. This can make it difficult for buyers to understand the origins and impact of the credits they are purchasing, and may lead to mistrust in the market.

4. Fraud and mismanagement

There have been instances of fraud and mismanagement in the voluntary carbon market, where sold carbon credits have not represented genuine emissions reductions or where the proceeds from carbon credit sales have not been used for their intended purpose. This can undermine confidence in the market and discourage the development of legitimate offset projects.

What pathway would a project developer follow to obtain carbon credit issuance?

1. The project developer identifies the carbon standard with the methodology most suited to its project activity.

2. The project developer would produce a project design document and submit this to a registry approved validator. The validator then assesses the application against the methodology and standards of the registry and certifies.

3. The project begins its initial crediting period.

4. The project developer would monitor annual emissions reductions and removals and use a registry approved verifier. The verifier would assess the monitoring and verification process and reject or certify the results.

5. The standard would now be able to issue credits to the account of the project developer. The project developer is then able to sell and transfer these credits to anyone which also maintains a registry account at the same standard.

6. The project developer can apply for additional certification.

What are the two key organisations that have been set up to address global VCM governance?

1. IC-VCM is an independent governance body focused on setting and enforcing global standards for the development of high-quality carbon credits. Its intention is to build supply side integrity to accelerate a just transition to limit warming to 1.5 degrees Celsius by 2050. The IC-VCM’s Core Carbon Principles will set the threshold standards for high-quality carbon credits and define which crediting programmes and methodologies are eligible.

2. VCMI is a multi-stakeholder VCM governance body. The initiative was co-founded by the UK Department for Business, Energy, and Industrial Strategy (BEIS) and the Children’s Investment Fund Foundation (CIFF). The VCMI’s objective is ‘to drive credible, net-zero aligned participation in voluntary carbon markets’ and it primarily focuses on the demand side of the VCM. It guides offset users on the credible use of voluntary carbon credits and associated claims via a Claims Code of Practice.

How has VCM governance worked previously?

The VCM has been self-regulating from the very beginning and has existed outside of national systems and is aimed at channelling private finance. The growing network brings additional scrutiny and thus can help drive improvements and raise credibility. One of the most important groups are the market critics (typically NGOs, journalists and scientists).