How to Design Optimal Investment Processes

Markus Schuller

25 years: Asset management

As much as we might think we're excellent at multitasking, we’re just not built for it as a species. And it’s not much different for those in investment management. Join Markus Schuller as he explores how to form optimal investment processes to help your team achieve the most evidence-based decisions possible.

As much as we might think we're excellent at multitasking, we’re just not built for it as a species. And it’s not much different for those in investment management. Join Markus Schuller as he explores how to form optimal investment processes to help your team achieve the most evidence-based decisions possible.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How to Design Optimal Investment Processes

11 mins 10 secs

Key learning objectives:

Define choice architecture

Understand how to align individuals, teams and processes

Identify 5 principles for investment processes

Overview:

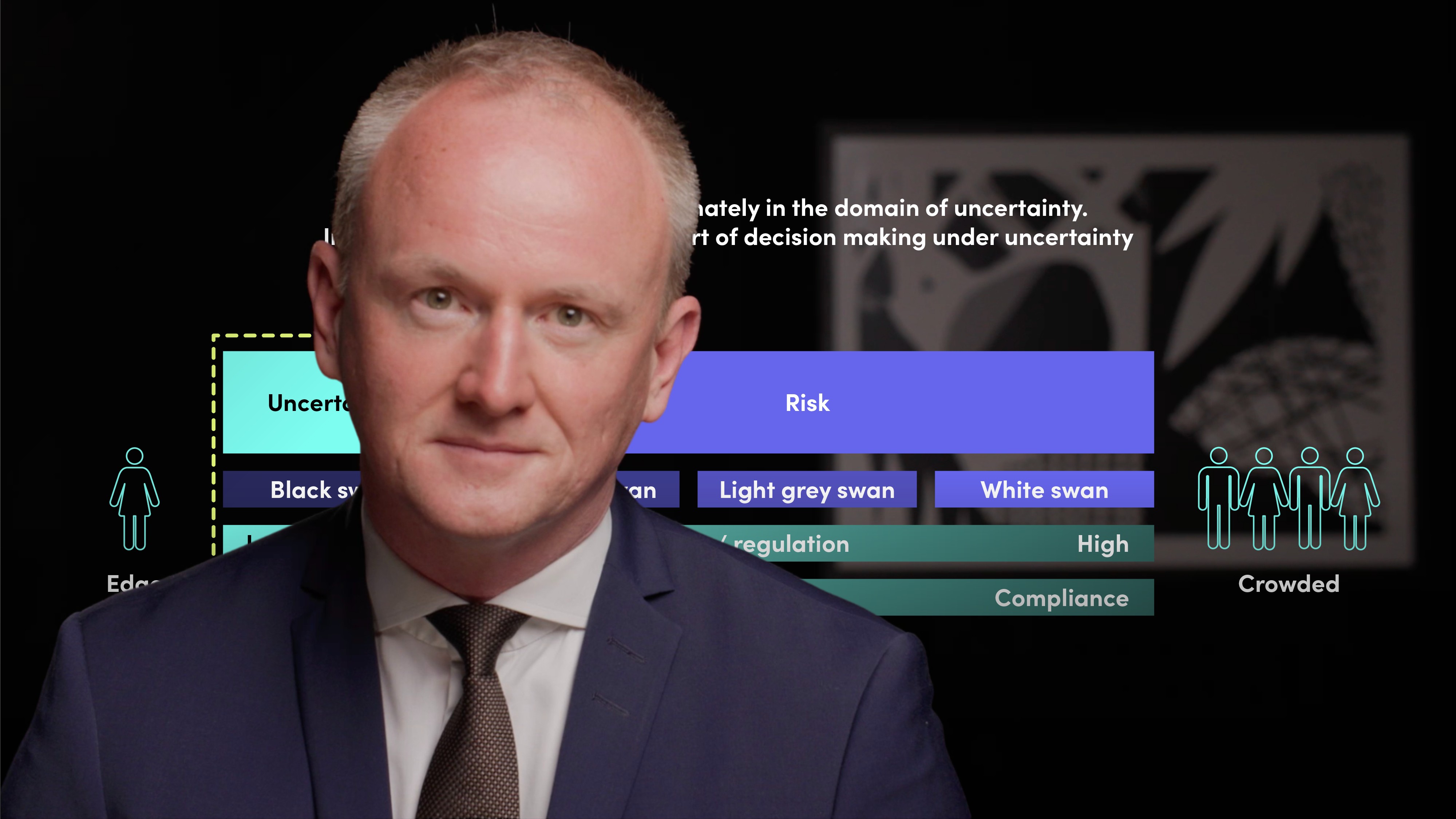

We are all constantly at risk of getting overwhelmed by uncertainty, due to our ambiguity and complexity intolerances. We face this issue in our work and personal lives - and it is no different for those in investment management. Recent research in applied behavioural finance concludes that the choice architecture of an investment process is of great significance when it comes to whether the decision is made rationally or emotionally. Making a good investment decision requires maximising the most evidence-based risk-reward asymmetry at the decision point. Best practices to achieve this asymmetry suggest a design made for decision-making under uncertainty. There are 5 useful design principles to remember for investment processes: investment hypothesis, implicit debiasing, seamless operational integration, ensuring purpose and supervising quality routines.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is choice architecture?

The practice of influencing choice by organising the context in which people make decisions. This was coined by Richard H. Thaler and Cass R. Sunstein in their book Nudge: Improving Decisions about Health, Wealth, and Happiness. Within the investment management space, the choice architecture acts as a focus enabler for individuals and teams, and can help to improve the quality of decision-making.

How can you align individuals, teams and processes?

Combining individual, team and organisational routines into the choice architecture can ensure resilience and adaptability within these practices. And investment process optimisation needs to start with achieving individual excellence.The choice architecture can be seen as the game arrangement of an investment process. For example, a portfolio manager is expected to openly experiment with new asset allocation methodologies, following an evidence-driven trial and error process. However, their organisation remains driven by a culture based on fear and responds intolerantly to mistakes. It is then only a matter of time until the employee either returns to the routines that come with a fear-based culture or leaves the organisation altogether.

What are the 5 design principles for investment processes?

1. Investment hypothesis

Ensure the investment hypothesis is diligently defined. The diligence by which the hypothesis is defined determines the quality of the sequence of evidence collected throughout the assessment.

2. Implicit debiasing

Create an environment by adding nudges and heuristics to the process to debias individual and group biases effortlessly, without them having to think about the effort needed.

3. Seamless operational integration

Investment processes have become tedious box-ticking exercises. Instead, we should aim to integrate the front, middle and back offices in the decision process beyond compliance. The cognitive diversity coming from the middle and back-office profiles is an asset in comprehensively assessing uncertainty.

4. Ensure purpose

Every investment process requires a transparent and accountable system that aligns each employee with the company’s purpose. The result of doing this correctly is fairness and loyalty among the team members and in exchange with the organisation.

5. Supervise quality routines

Established quality routines can deviate from their initial configuration for a number of reasons including employee turnover and misaligned incentives. To avoid this, you should ensure that periodic internal or external professional supervision takes place as to whether or not the established quality routines are still intact or if they need to be revised.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

There are no available Videos from "Markus Schuller"