Foundations for Investing in Renewable Energy

Joost Notenboom

Discover how investing in renewable energy aligns with the principles of a just transition. In this video, Joost explains how businesses and investors can balance climate goals with social and environmental responsibility through the lens of NewCo, a hypothetical SME producing renewable energy.

Discover how investing in renewable energy aligns with the principles of a just transition. In this video, Joost explains how businesses and investors can balance climate goals with social and environmental responsibility through the lens of NewCo, a hypothetical SME producing renewable energy.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Foundations for Investing in Renewable Energy

6 mins 54 secs

Key learning objectives:

Understand the renewable energy market and investment landscape

Outline how to align renewable energy investments with just transition principles

Understand importance of stakeholder value creation in responsible green business practices

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

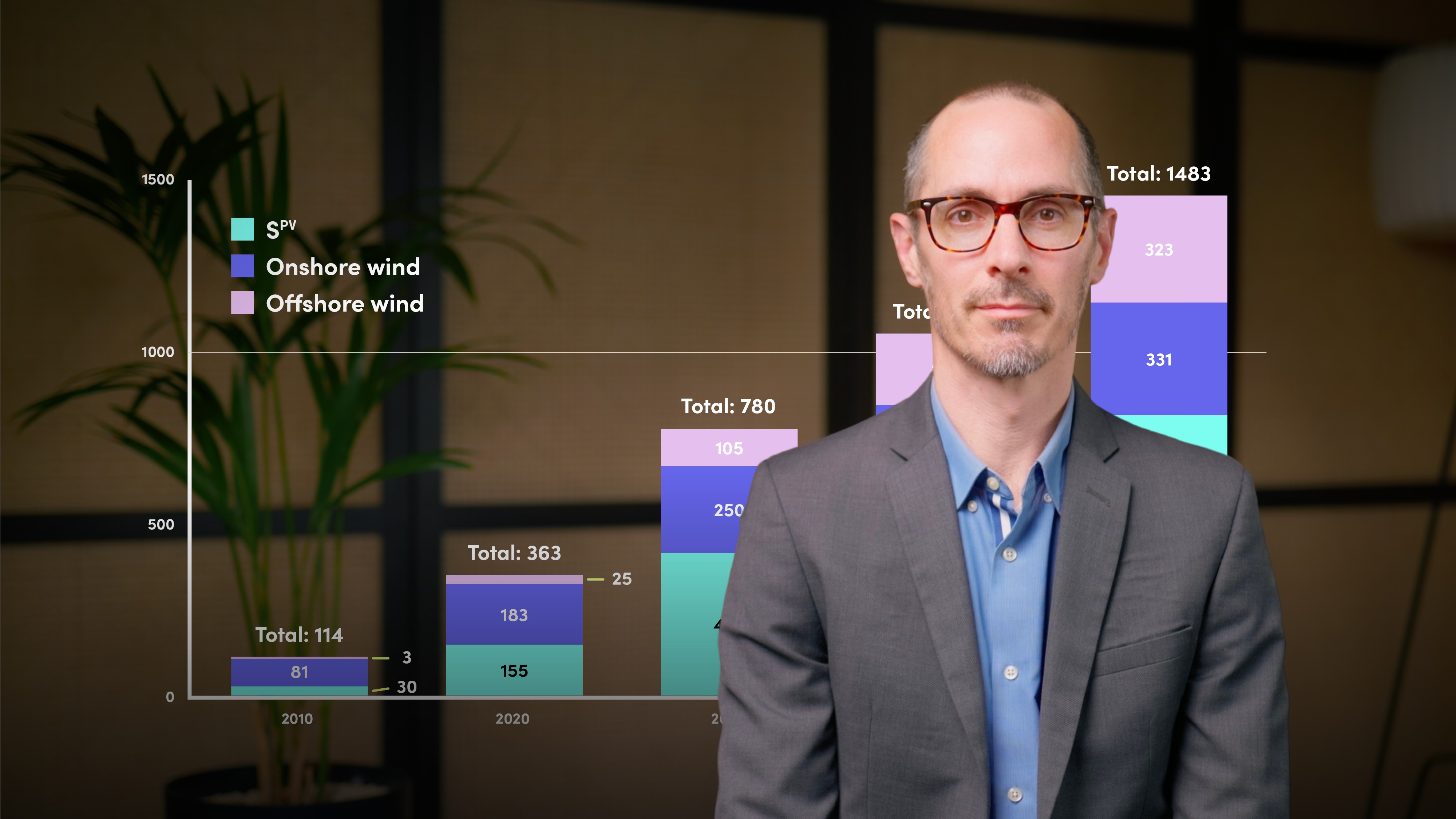

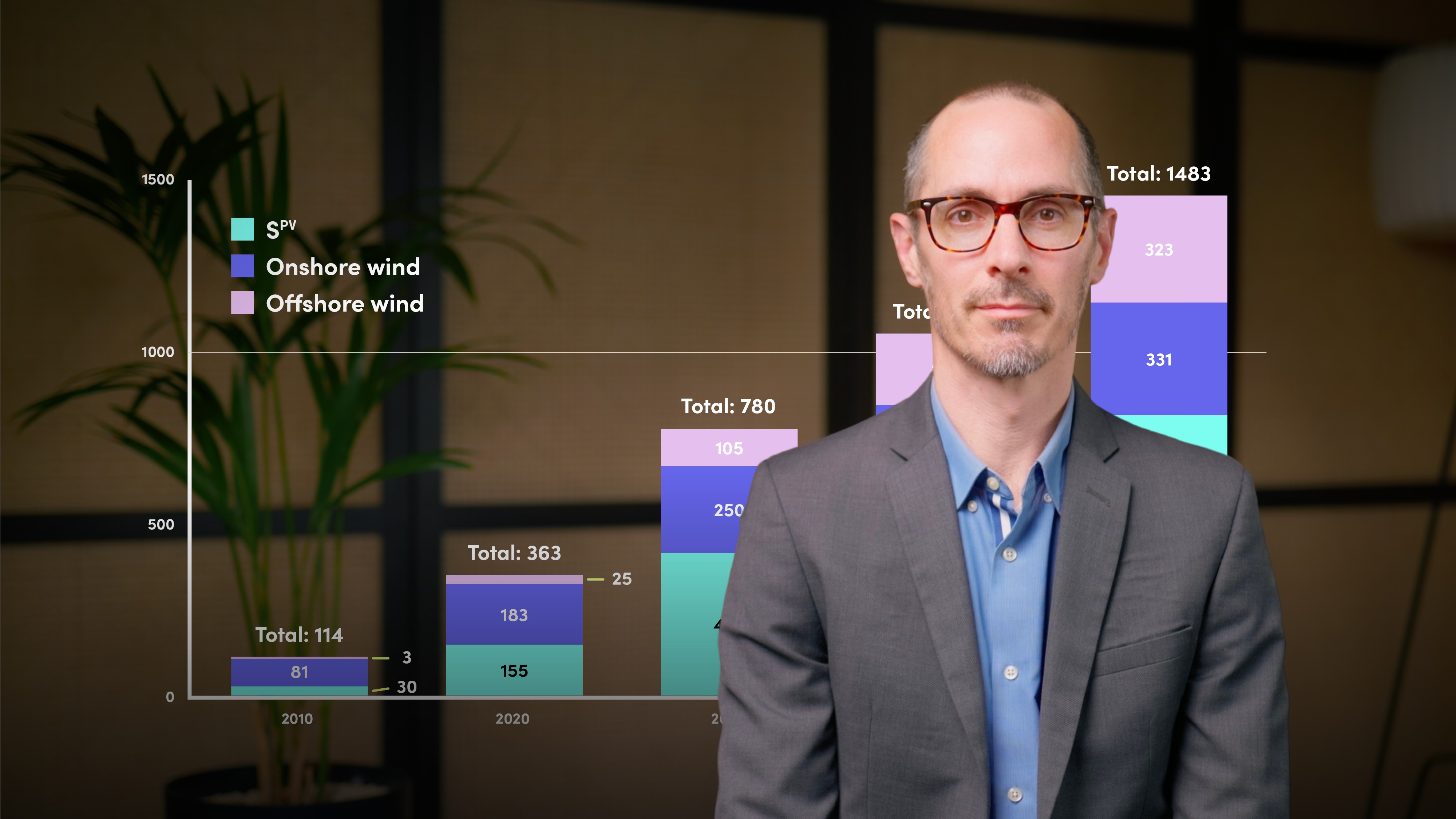

The energy transition shifting from fossil fuels to renewable energy stands as one of the 21st century’s most pressing challenges and opportunities. Beyond mitigating climate change, renewable energy investment provides a unique chance to reshape economies and align with sustainability goals. Technologies like solar, wind, and battery storage are at the forefront of this shift, driven by ambitious carbon reduction targets and increased electrification. This growth is fuelled by factors like energy independence, accelerated by geopolitical tensions such as the war in Ukraine.

NewCo is a hypothetical small-to-medium enterprise (SME) and it represents independent power producers (IPPs) that generate recurring revenue by selling electricity while creating strategic value. IPPs like NewCo are key players in a fragmented market dominated by utilities, developers, and independent producers. Understanding how these businesses operate offers valuable insights for investors and entrepreneurs aiming to enter the renewable energy sector.

Renewable energy projects must balance financial returns with social and environmental responsibility. This involves mitigating the impacts of infrastructure on local communities and biodiversity while addressing the needs of workers transitioning from high-carbon industries. These principles align with the “just transition” framework, which ensures that the economic benefits of renewable energy are equitably shared. At a European level, initiatives like the Green Deal and its Just Transition Mechanism provide guidelines for achieving these outcomes.

How can stakeholders benefit from renewable energy projects?

Stakeholder value creation is at the core of responsible renewable energy investments. For instance, communities affected by new projects must see tangible benefits, such as employment opportunities and infrastructure improvements. Similarly, biodiversity considerations should guide project design and implementation to minimise ecological harm. These practices not only ensure compliance with regulatory standards but also build trust and long-term support from stakeholders.

What role does innovation play in the energy transition?

New business models and technological advancements are critical for scaling renewable energy solutions. Companies like NewCo must leverage these innovations to optimise asset lifecycle management from development to operation and create additional value for investors and stakeholders. By combining technical expertise with responsible business practices, these enterprises can position themselves as leaders in the green economy.

For investors, understanding the dynamics of renewable energy markets helps identify opportunities that align with sustainability goals. Whether it’s supporting SMEs like NewCo or investing in large-scale projects, the potential for long-term returns is immense. For entrepreneurs and business leaders, adopting a stakeholder-centric approach is essential for building resilient and responsible renewable energy businesses.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Joost Notenboom

There are no available Videos from "Joost Notenboom"