ESG Bond Market Update H1 2021 & Broader Themes

This video by David Carmalt provides an overview of how the ESG bond market is developing, what kind of volumes and structures are being issued, and the key themes which are driving issuance and regulation. He also highlights the developments that have occurred in the bond market during Q2 of 2021.

This video by David Carmalt provides an overview of how the ESG bond market is developing, what kind of volumes and structures are being issued, and the key themes which are driving issuance and regulation. He also highlights the developments that have occurred in the bond market during Q2 of 2021.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

ESG Bond Market Update H1 2021 & Broader Themes

13 mins 27 secs

Key learning objectives:

Identify the latest trends in issuance and regulation within the ESG bond market

Understand how the ESG bond market relates to the broader bond market in terms of the kinds of structures utilised and the quantum of issuance per annum

Identify the key issuers of ESG bonds and what drives their decision to issue these structures rather than in non-ESG format

Overview:

While 2020 felt like a watershed year for ESG bond volumes, the first half of 2021 set the foundation for this year to eclipse the last one. In the following video, we look at the key trends in the ESG bond market over the course of Q2 2021, including who the issuers are, what drives them to issue in ESG format, how relevant is ESG in the context of the broader global bond market, and what are the latest regulatory and market drivers affecting issuance and bond structures.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Understand how the ESG bond market is developing.

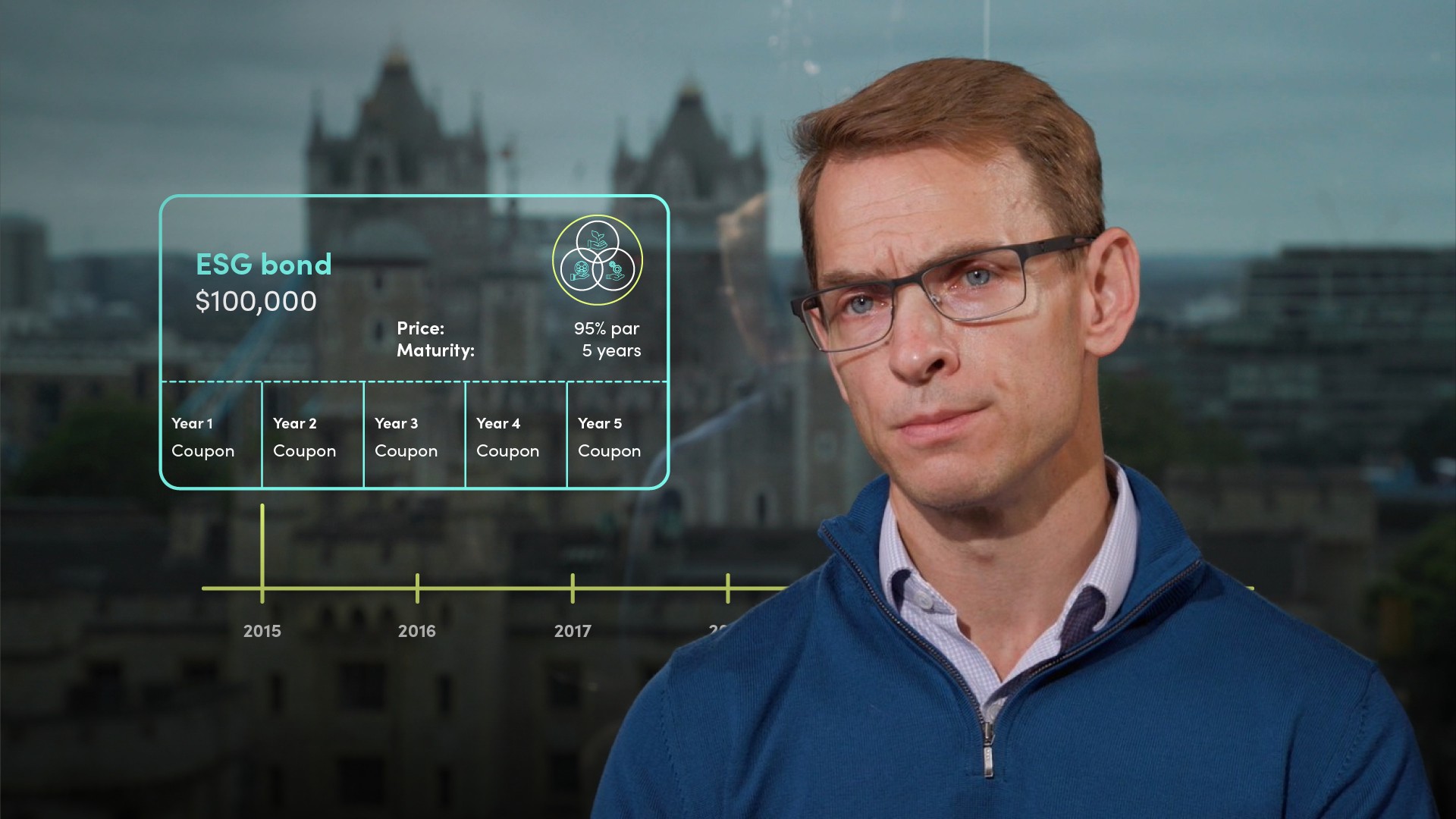

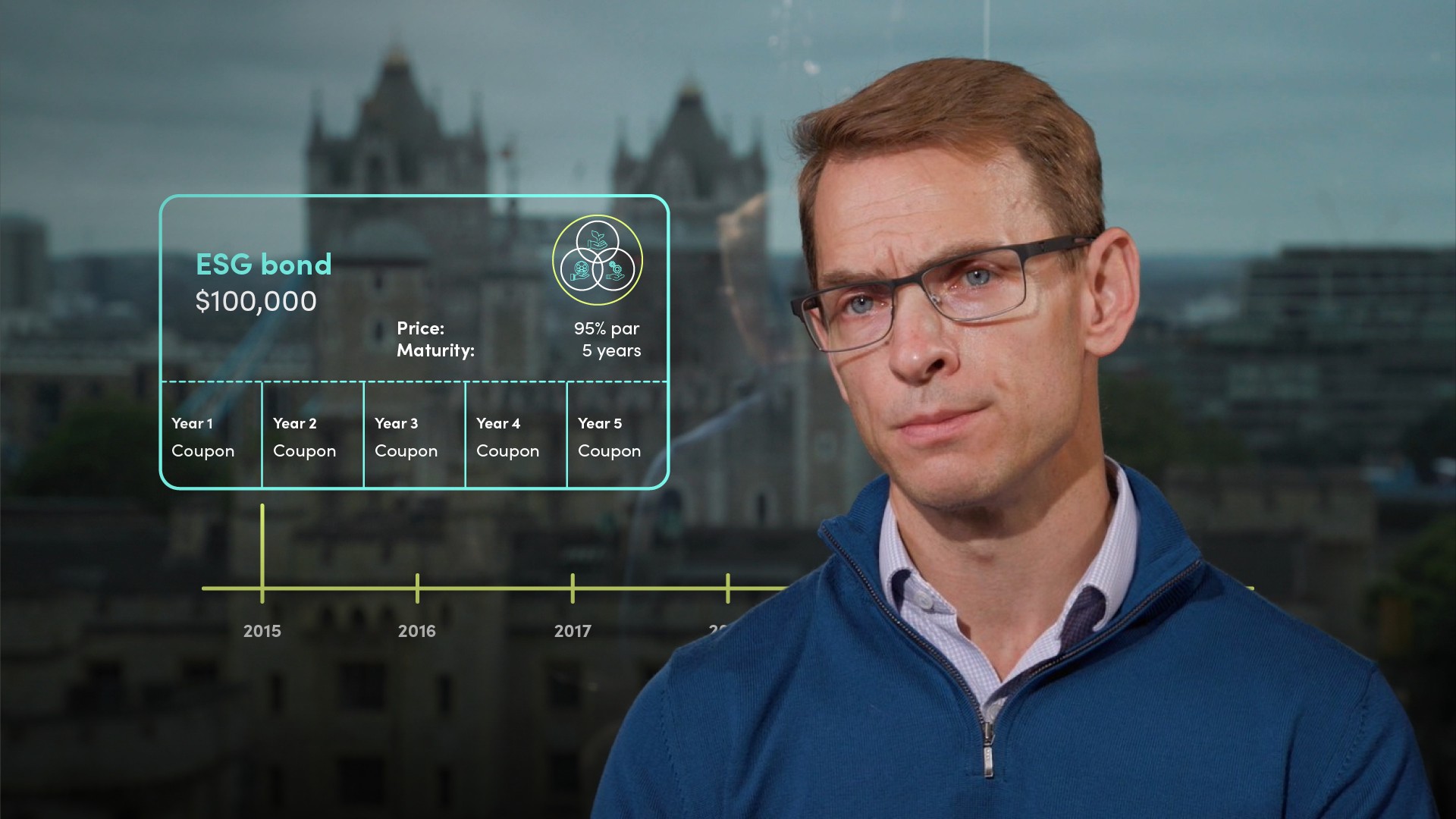

The ESG asset class has been growing strongly since around 2015 and accelerated particularly in the last 5-6 years with the significant increase in the number of Supranational, Sovereign and Agency (or “SSA”) borrowers utilising the markets. More Corporate and Financial Institutions issuers focused on the positive PR aspects, and a rise in the number of mandates given to the largest bond investors which demanded an ethical or ESG investment footprint.

In 2015 there was around US$85bn raised in ESG format, which grew to in excess of US$400bn in 2021. That’s a 370% rise in the space of 6 years. Year to date, we’ve seen US$340bn versus US$125bn over the same period in 2020 – that’s a 170% increase.

How do ESG bonds fit into the broader bond market?

2020 saw US$4.2 trillion of new issue supply – so last year, which was the largest ever for the ESG market, just under 10% of bond issuance was done in this asset class. But, volumes continue to build and there is no doubt that ESG or green bonds will become a staple tool.

ESG issuance is not in addition to regular funding in the bond market – issuers utilise ESG structures for some (or all of their issuance) as a replacement. So, in effect the net result overall is no additional bond issuance, rather the makeup of that borrowing is reconfigured.

Who are the major issuers of ESG bonds?

It continues to be dominated by SSA borrowers rather than Corporate or Financial Institutions. In no small part that is because the volumes issued by SSAs in non-ESG format is also significantly higher than from other sectors, but it is also because certain SSA issuers feel able to issue their entire requirements in ESG format.

In 2020 SSAs accounted for around US$280bn of the total US$400bn supply, or close to 70%. Covid requirements no doubt pushed that percentage up, but in most years, that percentage remains above 60%.

Who are the core buyers of ESG bonds?

The core buyers are large institutional investors – the asset managers, alternative investment houses, pension funds and insurance companies. They themselves are getting an increasing number of mandates from their end-investors to be invested in ethical, socially-responsible, and green assets. In addition to this, the regulators are increasingly looking at what proportion of certain investors’ assets are in ESG format, and what drives those investment decisions.

When does the issuer benefit from an ESG transaction?

If the bond market is strong and demand is high, an ESG transaction would typically see a modest benefit for the issuer – that could be in the context of 5 to 10 bps. In a more negative market however, or where competing issuance levels are higher, that ESG benefit largely disintegrates. The impact for a borrower of issuing in ESG format is therefore more PR related than pricing at this point. And indeed, issuers should not be going to market with an ESG offering with the expectation of a pricing advantage.

What are the developments that have occurred in the bond market during Q2 of 2021?

A key focus has been on ESG disclosure, diligence practices and taxonomy. These are on-going topics which require significant interaction between the regulators and broader market and which will take some months to fine tune before being cemented. In reference to the ‘broader market’ we mean issuers, investors, leading banks, law firms or ESG rating agencies.

The key regulatory developments seen over the course of 2020 and into 2021 have been a focus within ESG bonds. These developments in regulation have been led by the European Union and have included: improving the quality of data disclosure, creating a homogeneity around reporting standards and a greater focus on a more widely used taxonomy that dictates which reference assets and structures may be considered relevant for ESG issuance. The EU has also focused on the need for issuers and major investors to demonstrate the integration of ESG principles into their investment and disclosure processes.

We have also seen key “novel” issuers in Q2 on the ESG side, such as

- Amazon - Amazon had their first issue from their newly set up sustainable bond framework . Issued a $1bn 3 year sustainable bond in May, 2021

- Kelloggs - Kellogg’s launched its first sustainable bond, a €300m 8 year in May. The bond will finance or refinance eligible projects that align with its commitments which include addressing hunger relief and building climate resilience

- Whirlpool - Whirlpool issued their first sustainability bond in April - a $300m 10 year bond. Some of the projects it will finance include Whirlpool's Science Based Targets Initiative to reduce greenhouse gas emissions and to advance the eco-efficiency of whirlpool products.