Environment and Governance at VC Fund Operations

Hannah Leach

ESG and VC specialist

Sustainability and governance have been growing in prominence in the VC industry, which means that VC’s must now focus on managing and reducing their emissions and promoting good practice for governance. Where do you start? Join Hannah Leach as she walks you through these issues.

Sustainability and governance have been growing in prominence in the VC industry, which means that VC’s must now focus on managing and reducing their emissions and promoting good practice for governance. Where do you start? Join Hannah Leach as she walks you through these issues.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Environment and Governance at VC Fund Operations

7 mins 46 secs

Key learning objectives:

Identify ways VCs can manage environmental impact

Outline how VCs can achieve good governance

Understand the importance of reporting

Overview:

It is important for VCs to track, manage and report their carbon footprint. This is to set an example and lead by doing, to learn the process and gain practical insight into the processes that they are asking their portfolio companies to adhere to. This can include limits on air travel and promoting environmentally-conscious behaviour. Achieving good governance can be split into two steps - learning what best practice governance involves and promoting transparency.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How can VCs manage their environmental impact?

It is important for VCs to track, manage and report their carbon footprint. This is to set an example and lead by doing, to learn the process and gain practical insight into the processes that they are asking their portfolio companies to adhere to.

The main sources of carbon emissions for a VC fund are travel such as: business flights, daily commutes, office space (including energy usage and waste along with food supplies, and hosted events). Identifying and analysing this footprint is step one.

A VC fund can then begin to understand where the biggest impact lies, how best to manage and reduce their footprint and what targets to set for themselves.

- Common practices include:

- Limits on air travel

- Taking trains where possible

- Switching to a green energy provider in the office

- Promoting more environmentally-conscious behaviour within the team (e.g. introducing meat-free days and cycle-to-work schemes)

How can VCs achieve good governance?

As a model, venture capital doesn’t necessarily promote good corporate governance – it is private, organised in opaque partnerships and has always promoted rule-breaking and contrarian behaviour. Furthermore, teams are often small and lacking in the relevant resources, capacity and knowledge of what good corporate governance means.

1. VC funds should make efforts to understand what best practice looks like. VC funds should know who their limited partners are, which includes carrying out robust due-diligence on prospective LPs, establishing thorough anti-money laundering and anti-corruption processes for the fund, checking proof of identity and carrying out PEP and sanction-screens.

2. Transparency is a key tenet of strong governance, and VC funds should consider how this applies to them. This could be around making voting rights in the investment committee transparent (i.e. how investment decisions are considered and made) or how carry is allocated across the fund.

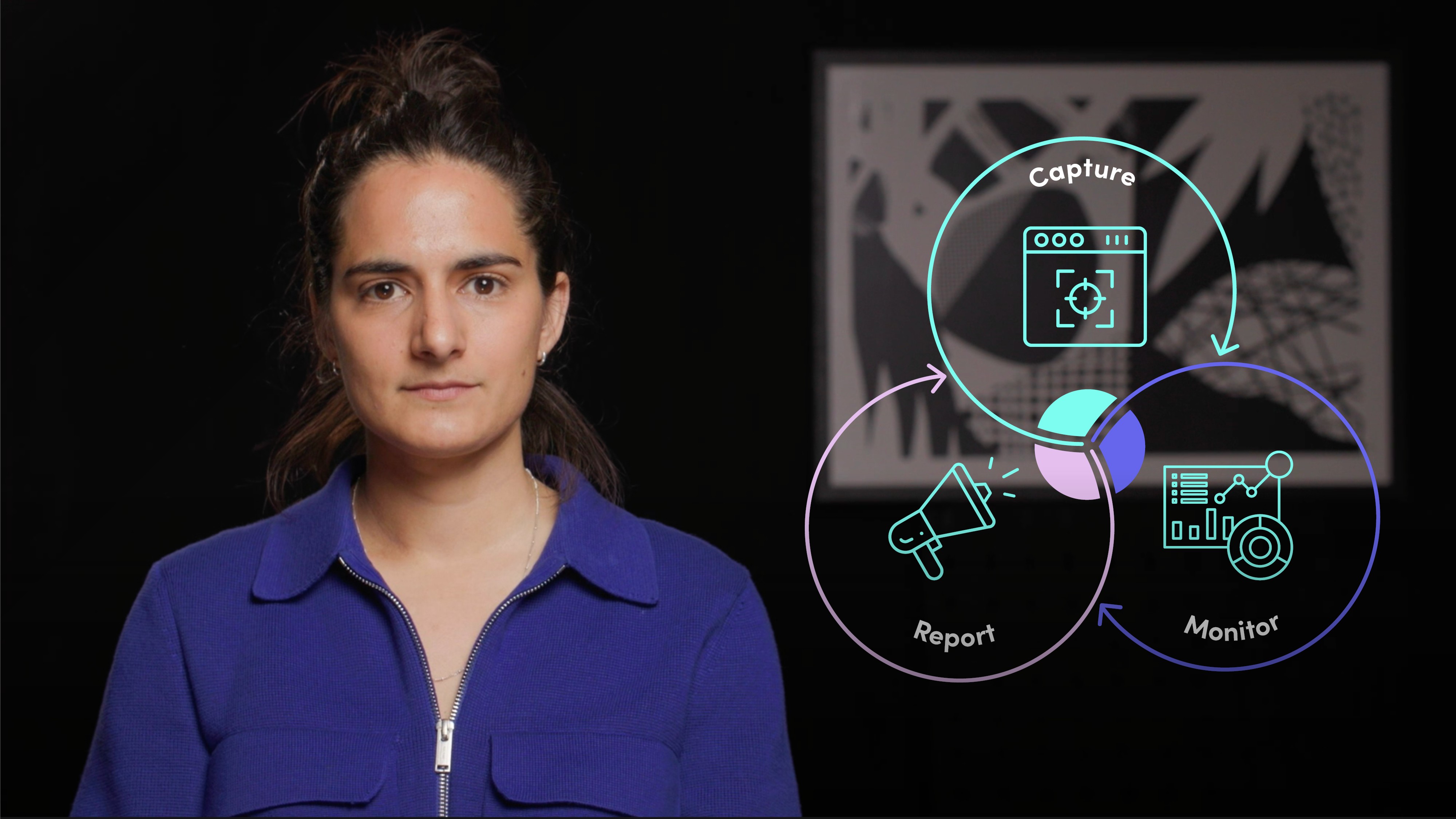

Why is reporting so important?

ESG is often understood as another reporting exercise. It is important to note who it is that you are communicating with in the ongoing reporting of your ESG activity and performance. The required reporting for VC funds on ESG will initially be driven in a big way by regulation (e.g. ESG vs. SFDR in Europe) and LP requirements. There are currently no accepted standards, including well-known standard setters such as the Institutional Limited Partners Association (ILPA), or the Principles for Responsible Investment (PRI), although the arrival of these standards is imminent. There will be metrics which LPs won’t ask for, but which are nevertheless important to capture, monitor and report back to your team on. Doing this enhances accountability, forces one to confront those areas where things might not be working well, and encourages a cycle of improvement. Fund managers should consider preparing an annual ESG report.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Hannah Leach

There are no available Videos from "Hannah Leach"