Embedding ESG Data into the Investment Process

Arun Kelshiker

20 years: Asset management and stewardship

In this video, Arun explores how ESG data is integrated across the investment process from research and valuation to portfolio construction and risk management. He explains key frameworks like the UN PRI, highlights real-world examples from firms like Manulife and Invesco, and discusses the tools and metrics investors use. He also addresses the challenges around ESG data transparency and ratings consistency, offering insights into how investors can navigate these issues to make smarter, more sustainable decisions.

In this video, Arun explores how ESG data is integrated across the investment process from research and valuation to portfolio construction and risk management. He explains key frameworks like the UN PRI, highlights real-world examples from firms like Manulife and Invesco, and discusses the tools and metrics investors use. He also addresses the challenges around ESG data transparency and ratings consistency, offering insights into how investors can navigate these issues to make smarter, more sustainable decisions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Embedding ESG Data into the Investment Process

14 mins 12 secs

Key learning objectives:

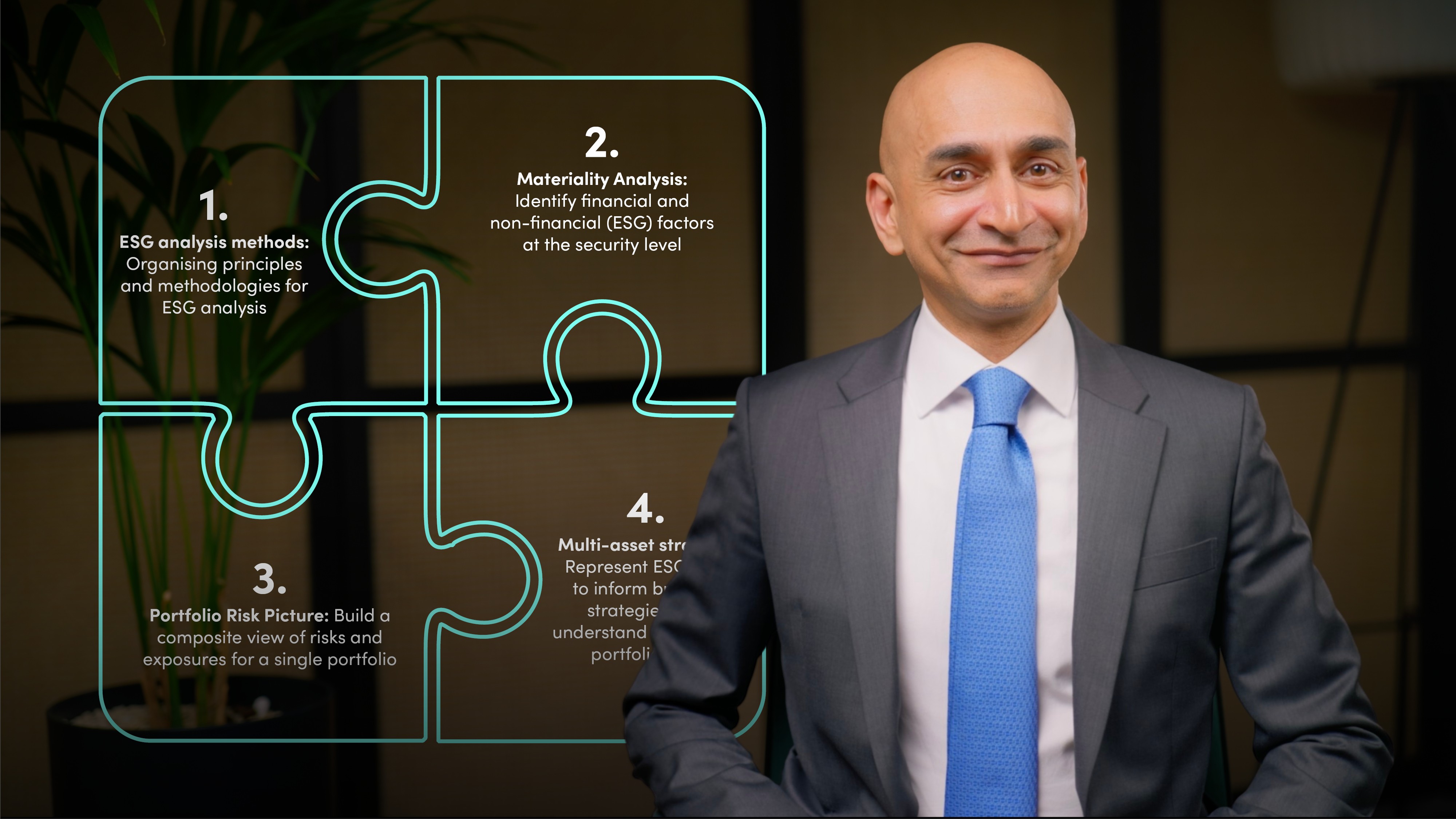

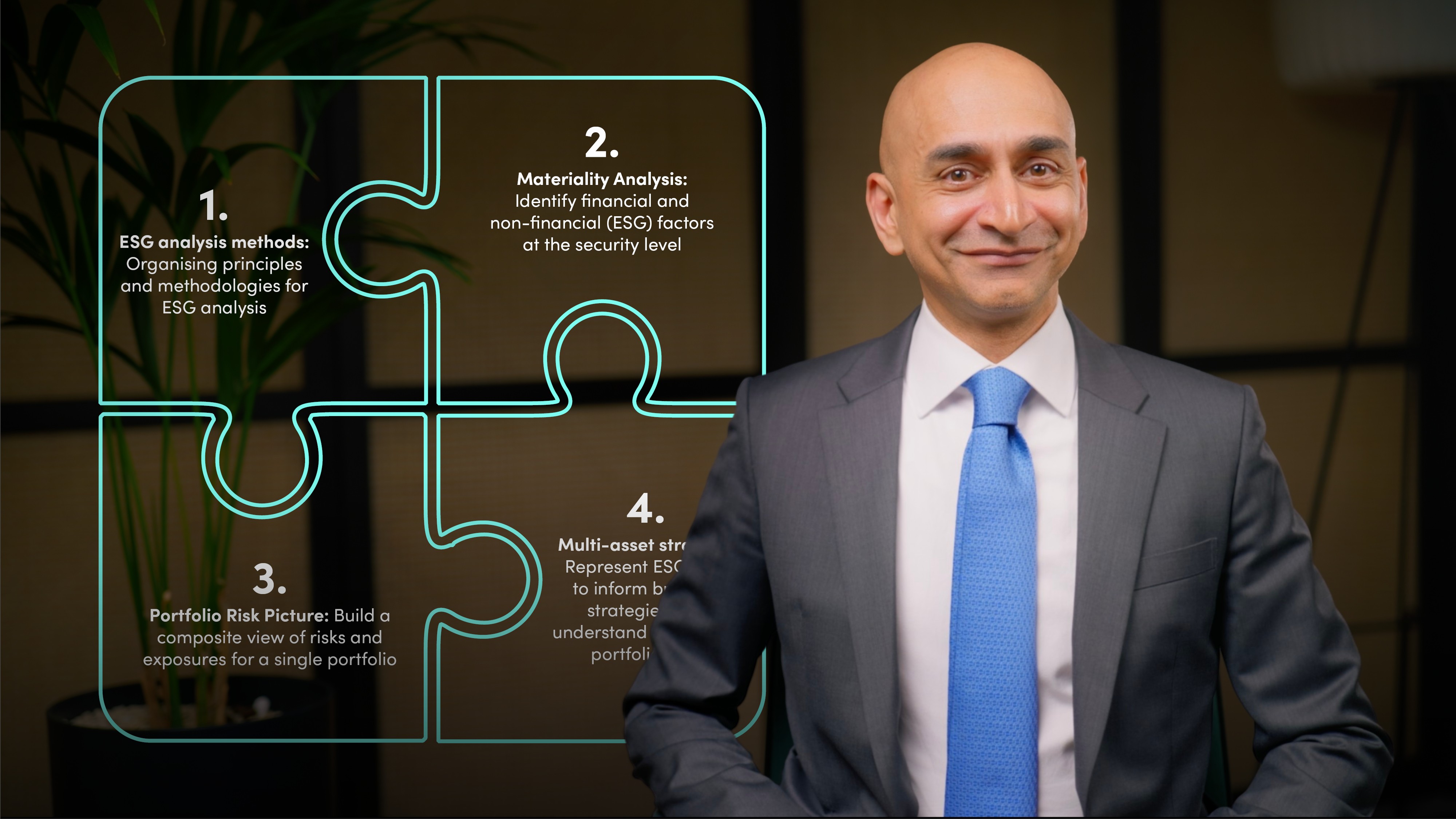

Understand how ESG data integrates into investment processes across equities and fixed-income strategies

Outline methodologies and tools used by investors and data providers for ESG integration

Identify challenges related to ESG data, such as transparency, methodological biases, and reliability

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Arun Kelshiker

There are no available Videos from "Arun Kelshiker"