A Structured Approach to Risk Assessment

Hans-Kristian Bryn

35 years: Strategic risk management and governance

Join Hans-Kristian Bryn and learn how to assess and prioritise risks by combining qualitative judgment with data-driven analysis. Explore how scenario planning, risk quantification and AI-enabled insight support smarter decisions and stronger strategic resilience.

Join Hans-Kristian Bryn and learn how to assess and prioritise risks by combining qualitative judgment with data-driven analysis. Explore how scenario planning, risk quantification and AI-enabled insight support smarter decisions and stronger strategic resilience.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

A Structured Approach to Risk Assessment

13 mins 3 secs

Key learning objectives:

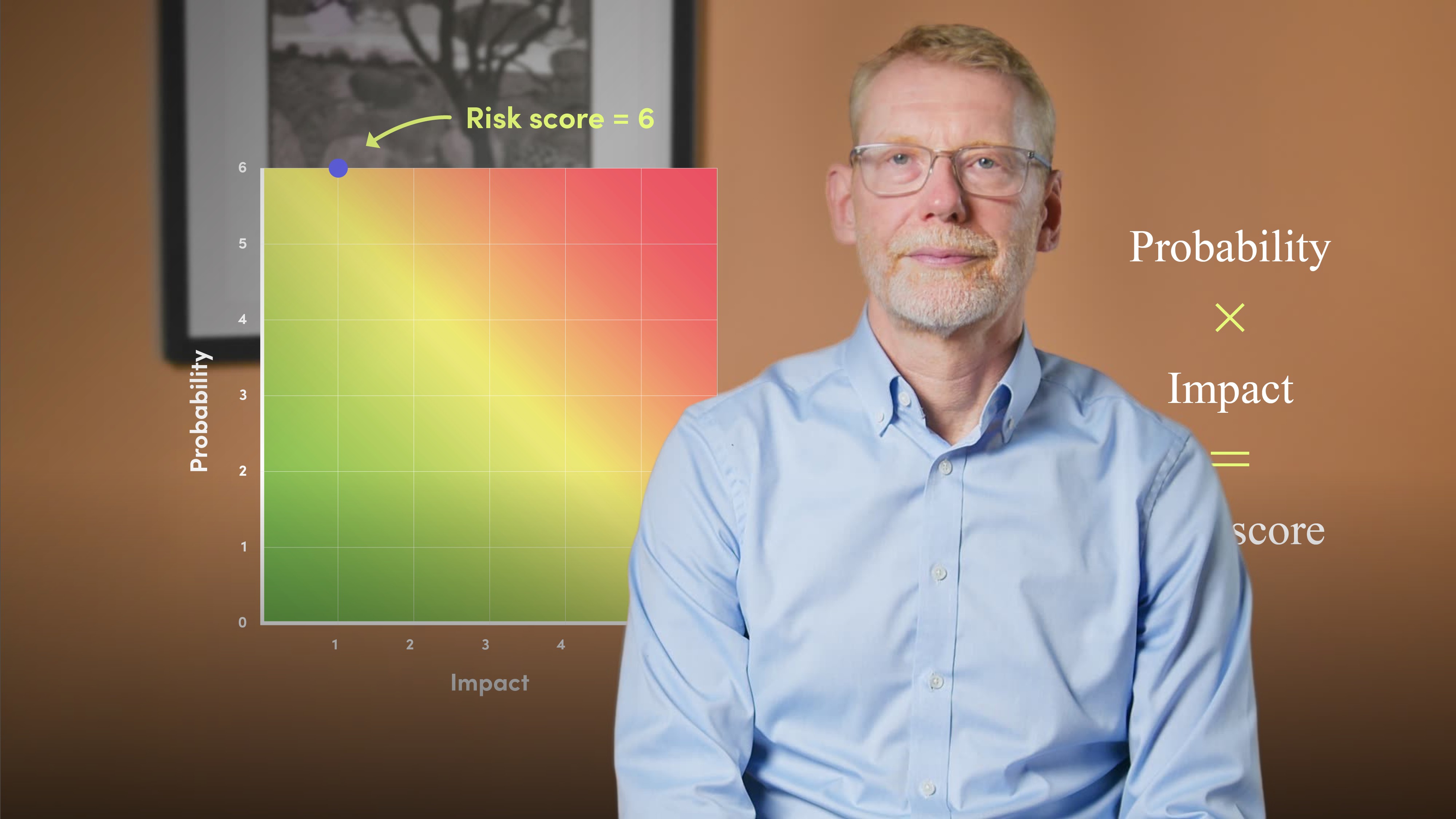

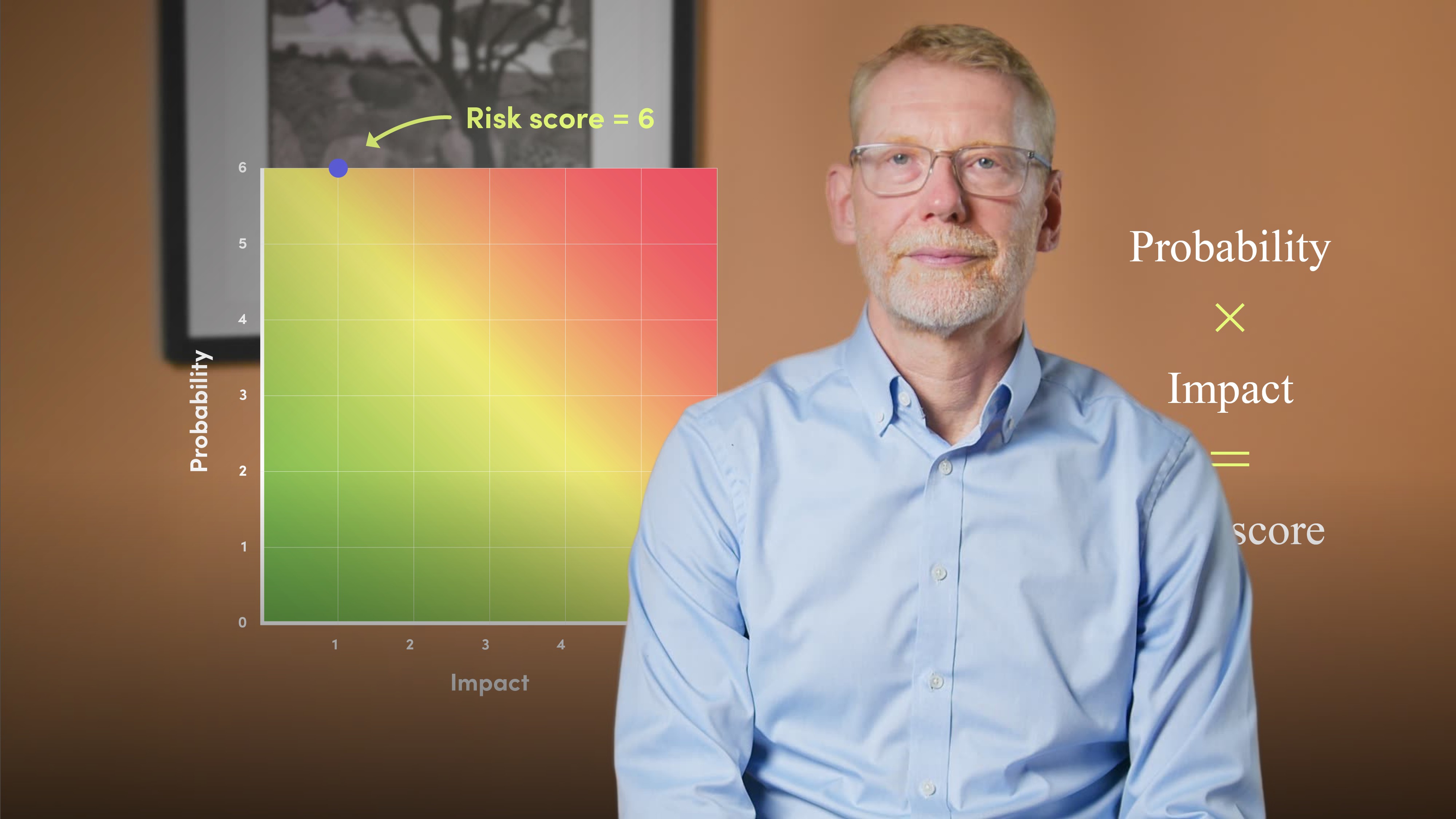

Understand the purpose of risk assessment in linking risk understanding to business strategy

Understand the differences between qualitative and quantitative assessment techniques and their relative strengths

Outline how risk prioritisation and transition analysis inform decision-making

Identify practical ways to embed risk assessment into ongoing business management

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Hans-Kristian Bryn

There are no available Videos from "Hans-Kristian Bryn"