COVID-19 Social & Sustainability Response Bond

Stephanie Sfakianos

35 years: Sustainable finance & banking

In the first video this series on Social & Sustainability bonds, Stephanie identifies the uses of social & sustainability bond issuance, i.e. to fund social and environmental projects, and discusses whether they have been effective.

In the first video this series on Social & Sustainability bonds, Stephanie identifies the uses of social & sustainability bond issuance, i.e. to fund social and environmental projects, and discusses whether they have been effective.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

COVID-19 Social & Sustainability Response Bond

12 mins 32 secs

Key learning objectives:

Define "Covid Response Bond"

Outline the ‘four pillars' set out by The Social Bond Principles (SBP)

Understand how useful the SBP is for issuers

Understand the impact of social measures

Understand why sustainability bonds increased in issuance this year

Overview:

The Coronavirus pandemic has had a dramatic impact on economic activity, and at the same time has exposed many fault lines in society which governments will be expected to tackle. It has led to an increase in the issue of social bonds (funding social projects) and sustainability bonds (social and environmental projects). This video will explore the “Covid Response Bond”, the four pillars set out by The Social Bond Principles and some of the challenges around measuring social impact.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the “Covid Response Bond”?

- 2020 has been the year of the “Covid Response Bond” which has been issued either as social bonds (funding social projects), or as sustainability bonds (funding a mix of social and environmental projects)

- In many ways, Covid bonds of whatever type are a good thing, even if they weren’t all equally rigorous in terms of their structuring and disclosure. It is the nature of a crisis that the need for action is now

- However, it remains to be seen whether in the coming months, it is generally viewed as being helpful to have yet another “label”, particularly if transactions don’t provide sufficient transparency for investors to understand the sustainability features of the issuer or the projects to which proceeds will be allocated

What are the ‘four pillars’ set out by The Social Bond Principles (SBP)?

The social bond market benefited from the launch in [2018] of The Social Bond Principles (SBP), which operate like the Green Bond Principles under the auspices of ICMA. The SBP, like the GBP, set out four “pillars” to which the issuer should adhere, in order to meet best market practice. These are:

- Disclosure of the Use of Proceeds;

- The process by which the eligible projects were selected;

- The process by which funds will be tracked within the issuer’s systems;

- A process for reporting on the allocation of proceeds and, where possible, the impact of the benefits achieved

How useful is the SBP for issuers?

The SBP has an excellent website which features a resource centre providing case studies and guidance on metrics and key performance indicators. As an example, an issuer looking to provide access to safe drinking water might report on the number of new households connected to a safe supply or the number of plants constructed. Health metrics might include maternal and infant mortality or simply the number of patients treated in a new or improved facility.

How simple is it to understand the impact of social measures?

- Measuring the impact of social measures is not a simple task. In reviewing the examples of social bonds, it is clearly enormously challenging to conceive of “science based” targets to mirror the kind of emissions targets that underpin environmental project reporting

- Most issuers therefore stop at the point of reporting outputs from the projects, such as the number of beneficiaries of a particular initiative. The next step, of identifying the outcomes and beyond that, the impact, could be a mammoth undertaking

- If we take micro enterprises as an example: at the lower end of the scale, where lending is to individuals, it is simply unrealistic to expect an issuer to measure and report on the medium and long term impacts of a large number of micro loans

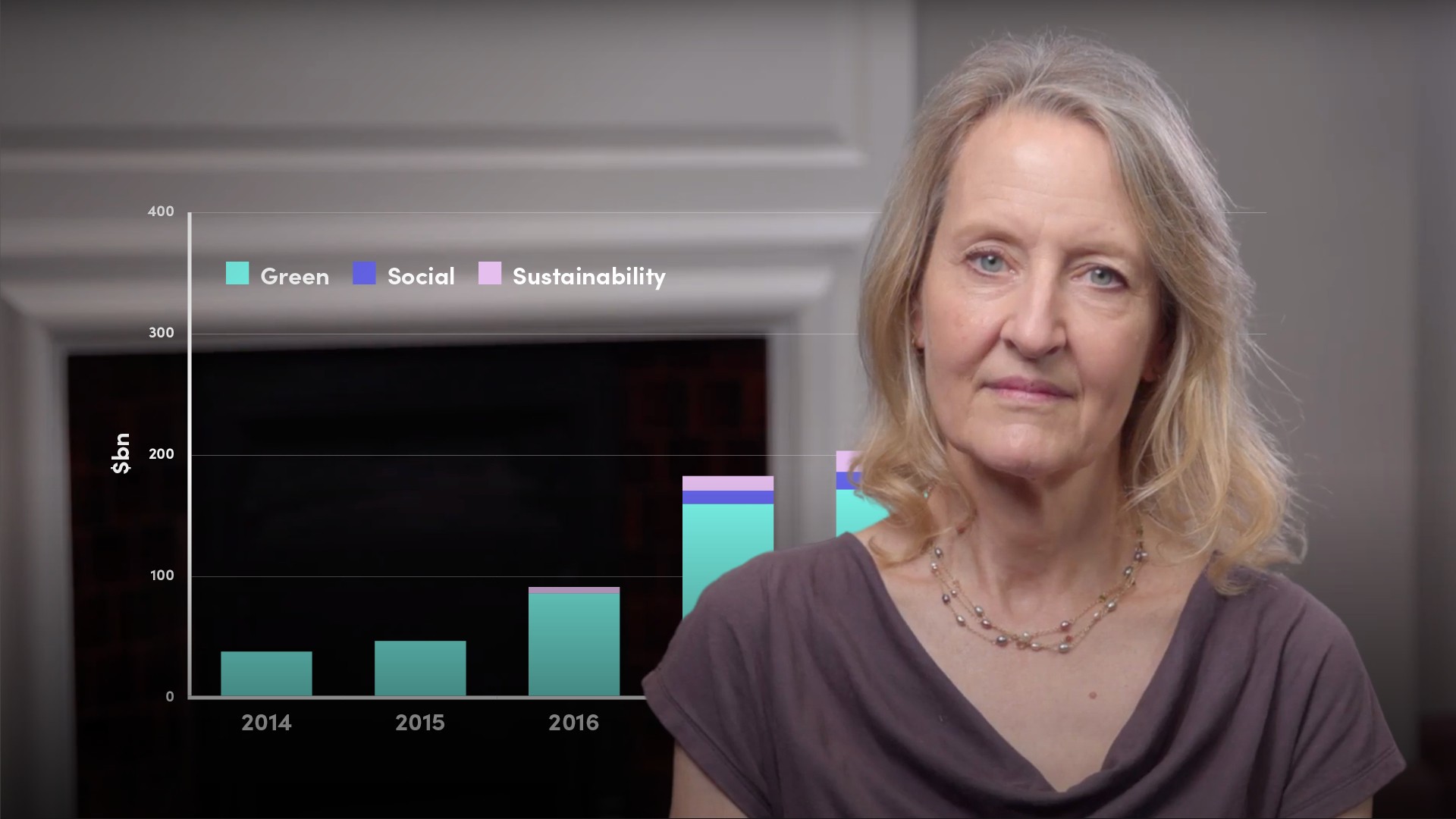

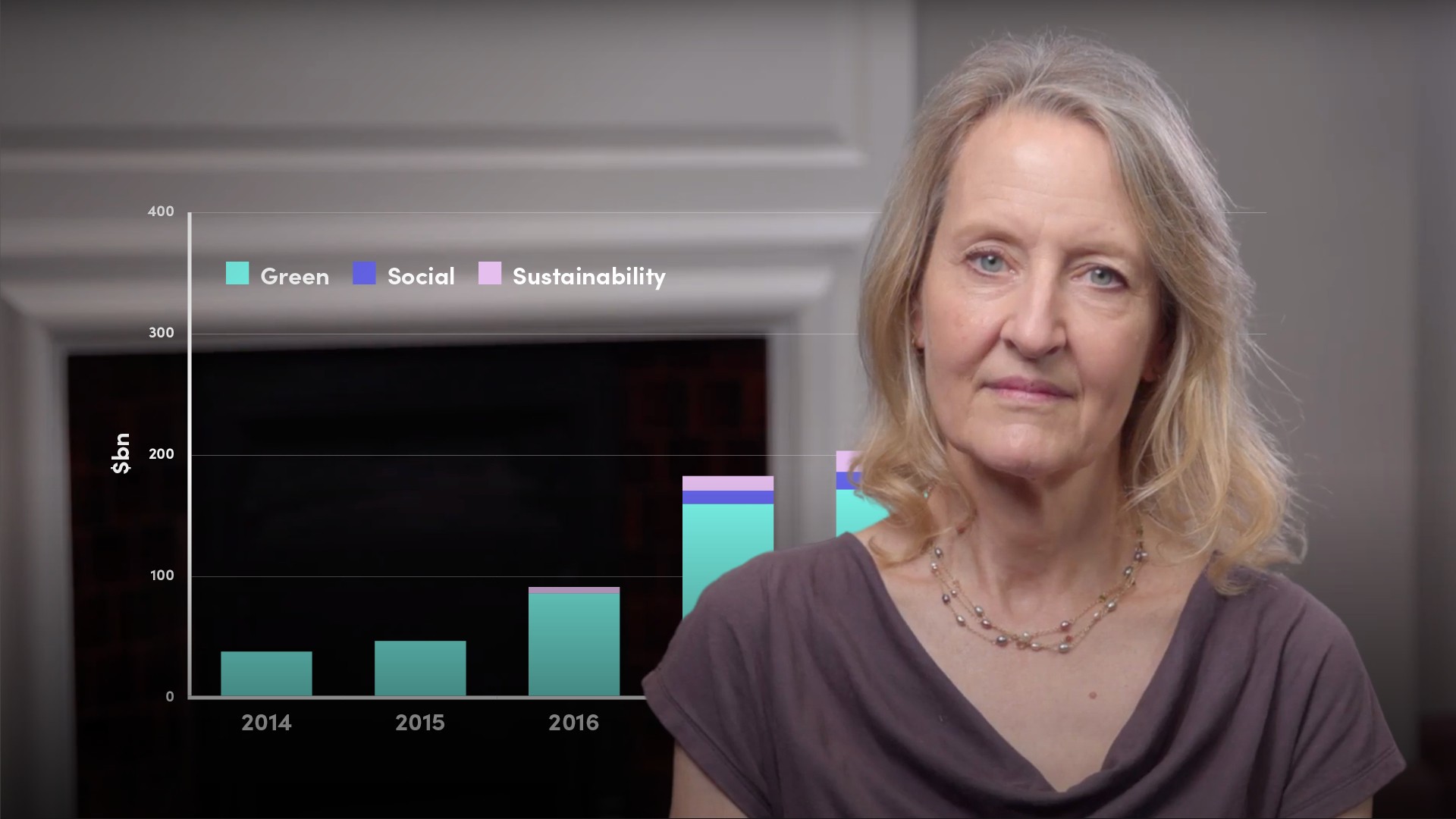

Why have Sustainability bonds increased in issuance this year?

- Sustainability Bonds have matched social bonds in terms of issuance this year

- These are “Use of Proceeds” bonds, just like labelled Green and Social bonds, which finance projects with a mix of green and social projects, assets and activities

- One big attraction for issuers is that a Sustainability Bond gives them a lot more flexibility in selecting projects. Any issuer, anywhere, can at the very least say that their activities promote employment, which the Covid crisis has helped to highlight as a social good and which is encapsulated in UN Sustainable Development Goal 8, calling for Decent Work and Economic Growth

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Stephanie Sfakianos

There are no available Videos from "Stephanie Sfakianos"