ESMA releases Final Report on Guidelines for fund names using ESG or sustainability-related terms

CMS

By: Laura Houët and Daniel Lederman

On 14 May 2024, ESMA released its Final Report setting out its finalised guidelines (the “Final Report Guidelines”) on the use of ESG and sustainability-related terms in investment fund names. Following the incorporation of feedback received from stakeholders and market participants to the proposals in the Consultation Paper released on 18 November 2022 (the “Consultation Paper Proposal”), several changes have been made to the Guidelines – which we summarise below.

ESMA considers that fund names, as the first information seen by investors, can materially impact investors’ decision-making and its Final Report Guidelines are intended to provide clear criteria to tackle the perceived greenwashing risk arising from fund names being improperly used, while sustainable disclosure legislation continues to evolve.

What should you do now?

Clients should now take action to review their fund names against the Final Report Guidelines and make plans to change these where necessary. The Final Report Guidelines will come into effect three months after they are published on ESMA’s website in all EU official languages (the “Application Date”). Managers of any new funds must apply them immediately following the Application Date, with existing funds having 6 months to align.

Notably:

- The Final Report Guidelines still require managers to exercise a level of judgement and so clients should consider this carefully against their existing policies and procedures for SFDR;

- The Final Report Guidelines come as managers in the UK are assessing their products against the new FCA Anti-Greenwashing Rule and the application of the Sustainability Disclosure Requirements, which include detailed requirements on naming and marketing. For clients with EU and UK ranges, we recommend considering the Final Report Guidelines alongside their preparations for the UK implementation and ensuring consistency of approach where possible.

What are the Final Report Guidelines?

1. ESG-Related Terms

Consultation Paper Proposals: proposed that if a fund had any ESG-related words in its name, a minimum proportion of at least 80% of its investments should be used to meet the environmental or social characteristics or sustainable investment objectives in accordance with the binding elements of the investment strategy.

Final Report Guidelines:

- Removed the 50% threshold for sustainable investments.

- Retained the 80% threshold for investments used to meet environmental and/or social characteristics or sustainable investment objectives.

2. Sustainability-related terms

Consultation Paper Proposals: proposed that if a fund had the word “sustainable” or any other similarly derived word in its name, it should allocate, within the 80% of assets allocated to meet the environmental or social characteristics or sustainable investment objectives, at least 50% to sustainable investments as defined in Article 2(17) of the SFDR.

Final Report Guidelines:

- Removed the 50% threshold for sustainable investments.

- Introduced a commitment to invest meaningfully in sustainable investments for the use of any sustainability-related words in funds’ names.

3. Impact-related terms

Consultation Paper Proposals: proposed that funds should only be permitted to use the word “impact” or “impact investing” or any other impact-related term where (i) the quantitative thresholds and minimum safeguards set out here are met, and (ii) their investments are made with the intention to generate positive, measurable social or environmental impact alongside a financial return.

Final Guidelines:

- When using any “impact”-related word fund managers should ensure that the investments under the minimum proportion of investments are made with the intention to generate positive, measurable social or environmental impact alongside a financial return.

- When using any “transition”-related word fund managers should demonstrate that the investments are on a clear and measurable path to social or environmental transition.

4. Minimum safeguards

Consultation Paper Proposals: proposed minimum safeguards for all funds with an ESG or sustainability -related term, including exclusion criteria for Paris-aligned Benchmarks (PAB).

Final Report Guidelines:

- Adjusted the Climate Transition Benchmark (CTB) exclusion criteria to provide for terms that are transition-, social- and governance-related, covering:

- companies involved in any activities related to controversial weapons;

- companies involved in the cultivation and production of tobacco; and

- companies found in violation of the United Nations Global Compact (UNGC) principles or the Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises.

5. Transition Category (NEW)

Final Report Guidelines:

- Introduced a new category for transition-related terms, such as “improving”, “progress/ion”, “evolution”, “transformation”, and any related words to catch a wide set of terms that give the impression of a positive evolution towards the goals described in the objectives.

- Requires, in addition to the 80% threshold, the application of CTB exclusions only.

6. Separation of “E” from “S” and “G” terms and combination of terms (NEW)

Final Report Guidelines:

- Separated the terms related to social (S) and governance (G) from environmental (E) terms.

- Funds with social and governance terms in their names may apply the CTB exclusions only.

- Funds with environmental terms should still only be used by funds applying the PAB exclusions.

- Noted that the commonly used “ESG” and “SRI” abbreviations would still be considered environmental terms.

In summary

Conclusion

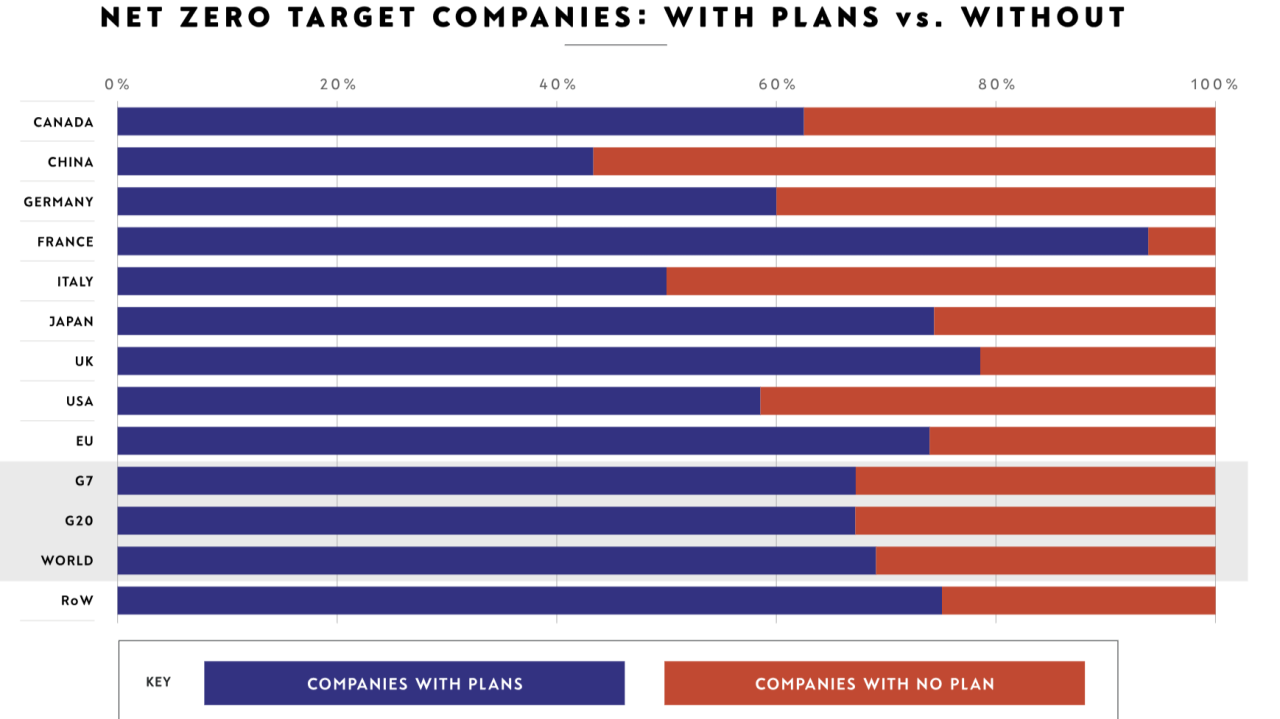

ESMA has Final Report setting out its finalised guidelines (the “Final Report Guidelines”) on the use of ESG and sustainability-related terms in investment fund names. Following the incorporation of feedback received from stakeholders and market participants to the proposals in the found that the proportion of funds using ESG terms of some description has increased by a factor of four in 10 years; at the same time global sustainable fund assets have tripled over the last three years to over €2.1 trillion. These Final Report Guidelines will now frame the regulatory landscape for all UCITS and AIF funds, investors and downstream servicing entities seeking to tap into this market, but significant work will be needed in the transition period to bring products and ongoing monitoring activities up to the regulatory standards required.

This article was written by CMS partner Laura Houët and associate, Daniel Lederman. It was first published on CMS Law-Now on 16th May 2024, available here.

CMS

Share "ESMA releases Final Report on Guidelines for fund names using ESG or sustainability-related terms" on