The CBAM: what is it and how will it affect the market?

CMS

Regulation (EU) 2023/956 establishing a carbon border adjustment mechanism (CBAM) entered into force on 17 May 2023. The implementation of the CBAM has been divided into a transitional period (from 1 October 2023 to 31 December 2025) and a target period (starting 1 January 2026).

Why has the CBAM been introduced?

With the establishment of the scheme for greenhouse gas emission allowance trading (EU ETS) in 2005, which covers, among other things, energy intensive installations, the European Union has set a course of action to reduce overall greenhouse gas emissions. However, the ever-rising costs of the decarbonisation measures introduced by the European Union for EU industry have resulted in recent years in an increasing relocation of energy intensive industries outside the European Union or the importing of goods into the EU customs territory from countries lacking effective climate policies and large-scale decarbonisation measures (i.e. carbon leakage). It should be noted, however, that recently there have been indications that economies, which thus far have been seen as reluctant to put decarbonisation measures in place, such as the People’s Republic of China, are announcing a gradual introduction of emission reduction targets for energy intensive industries from 2030 to 2055.

Existing mechanisms for addressing the risk of carbon leakage in sectors or subsectors where such risk exists consist of the transitional free allocation of EU ETS allowances and financial measures to compensate for indirect emission costs incurred from greenhouse gas emission costs passed on in electricity prices.

The EU, however, is of the opinion that such free allocation weakens the price signal that the system provides and affects the incentives for investment through the further reduction of greenhouse gas emissions and decarbonisation measures.

The CBAM is designed to reduce the risk of carbon leakage (i.e. the release of greenhouse gases into the atmosphere from the production of goods) with the expectation that it will at the same time contribute to decarbonisation in third countries (a country or territory outside the customs territory of the Union). The CBAM aims to achieve a transition from the existing mechanisms to carbon prices that are equivalent for imports and domestic products. To ensure a gradual transition from the current system of free allowances to the CBAM, the CBAM will be progressively phased in while free allowances in sectors covered by the CBAM are phased out.

The CBAM is part of the “Fit for 55” package that is an element of the European Green Deal initiative presented by the European Union, which aims to transform the EU into a fair and prosperous society, with a modern, resource-efficient and competitive economy, where there will be no net emissions of greenhouse gases by 2050 (at the latest) and where economic growth will be decoupled from the use of resources.

How does CBAM work?

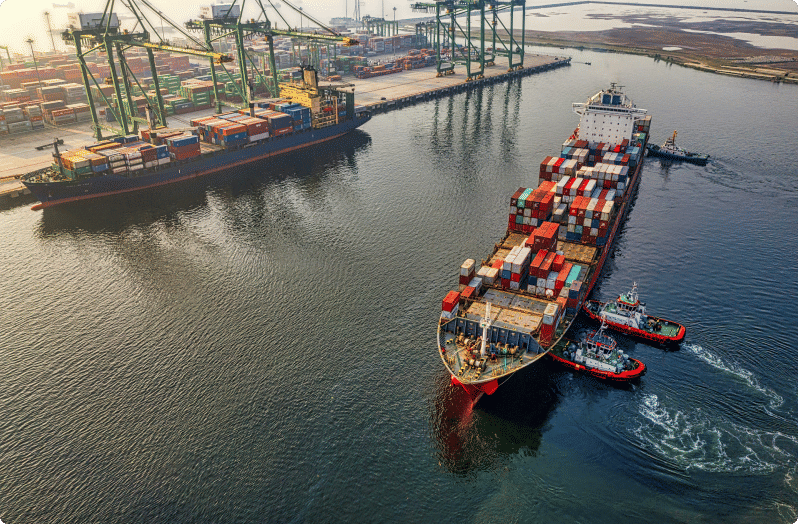

The CBAM introduces a charge that will increase – as an additional cost – the price of imported industrial products, taking into account the emissions generated by these products (i.e. embedded emissions). This charge is intended primarily to protect EU emission-intensive businesses, which incur growing costs of the purchase of greenhouse gas emission allowances, while outside the EU such costs are often not paid at all, and thus imported goods are simply cheaper, which affects the competitiveness of EU producers that are subject to charges under the EU ETS system. The CBAM applies to greenhouse gas emissions embedded in goods on their importation into the customs territory of the EU from a third country. The date determining whether or not certain goods will be covered by a CBAM report is the date when the goods are released for free circulation in the customs territory of the EU.

Sectors covered

Phased in gradually, the CBAM will initially apply, among others, to the following goods:

- cement;

- electricity;

- fertilisers;

- iron and steel;

- aluminium;

- organic chemicals and plastics, and goods made from them;

- hydrogen;

- ammonia.

In addition, the CBAM applies to processed products from those goods resulting from an inward processing procedure. With this scope, once fully implemented, the CBAM will cover more than 50% of emissions in the sectors falling under the EU ETS. A detailed list of goods covered by the CBAM is provided in Annex I to Regulation 2023/956. Ultimately, the scope of the CBAM may be extended to include other goods.

Who do the new obligations apply to?

The obligations under the CBAM will have to be fulfilled by importers, who will be under a duty to declare annually the quantity of goods imported into the EU in the previous year, along with their embedded greenhouse gas emissions. The gradual phase-in of the CBAM between 2026 and 2034 will take place in parallel with the gradual phase-out of the free allocation of EU ETS allowances. The process of applying for the authorisation of declarants, registration of operators and installations in third countries, as well as setting up accounts in the CBAM registry, will begin on 31 December 2024.

This article was written by CMS associate, Bartłomiej Głąbiński. It was first published on CMS Law-Now on 26th February 2024. You can read the full article here.

CMS

Share "The CBAM: what is it and how will it affect the market?" on

Latest Insights

Concentrated power, systemic fragility: The real lesson of the Greensill collapse

11th March 2026 • xUnlocked