Explainer: Impact of US Banks exiting the Net-Zero Banking Alliance

Prasad Gollakota

20 years: Capital markets & banking

Understanding what it means for global sustainability efforts

Banks finance the majority of the world’s new renewable energy projects, which is invaluable in the transition to net zero. But with the six largest US banks stepping back from the global Net-Zero Banking Alliance (NZBA), what happens next for the global journey toward a sustainable future?

What is the NZBA?

The Net-Zero Banking Alliance is an industry-led, global initiative launched in April 2021 under the auspices of the United Nations Environment Programme Finance Initiative (UNEP FI).

Key objectives of the NZBA

- Achieving Net-Zero by 2050: Members commit to aligning their lending and investment portfolios with net-zero greenhouse gas (GHG) emissions by 2050.

- Interim targets: Banks must set science-based interim targets for 2030 (or sooner) to ensure progress toward the 2050 goal. These targets should focus on high-emitting sectors such as energy, transportation, and heavy industry.

- Transparency and accountability: Members must publicly disclose their targets, methodologies, and progress, following best practices for transparency and accountability.

- Support for Global Climate Goals: The alliance aligns with the goals of the Paris Agreement, which aims to limit global warming to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels.

The NZBA includes over 100 banks from around the world, representing a significant portion of global banking assets. Members range from large multinational institutions to regional and national banks.

The NZBA is a critical part of the global financial sector’s effort to combat climate change. By aligning banking activities with net-zero goals, the alliance plays a pivotal role in redirecting capital toward sustainable projects and away from carbon-intensive industries. It helps ensure that banks not only support climate goals through their operations but also influence the broader economy to transition toward sustainability.

Recent developments

In a significant shift just weeks before the inauguration of climate-sceptic Donald Trump as US president for a second term, the six largest banks in the US — JP Morgan, Citigroup, Bank of America, Morgan Stanley, Wells Fargo, and Goldman Sachs — exited the UN-convened NZBA.

Following the exodus, the alliance as of January 2025 comprises 141 banks from 44 countries, representing total assets of USD$61 trillion and 40% of global banking assets.

The withdrawals by major US banks from the NZBA are seen as a preemptive move to counter "anti-woke" criticism from right-wing politicians, reflecting a shift in the political landscape.

Although the banks have not provided detailed explanations for their departures, this does not necessarily indicate a retreat from their broader sustainability goals. “We remain committed to reaching net zero and continue to be transparent about our progress,” a spokesperson for Citigroup said. A spokesperson for Goldman Sachs said the bank was “very focused” on increasingly stringent standards and reporting requirements imposed by regulators, and insisted the bank had “made significant progress on the firm’s net zero goals”.

How does the change affect banks engaged in emissions reduction?

With six of the world’s largest banks, and significant financiers of fossil fuels, stepping away from the NZBA, questions arise about the alliance's capacity to drive the climate transition. While this is not a "knockout blow," Hetal Patel, head of sustainable investment research at Phoenix Group, suggests the alliance is "unfortunately weakened" by these departures.The mixed reception market participants gave to the NZBA’s 2024 Guidelines for Climate Target Setting may also fuel some uncertainty for the future. The updated guidelines cover not only lending and investment but also capital markets arranging and underwriting, aiming for a more holistic approach to climate target setting. Some critics, however, highlighted ongoing challenges, particularly the gaps between sectoral targets and overall net-zero commitments among member banks.

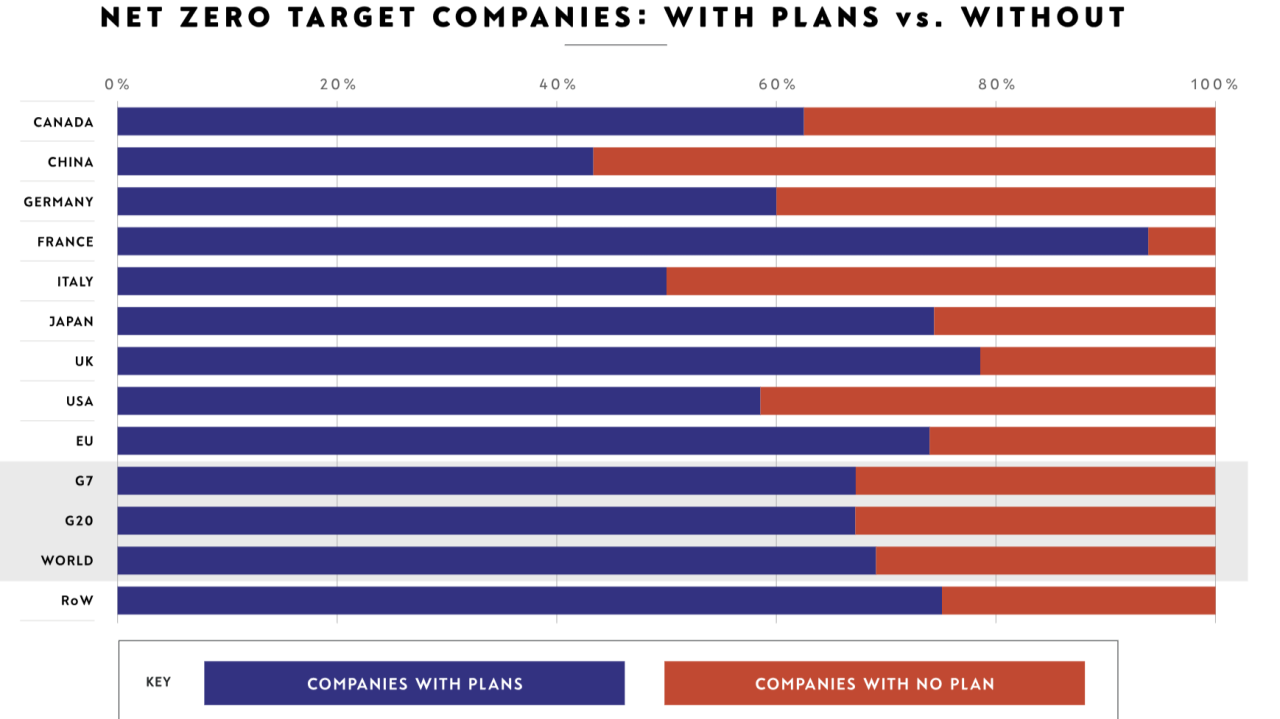

Interestingly, however, the withdrawal of US banks might serve as a catalyst for raising the bar on climate commitments, especially as most of the banks currently in the coalition are from Europe. Paddy McCully, Senior Analyst at Reclaim Finance, argues that European and other banks now have an opportunity to push the NZBA toward stronger stances against fossil fuel expansion, potentially strengthening the alliance’s overall impact.

“European and other banks must not use the exit of the US banks as an excuse to weaken their own climate commitments,” he says. “On the contrary, they have a unique opportunity to encourage the NZBA to strengthen its recommendations, by adopting meaningful positions against the expansion of fossil fuel.”

“Other major fossil fuel financiers, such as the Canadians and the Japanese, must also not replace the US as obstacles to stronger action within the NZBA,” McCully warns.

Looking ahead, the NZBA stands at a pivotal moment, with the potential for either bolstering its commitments or encountering new challenges based on the actions of its remaining members. Moving toward a more sustainable economy is a pressing issue that demands concerted efforts from both the public and private sectors, with financial services playing a pivotal role.

Prasad Gollakota

Share "Explainer: Impact of US Banks exiting the Net-Zero Banking Alliance" on