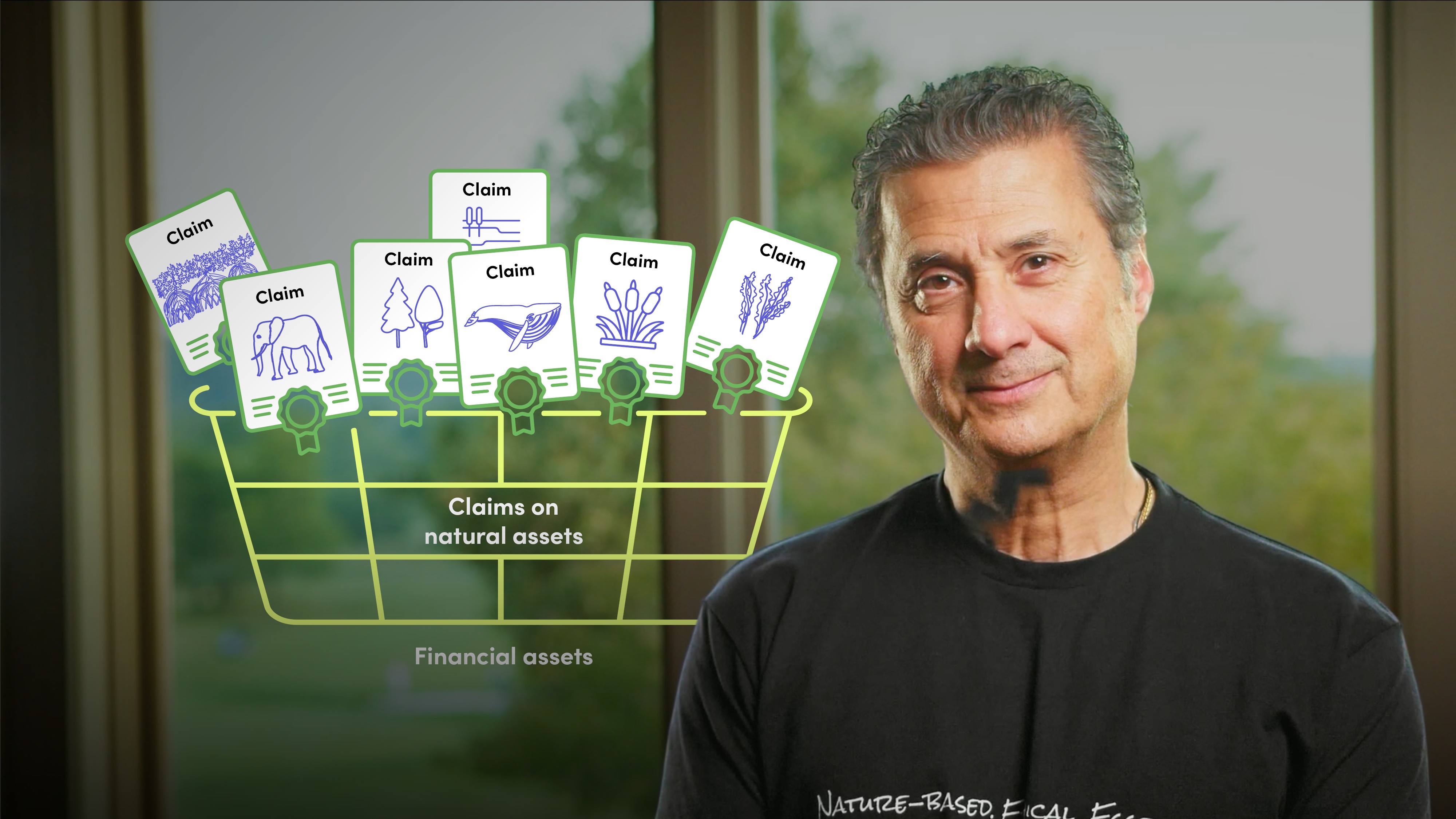

What is the (Carbon) Value of a Whale?

Ralph Chami

CEO & Co-founder: Blue Green Future

In this video, Ralph Chami explores the challenges in valuing natural resources. He explains how integrating wild animals and marine vegetation into nature-based solutions can attract significant investments for climate mitigation and biodiversity conservation. He delves deep into the role of whales in sequestering CO2 and proposes a path forward, by means of an economy rooted in natural preservation and prosperity through innovative financial instruments.

In this video, Ralph Chami explores the challenges in valuing natural resources. He explains how integrating wild animals and marine vegetation into nature-based solutions can attract significant investments for climate mitigation and biodiversity conservation. He delves deep into the role of whales in sequestering CO2 and proposes a path forward, by means of an economy rooted in natural preservation and prosperity through innovative financial instruments.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the (Carbon) Value of a Whale?

15 mins 49 secs

Key learning objectives:

Understand the current global biodiversity financing gap and how this can be bridged through nature-based solutions

Understand how valuing ecosystem services provided by wild animals and marine vegetation can make these entities valuable assets in the fight against climate change

Outline the current limitations of nature-based solutions

Overview:

The rapid decline of biodiversity threatens both our biosphere and humanity. To address this, significant investments in conservation are crucial. However, current funding falls short due to non-market valuations of natural assets. Wild animals, especially whales and elephants, play instrumental roles in carbon sequestration, with values reaching $3 million per whale based on their carbon offset contributions. Additionally, marine vegetation, like seagrasses, offer invaluable services, cumulatively worth over $1 trillion. Despite their crucial roles, our economic system fails to adequately value them. To bridge this gap, we should integrate these natural services into financial markets, creating tradable assets. Such a framework not only promotes nature preservation but also incentivises both public and private sectors to champion conservation.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ralph Chami

There are no available Videos from "Ralph Chami"