Asia Sustainable Finance Update Dec 2021

Ma Jun

Founder and President: Institute of Finance and Sustainability

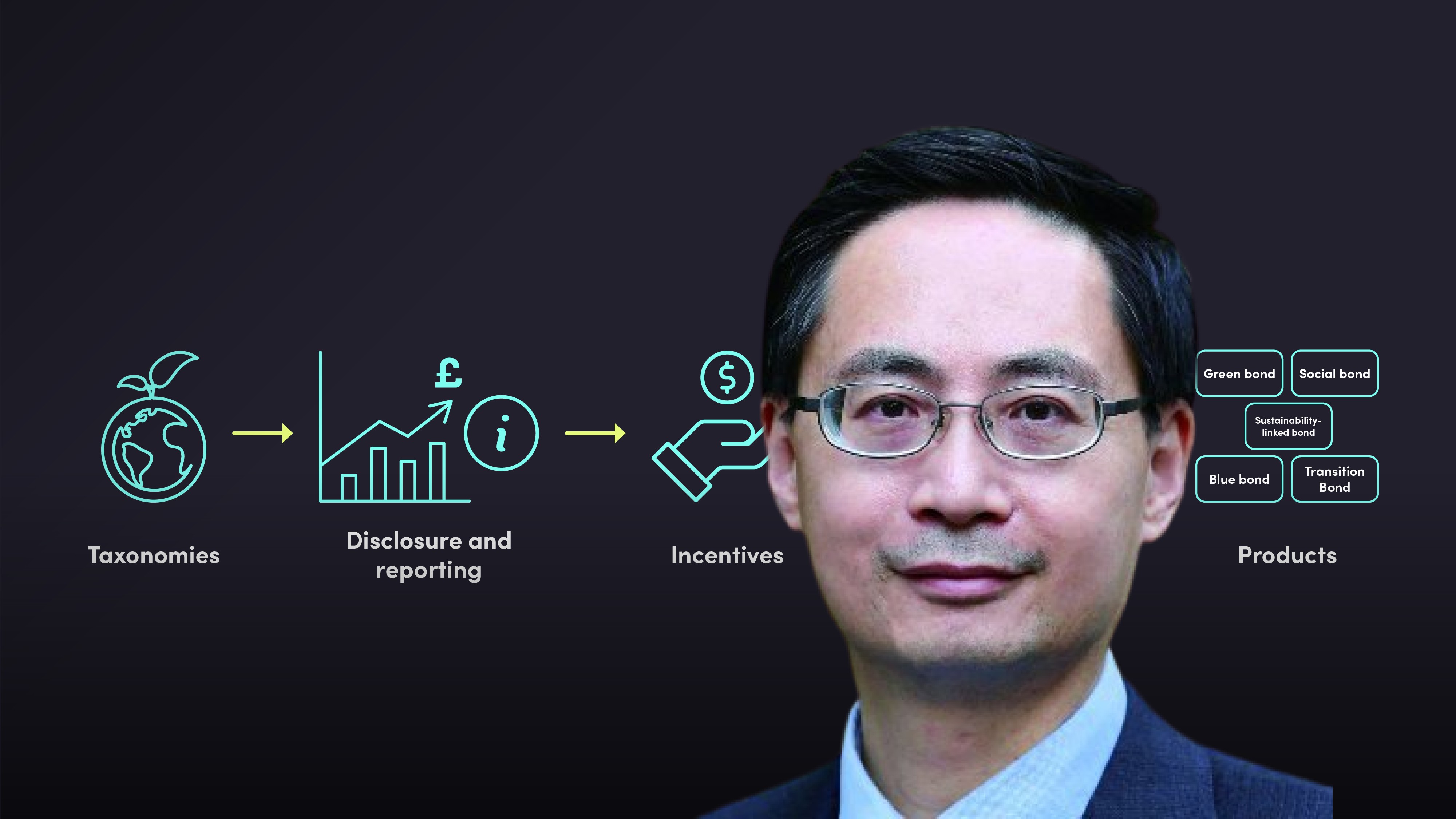

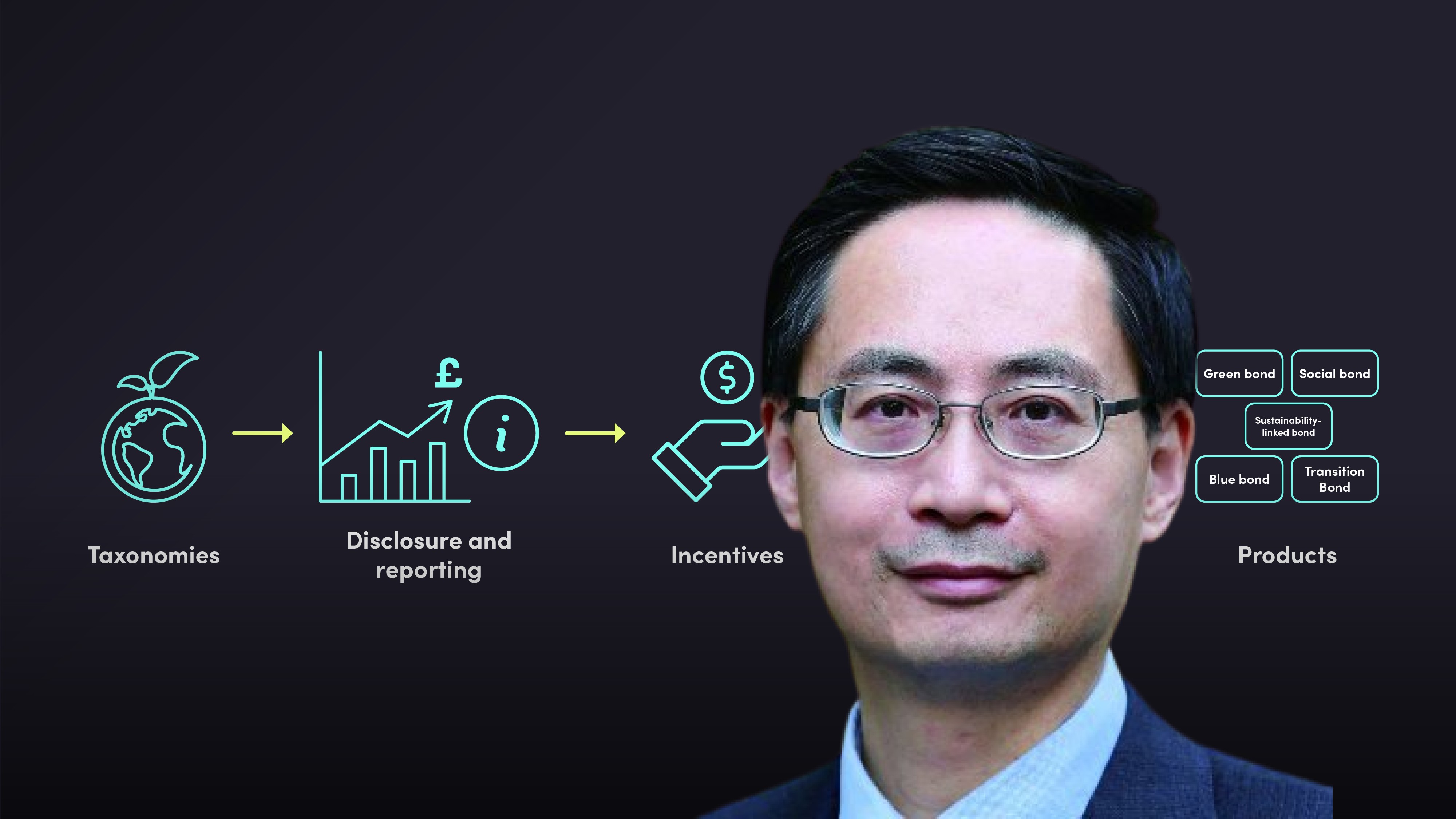

In this first video, Dr Ma Jun uses a framework to describe the development of sustainable finance in Asia. He starts by outlining the development of various sustainable finance taxonomies, before moving on to discuss changes in disclosure and reporting of sustainable activities. He then discusses why incentives are required to finance sustainable activities, before finishing up by discussing some of the risks to the market as well as some of the newest sustainable finance product development.

In this first video, Dr Ma Jun uses a framework to describe the development of sustainable finance in Asia. He starts by outlining the development of various sustainable finance taxonomies, before moving on to discuss changes in disclosure and reporting of sustainable activities. He then discusses why incentives are required to finance sustainable activities, before finishing up by discussing some of the risks to the market as well as some of the newest sustainable finance product development.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Asia Sustainable Finance Update Dec 2021

10 mins 34 secs

Key learning objectives:

Identify some of the key sustainable finance taxonomies in Asia

Understand the importance of disclosure

Understand the purpose of incentives

Identify some of the key risks associated with sustainable finance

Identify some of the new green products emerging from Asia

Overview:

Sustainable finance is on the rise everywhere on the planet and Asia is no different. The development of sustainable finance in Asia can be outlined through a framework describing taxonomies, disclosure, incentives, risks and products. The number of taxonomies is on the rise, this could lead to market segmentation, lack of transparency and increased transaction costs. Disclosure is very important in ensuring market transparency and ensuring that green money gets to the right green projects. Incentives are then required to attract private investment towards green projects. Climate risk analysis in Asia is a relatively new concept but is developing rapidly, there have been new requirements for banks to conduct climate risk analyses and report the results. Finally, product innovation in Asia has been very high. There has been a massive growth in green bond issuance recently, as well as an increase in the variety of products on offer in Asia.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What sustainable finance taxonomies are there in Asia?

In 2016 it was consensus amongst the G20 that a taxonomy was required, meaning one wasn’t available, now there are over 200 taxonomies around the world, which causes its own problems.

In China, there are three taxonomies, a green lending taxonomy, a green bond taxonomy and a green projects taxonomy.

Bangladesh was one of the earliest countries with a taxonomy for green lending.

Mongolia has also adopted a sustainable finance taxonomy.

There are a few taxonomies in development for countries including Kazakhstan, Sri Lanka and Singapore.

Japan is the first Asian country to formalise a transition taxonomy, which is something that is missing from most of the world.

What disclosure developments have taken place in Asia?

Disclosure is essential in ensuring market transparency.

In 2017, China started off with mandatory disclosure requirements for highly polluting companies, and more recently the CSRC (Chinese securities regulator) introduced a mandatory requirement for ESG disclosure. The PBOC has also recently stated that they are going to introduce mandatory environmental information disclosure requirements for all financial institutions.

Hong Kong has had mandatory ESG disclosure for district companies since mid-2020, and they are considered a leader within the region.

Japan is leading the way in terms of having their corporates and financial institutions signing up to the Taskforce on Climate-Related Disclosure (TCFD), with one of the largest number of corporates adopting the TCFD on a voluntary compared with other countries.

What is the importance of incentives?

Green projects often are not profitable enough to attract private investment, therefore some sort of incentive is required from the government, the regulators or the green bond issuer themselves. Incentives could cover part of the actual risk or the cost of verification for example.

What development in products has there been?

In China there was 181% growth of green bond issuance in the first half of 2021 compared with the same period of the previous year. This has been partly driven by the carbon neutrality pledge by the government.

Other new products include a Green Sukuk bond from Malaysia, a Blue Bond issued by the Industrial Bank in China and a Biodiversity Bond was issued by the Bank of China.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Ma Jun

There are no available Videos from "Ma Jun"