Selected Asian ESG Taxonomies

Keith Mullin

35 years: Capital markets editorial

In this video, Keith covers some prominent Asian developments in ESG taxonomies. A number of Asian countries have moved forward with these taxonomies, including China, Japan, Singapore, Malaysia, Indonesia, South Korea, Mongolia, and Bangladesh. Each initiative is at a different stage, but by the end of this video, you will have a general idea about the direction of travel. Keith focuses on China and Japan in particular, discussing their specific goals, strategies, and implementation processes for their taxonomies. From China's Green Bond Endorsed Projects Catalogue to Japan's focus on transition finance and decarbonising electricity, this video provides a comprehensive overview of the progress being made in Asia towards sustainable finance and net-zero emissions.

In this video, Keith covers some prominent Asian developments in ESG taxonomies. A number of Asian countries have moved forward with these taxonomies, including China, Japan, Singapore, Malaysia, Indonesia, South Korea, Mongolia, and Bangladesh. Each initiative is at a different stage, but by the end of this video, you will have a general idea about the direction of travel. Keith focuses on China and Japan in particular, discussing their specific goals, strategies, and implementation processes for their taxonomies. From China's Green Bond Endorsed Projects Catalogue to Japan's focus on transition finance and decarbonising electricity, this video provides a comprehensive overview of the progress being made in Asia towards sustainable finance and net-zero emissions.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Selected Asian ESG Taxonomies

11 mins 46 secs

Key learning objectives:

Outline the various taxonomies in China

Understand the Japanese approach to developing a taxonomy specifically focused on transition activities

Outline the Singapore-based pan-ASEAN taxonomy being developed and the challenges it brings

Overview:

Asian countries have been implementing Environmental, Social, and Governance (ESG) taxonomies to promote sustainable development. China is the most advanced in Asia with three taxonomies for green loans, projects and bonds. Japan is focusing on transition finance to reach its 2050 net zero commitment and has developed a Climate Innovation Finance Strategy, which aims to decarbonise electricity and promote electrification in all sectors. A Singapore-based pan-ASEAN taxonomy is also being developed, but this has run into some challenges due to the differences between the countries.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What taxonomy development has there been in China?

China has developed three taxonomies for green loans, projects, and bonds. The Green Bond Endorsed Projects Catalogue provides minimum criteria for classification as green and serves as a roadmap to meet China's Integrated Reform Plan for Promoting Ecological Progress.

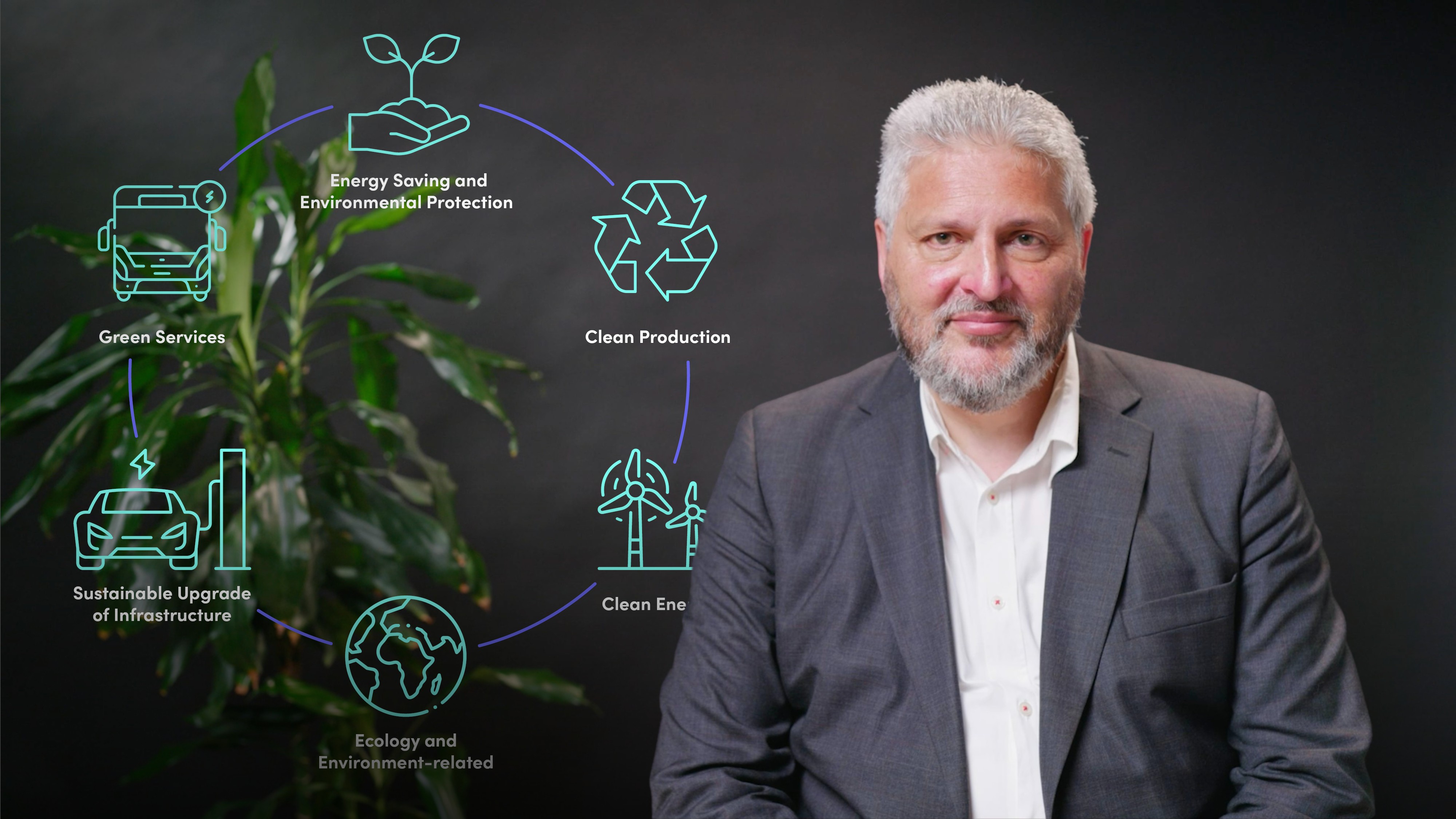

The latest edition of the catalogue took effect in July 2021 and breaks economic activity down into six broad industries such as Energy Saving and Environmental Protection, Clean Production, Clean Energy, Ecology and Environment-related, Sustainable Upgrade of Infrastructure, and Green Services. These headline activities are further broken down into 47 sub-activities and again into 201 baseline economic activities whose minimum criteria are all described.

Additionally, the Chinese and EU taxonomies are evolving in a harmonised manner.

What is Japan’s approach to developing a taxonomy?

Japan’s approach to developing a taxonomy is focused on transition finance. The Ministry of Economy, Trade and Industry (METI) has developed the Climate Innovation Finance Strategy which includes action plans for 14 priority growth sectors and focuses on decarbonising electricity, promoting electrification in all sectors, investing in battery technology and offshore wind, hydrogen power and carbon capture, utilisation, and storage for carbon recycling.

The Financial Services Agency, METI, and the Ministry of the Environment have issued Basic Guidelines on Climate Transition Finance in May 2021 to act as a reference point for borrowers, lenders, and other market participants.

Japan's transition taxonomy is being developed by the Transition Finance Study Group who has developed a basic taxonomy for transition finance, classifying it into two types: A-Type finance at the asset level and C-Type finance at the corporate level.

How is the Singapore-based pan-ASEAN taxonomy being developed and what challenges are there?

The Singapore-based pan-ASEAN taxonomy is being developed by the Green Finance Industry Taskforce, which is a group of 18 members from banks and investors. The taskforce published a positioning paper in January 2021 which set out the basic approach to a taxonomy for Singapore-based financial institutions, particularly those that are active across ASEAN. The taskforce's report focuses on economic sectors important to Singapore and ASEAN and is aware that any methodology needs to be consistent with other taxonomies.

The taskforce proposed that the taxonomy covers green and transition activities across four environmental objectives, Climate change mitigation, Climate change adaptation, protecting biodiversity, and promoting resource resilience.

However, crafting a Singapore-based pan-ASEAN regional initiative brings with it some challenges due to the different levels of development and different GHG emission targets among ASEAN countries.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Keith Mullin

There are no available Videos from "Keith Mullin"