Portfolio Level ESG Integration II

Arun Kelshiker

20 years: Asset management and stewardship

In this video, Arun explores ESG integration across asset classes. He also talks about historical trends in applying ESG, compare screening for companies and funds, optimising ESG portfolios, and understanding ESG in passive investing.

In this video, Arun explores ESG integration across asset classes. He also talks about historical trends in applying ESG, compare screening for companies and funds, optimising ESG portfolios, and understanding ESG in passive investing.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Portfolio Level ESG Integration II

14 mins 4 secs

Key learning objectives:

Understand how ESG has historically been applied to various asset classes

Understand how ESG screening varies between individual companies and collective investment funds

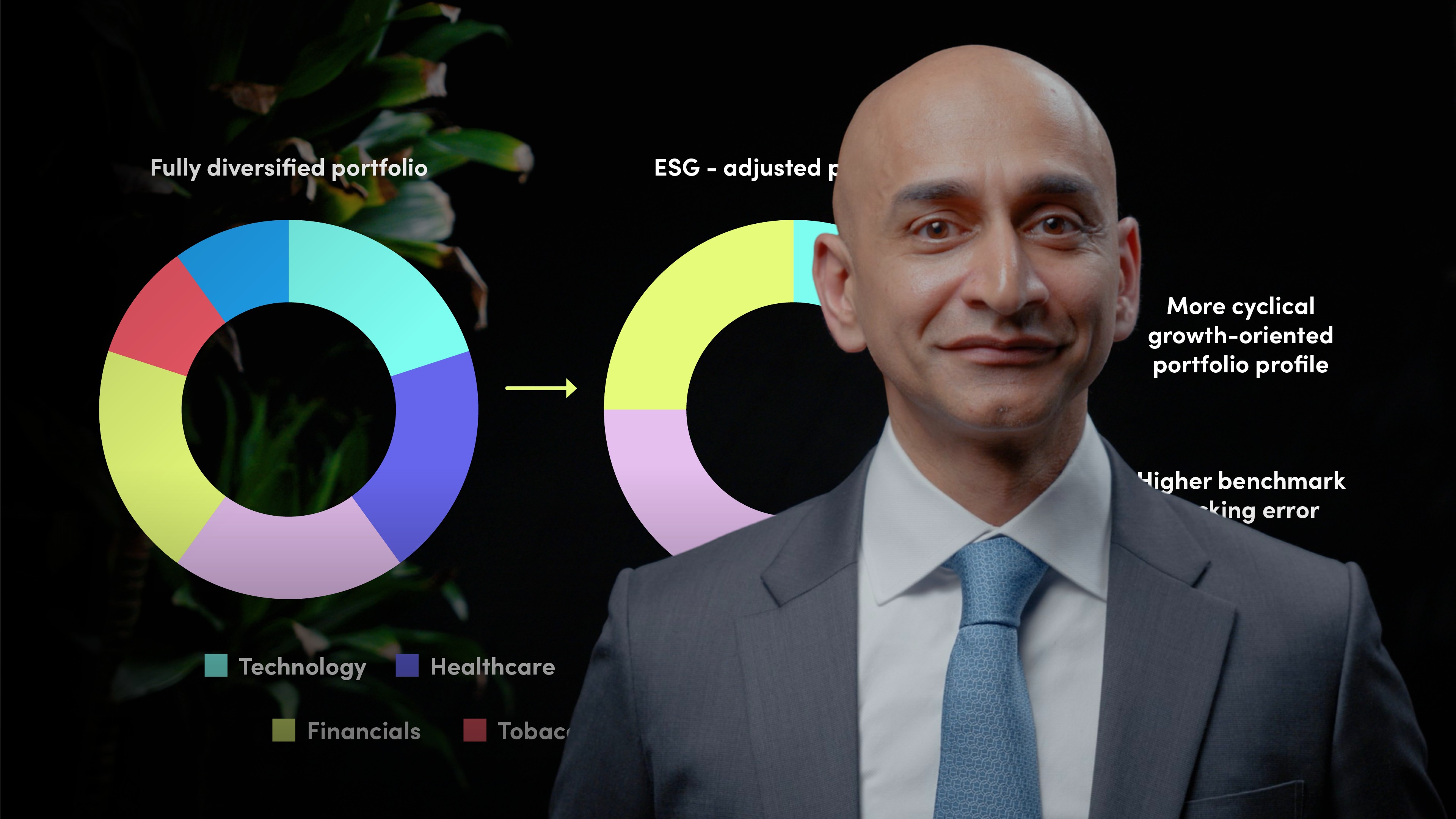

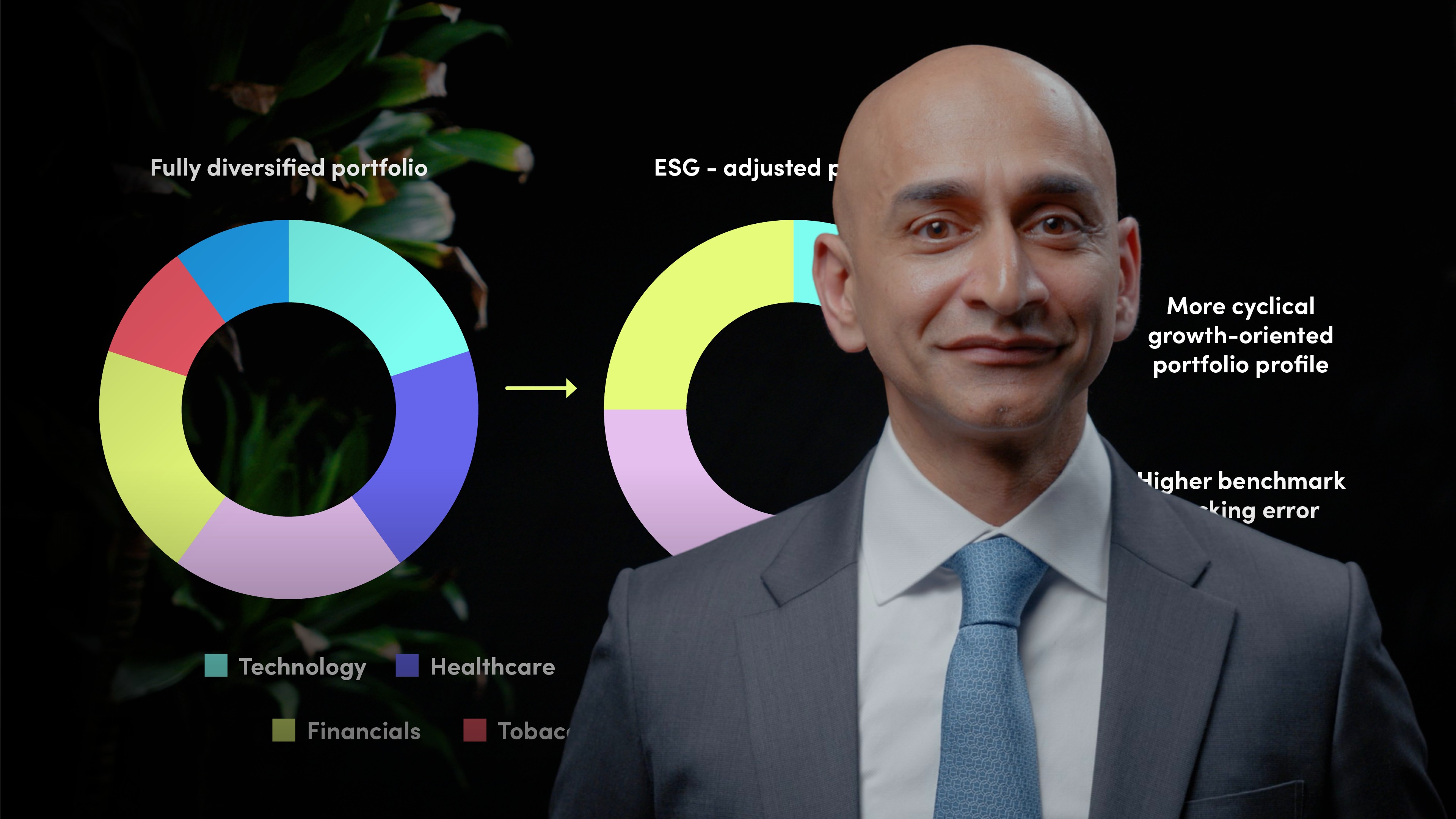

Understand how ESG integrated portfolios can be optimised

Understand how to integrate ESG into passive portfolios

Overview:

ESG integration varies in depth and approach across asset classes. Equities are at the forefront in terms of transparency and shareholder engagement, while fixed income has lagged in ESG adoption. Hedge funds are steadily adopting ESG, as reflected in the PRI's revised frameworks. In private equity, investors commonly employ exclusionary screens, but partners are pivoting to positive ESG screening. Real estate investments offer distinct ESG prospects, with organisations like GRESB providing tailored insights. Screening methods pinpoint ESG risks in both individual companies and broader funds. Balancing risk-return with ESG objectives is vital when refining ESG-integrated portfolios. While ETFs and other passive portfolios are ramping up ESG integration, they face distinct hurdles in active engagement and possible diversification constraints.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Arun Kelshiker

There are no available Videos from "Arun Kelshiker"