How the EU Is Regulating Sustainable Investing

Arun Kelshiker

20 years: Asset management and stewardship

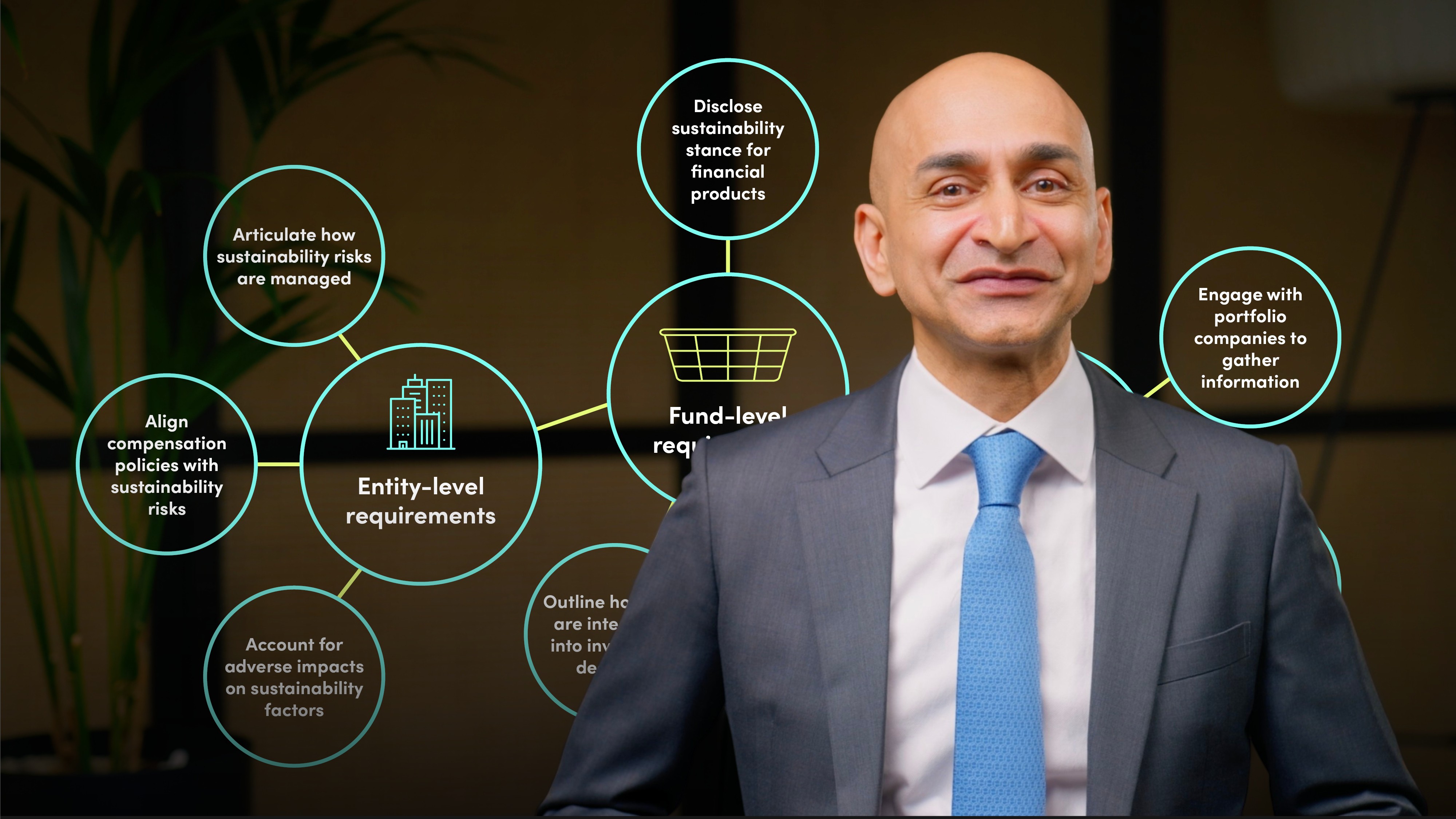

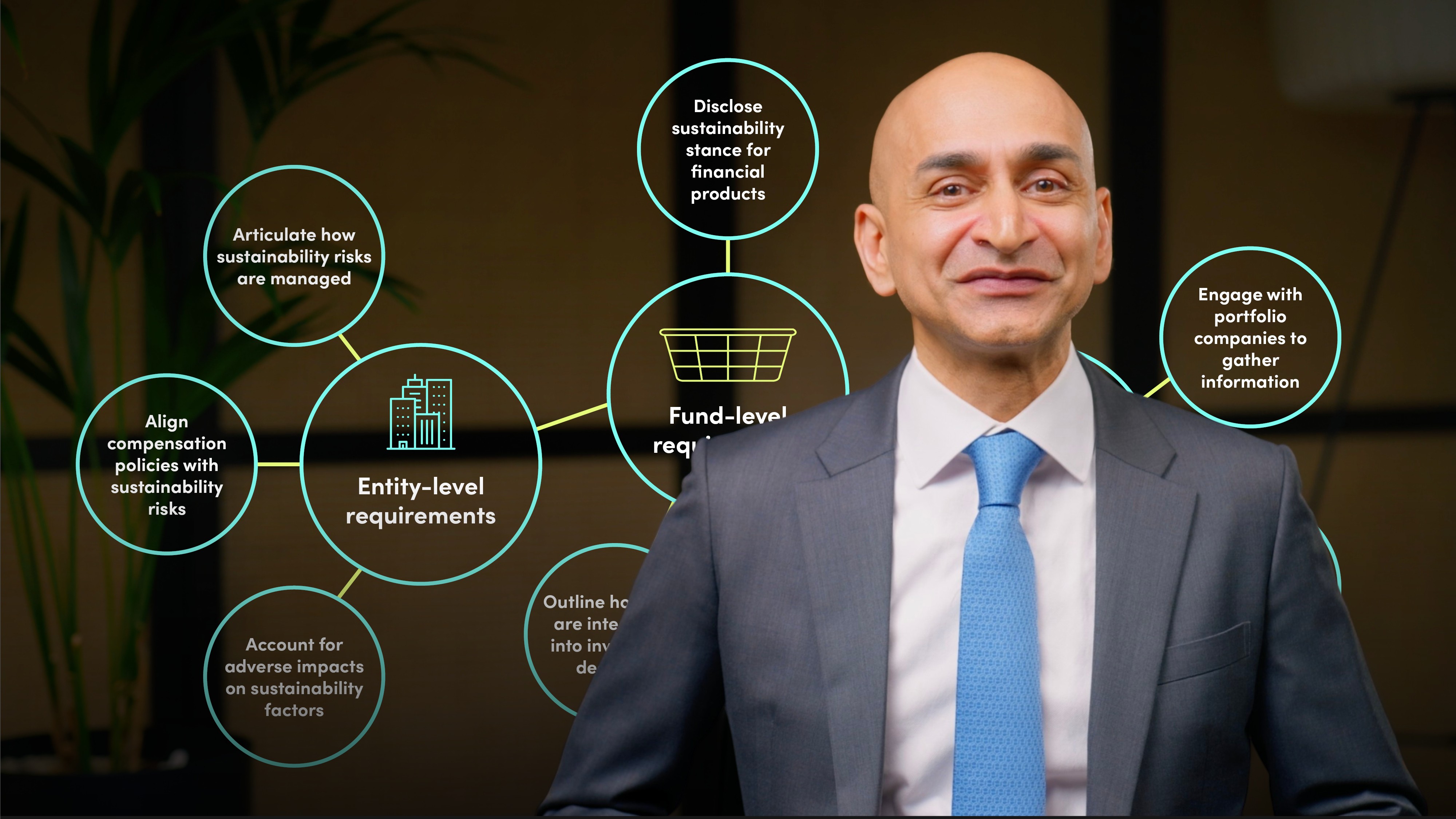

In this video, Arun breaks down the EU’s Sustainable Finance Disclosure Regulation (SFDR) and explains how it promotes transparency and accountability in sustainable investing. He explores how the SFDR works alongside the EU Taxonomy to define what counts as environmentally sustainable, and walks through the key differences between Articles 6, 8, and 9 financial products. He also sheds light on how the regulation combats greenwashing by requiring financial institutions to disclose sustainability risks and impacts at multiple levels.

In this video, Arun breaks down the EU’s Sustainable Finance Disclosure Regulation (SFDR) and explains how it promotes transparency and accountability in sustainable investing. He explores how the SFDR works alongside the EU Taxonomy to define what counts as environmentally sustainable, and walks through the key differences between Articles 6, 8, and 9 financial products. He also sheds light on how the regulation combats greenwashing by requiring financial institutions to disclose sustainability risks and impacts at multiple levels.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

How the EU Is Regulating Sustainable Investing

9 mins 27 secs

Key learning objectives:

Understand the purpose and scope of the Sustainable Finance Disclosure Regulation (SFDR)

Outline the role of the EU Taxonomy in defining environmentally sustainable economic activities

Identify the categories of financial products under SFDR and their corresponding disclosure requirements

Understand how SFDR addresses greenwashing and promotes transparency in sustainable investing

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

- Article 6 funds are general investment products that do not integrate sustainability considerations, allowing investments in industries like tobacco or coal

- Article 8 funds (light green) promote environmental or social attributes but may not explicitly target sustainable outcomes

- Article 9 funds (dark green) focus solely on sustainable investments with a clearly defined objective, such as renewable energy

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Arun Kelshiker

There are no available Videos from "Arun Kelshiker"