Disruptive Risks

Hans-Kristian Bryn

35 years: Strategic risk management and governance

Businesses are affected by disruptive risks whether they are aware of it or not. In this video, Han's focuses on the concept of disruption and disruptive risks, along with the various approaches to addressing them. He further talks us through the processes to a better understanding of disruption and finishes by explaining the Governance implications of insufficient risk management.

Businesses are affected by disruptive risks whether they are aware of it or not. In this video, Han's focuses on the concept of disruption and disruptive risks, along with the various approaches to addressing them. He further talks us through the processes to a better understanding of disruption and finishes by explaining the Governance implications of insufficient risk management.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Disruptive Risks

13 mins 45 secs

Key learning objectives:

What is disruption or disruptive risks?

How can we better understand disruptive risks?

How can an enhanced understanding of disruption create value?

Overview:

Disruptive risks are present in everyday life; Amazon’s impact on retail, takeout and delivery services by the likes of Just Eat and Deliveroo, and the smartphone / app enabled use of taxis provided by the likes of Uber. However, in a business to business (B2B) context, these disruptions can adversely affect our businesses if we don’t anticipate and counter them.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is disruption or disruptive risks?

Disruptive risks are risks that could threaten the business model and the viability of the business.

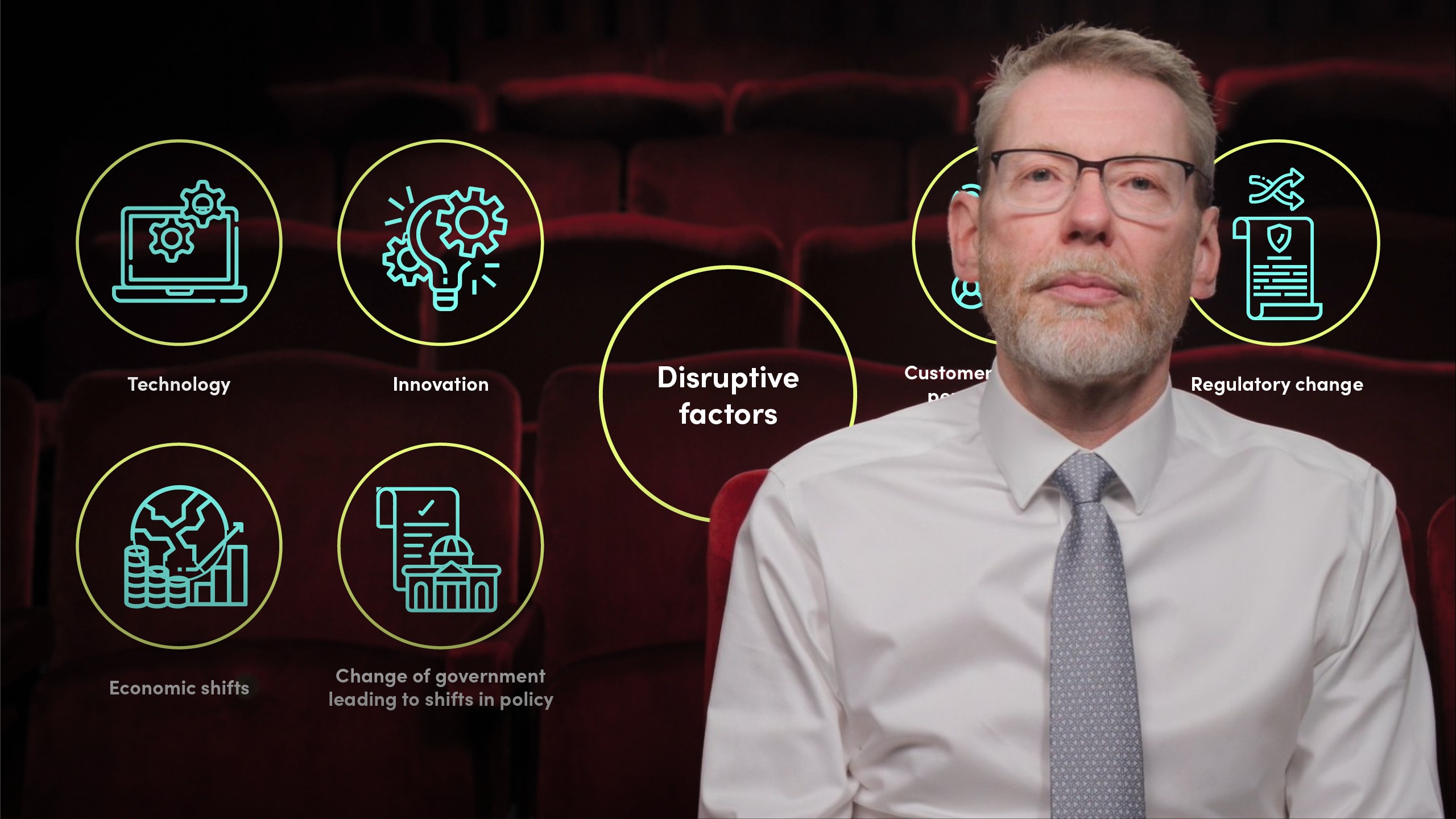

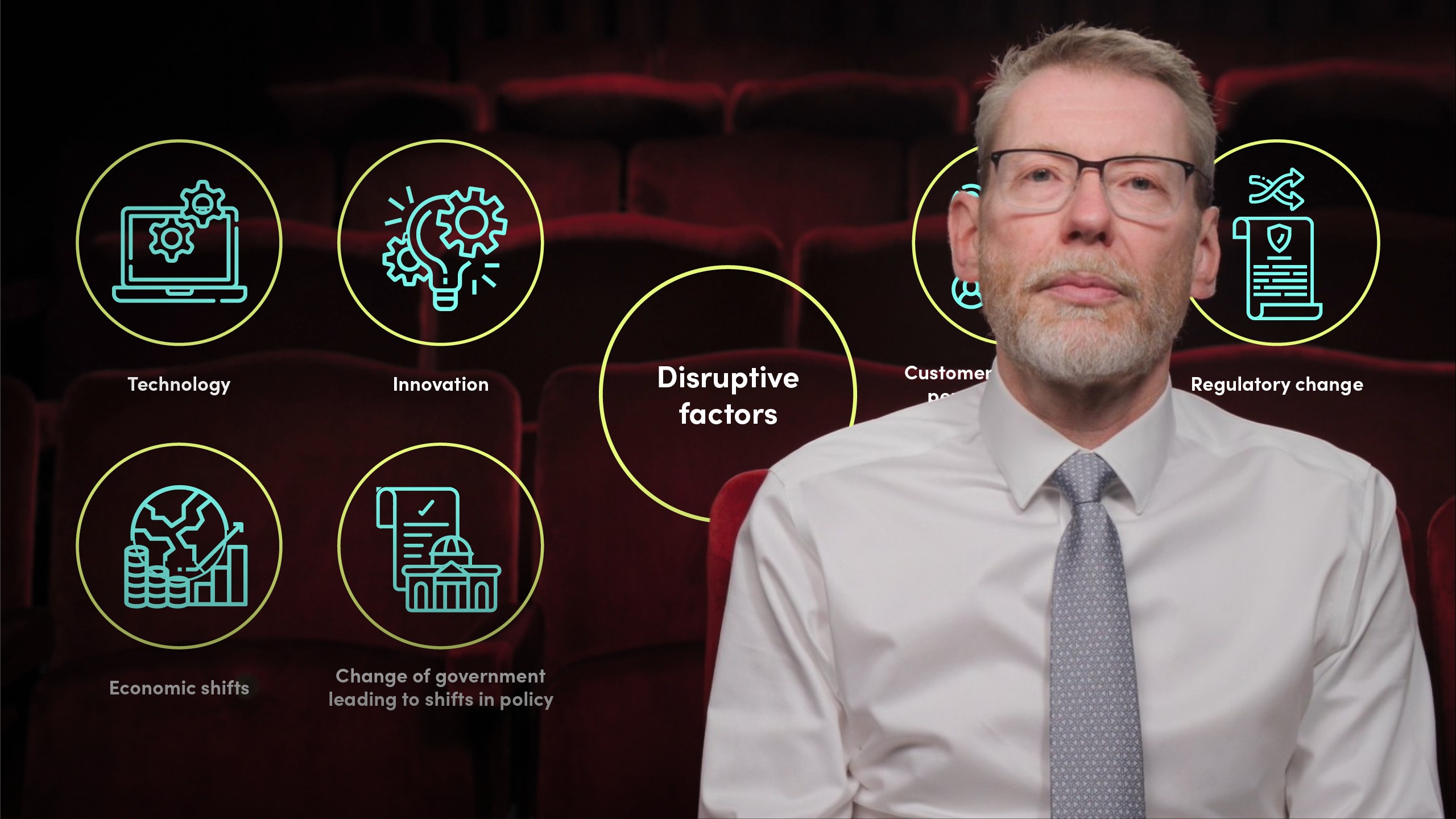

There are a number of possible sources of disruption:

- Technology - this includes digital access to content, product and fulfilment, AI, Robotic Process Automation

- Innovation - as new business models are often enabled by technology or data analytics

- Customer and consumer perception of value - be that ease of access, choice and/or fulfilment mechanism

- Regulatory change - in particular redefinition of the ‘rule book’

- Economic shifts

- Change of government - leading to shifts in policy

- Social movements - such as Greta Thunberg and Extinction Rebellion are shaping public perception and leading organisations to review and redefine their purpose to align with new expectations on for example; sustainability and response to climate challenge

- Health pandemics

It is important to recognise that there is significant disruption taking place in the B2B space. This is not a new phenomenon! For example, the mini steel mills in the 1980s fundamentally changed the minimum economic scale, cost structure and inputs required for steel production and therefore had a significant impact on the structure and economics of the steel industry. Other B2B examples include 3D printing of airline parts, Amazon entry into B2B warehousing and distribution, Fintech and online Challenger banks.

How can we better understand disruptive risks?

Most organisations find disruption and disruptive risks a challenging topic – it is difficult to predict when / how the risk could crystallise and also what the impact could be. However, given that disruption could threaten the business model, businesses must take time to ‘stress test’ their business models and understand the vulnerabilities. Notwithstanding this, many organisations are struggling to anticipate and act on disruptive risks. The main reason for this is that disruptive risks often fall into the category of “too difficult” or “let’s look at this later”.

In order to create a better context for understanding disruption, it is important that the management discussions have these characteristics:

- Be externally rather than internally focused, and also be sensitive to early signals of potential disruptive change – be that from a technology, value proposition, pricing or delivery perspective

- Include potential risks and root causes that are not well understood or have limited data available – in other words, they are also emerging risks. As a consequence, there will be a lot of ambiguity to be worked through by the management team

- Recognise highly uncertain timescales – test whether the organisation is able to pick up and interpret early warning signals

- Include a broad range of inputs and experience – both internally and externally

- Incorporate an acceptance that the business model or business models might be threatened and the need for inclusion of the results in the broader strategic and financial viability considerations

- Recognise that Management’s sense of strategic uncertainty might increase

There are some practical questions that can assist organisations in focusing on the real impact of disruption. For example,

- How could new entrants come into the market?

- How resilient is the existing business model to a new entrant or new value proposition?

- What would an ‘Amazon’ operator look like if established by a new entrant?

- How well prepared are we to respond to disruption / disruptors for example, new entrants, predatory pricing, technology advancements, changes to customer behaviour?

How can an enhanced understanding of disruption create value?

Disruption should be an integral part of the strategic and risk management processes and used as a stress test on strategic options. It also needs to be recognised that predicting the what and how of disruption is challenging. However, by thinking about disruption from a strategic and operational perspective, we are more likely to both identify possible sources of disruption and indeed, be in a position to respond decisively when disruption happens.

There are both value protection and value enhancement benefits to be derived from understanding disruptive risks better. However, in order to generate these benefits, there are a number of factors to consider.

Going forward, Excos and Boards are going to have to focus on disruption and ensure that their organisations are as resilient as possible both from a strategic and operational perspective.

Additionally, visible engagement and support from the CEO and the Executive team, and alignment of the strategy and risk processes, are critical factors to ensure effective consideration of the impact of disruptive risks on strategic options and choices.

In summary, businesses need to be able to articulate clearly:

- From a value creation perspective; Where and how do we compete and win?

- From a value protection perspective; What are the disruptive risks that could prevent us from succeeding?

- From a preparedness perspective; How resilient is our current set up and footprint both from a strategic and operational perspective?

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Hans-Kristian Bryn

There are no available Videos from "Hans-Kristian Bryn"