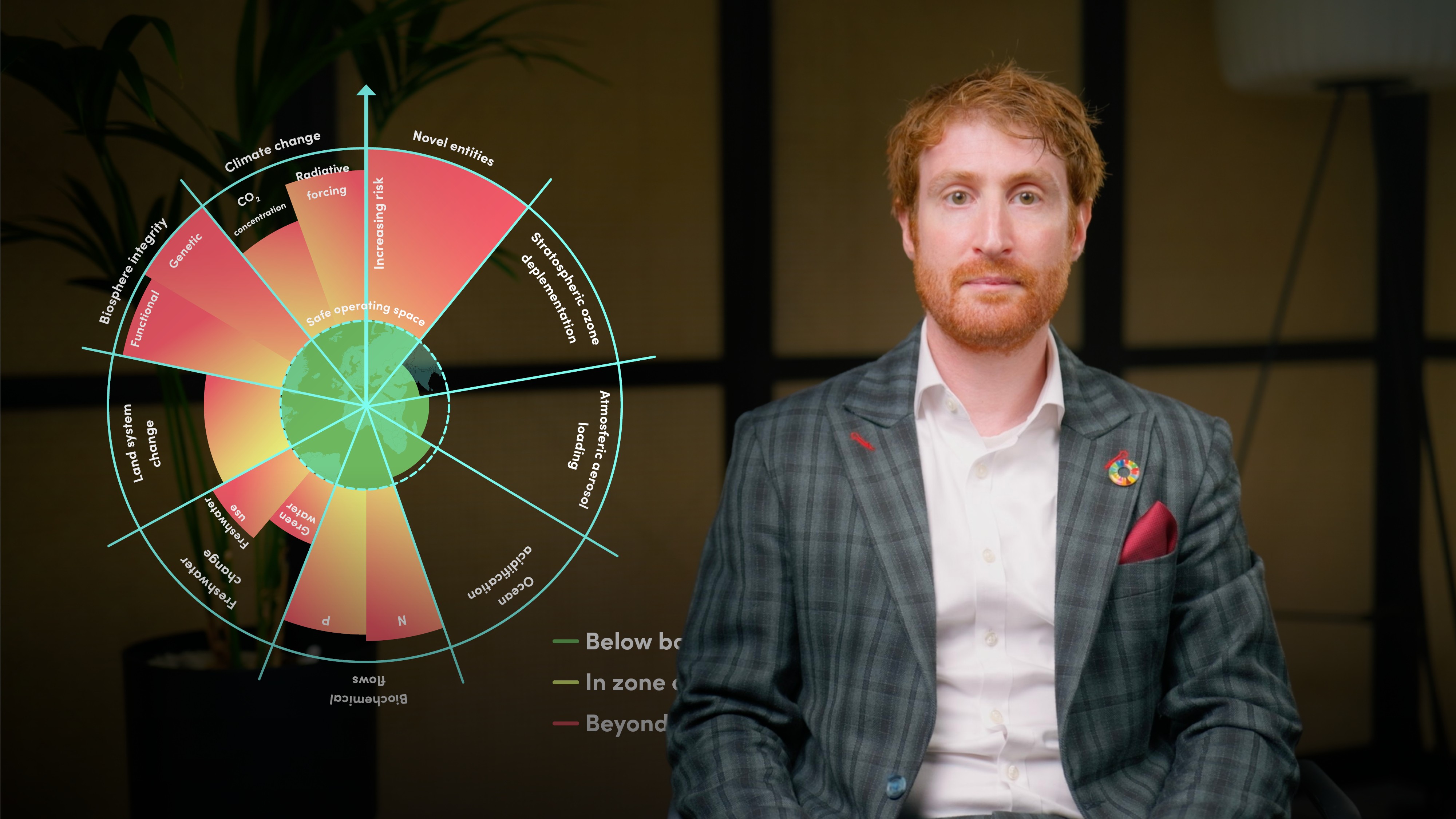

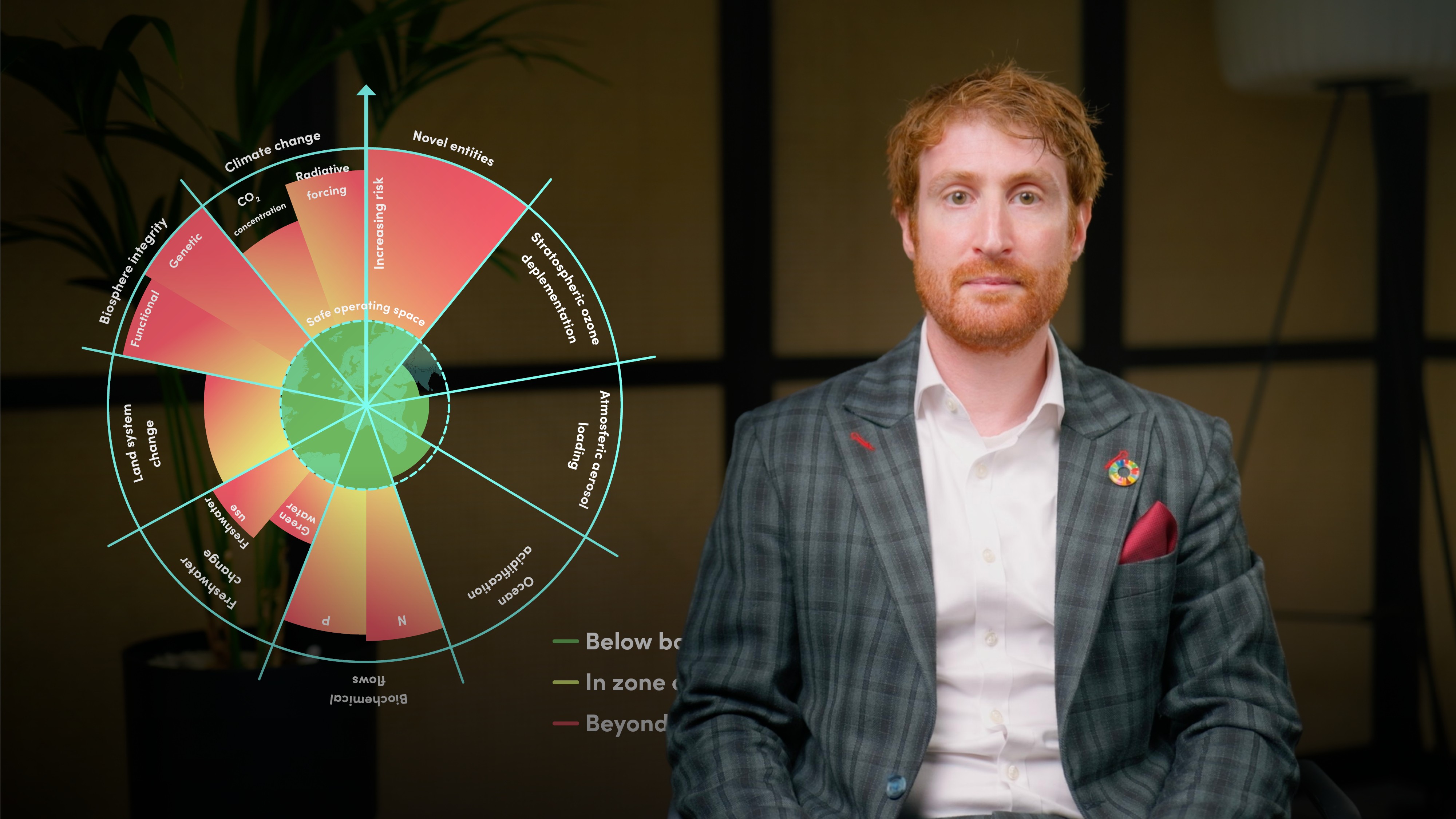

Assessing Nature Risks and Opportunities

David Carlin

Head of Climate Risk

In this video, David explores the critical connection between nature and climate, highlighting the financial risks of biodiversity loss and ecosystem degradation. He explains why financial institutions must integrate nature-related risks into their strategies and how frameworks like TNFD and UNEP FI’s Risk Centre support nature-positive finance.

In this video, David explores the critical connection between nature and climate, highlighting the financial risks of biodiversity loss and ecosystem degradation. He explains why financial institutions must integrate nature-related risks into their strategies and how frameworks like TNFD and UNEP FI’s Risk Centre support nature-positive finance.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Assessing Nature Risks and Opportunities

12 mins 52 secs

Key learning objectives:

Outline the categories of nature-related risks and their financial implications

Understand how climate change and nature loss are interconnected and why separating them can lead to blind spots in financial decision-making

Identify how financial institutions can respond through disclosure, strategy, and opportunity capture

Outline how frameworks like TNFD and programmes like UNEP FI’s Risk Centre support nature-positive finance

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

David Carlin

There are no available Videos from "David Carlin"