Will Trump halt energy transition progress?

Rahul Bhushan

15 years: Structured Products and Sustainability

Explore how a Trump re-election in 2024 might impact the US clean energy sector, including the IRA, tariffs, and state-level initiatives

This analysis aims to objectively assess the potential impact of a Trump re-election on the US clean energy sector. It does not reflect any political endorsement.

The potential re-election of Donald Trump in November 2024 raises questions about the future of the US clean energy revolution. However, several factors suggest the transition may continue robustly. In this blog, we explore whether a Trump re-election could disrupt the progress of the US clean energy transition, examining the IRA, tariffs, historical performance and state-level initiatives.

Unlikely repeal of the IRA

While Trump has pledged to dismantle the Inflation Reduction Act (IRA), achieving this would be highly challenging. The IRA represents the largest environmentally focused investment policy in US history, with an estimated $380 billion allocated to clean energy projects, individual clean energy incentives, EVs, sustainable fuels, conservation, building efficiency and electrification. This extensive scope and the accompanying benefits have garnered significant bipartisan support.

Many tax credits and subsidies under the IRA are popular, particularly in red states, due to their job creation and economic growth impacts. These provisions support renewable energy projects, critical mineral processing and battery manufacturing, all of which are critical to local economies. For instance, the IRA is expected to create over 80,000 jobs and generate $98 billion in investment across 142 announced projects. Additionally, funds have already been allocated to various projects, making it difficult to claw back these investments.

Repealing the IRA would require complete control of the presidency, Senate and House by the Republicans, a challenging feat given the current political landscape and the diverse interests within the Republican Party. Even if the Republicans gained control of the presidency, Senate and House, the IRA has already spurred significant investments and job creation, making it politically risky to dismantle a policy that is delivering tangible benefits. Moreover, the act strengthened Investment Tax Credits and Production Tax Credits, which apply to various environmental and climate-focused projects, including solar, wind, geothermal and tidal energy. The uncapped nature of the bill means it could generate even higher levels of energy and climate spending if the demand exists.

Many elements of the IRA, such as tax credits for nuclear, hydrogen and carbon capture and storage (CCS), enjoy growing bipartisan support. However, consumer incentives for EVs and home heating are more at risk under a GOP-led government. Potential modifications to tax credits for wind and solar projects may occur but would be very challenging to implement.

The IRA’s extensive scope and job creation potential have garnered significant bipartisan support, making its repeal challenging.

Positive impact of tariffs on US energy transition stocks

Tariff policies, particularly on Chinese imports, may inadvertently benefit US green energy stocks. By imposing tariffs on Chinese solar panels and related components, domestic manufacturers may find a more favourable market environment, potentially boosting their stock performance.

Tariffs on Chinese imports, including solar panels, lithium-ion batteries and EV components, create a protective market for US manufacturers. The Trump administration initially imposed 30% tariffs on solar panels, which Biden later extended with some exemptions. These tariffs aim to counteract the competitive pricing of heavily subsidised Chinese products, which flood the global market at low costs.

Companies like First Solar (FSLR) have benefited from these tariffs as they mitigate the price advantage of Chinese imports, potentially boosting domestic production and sales. Other companies such as SunPower Corporation (SPWR) and Enphase Energy (ENPH) could also see positive impacts as the tariffs help level the playing field.

The continuation and potential increase in tariffs can lead to more domestic manufacturing jobs and investment. The US International Trade Commission noted that several major panel manufacturers had opened new facilities in the US since the tariffs were first imposed. For instance, the solar industry has seen investments in new production facilities which could further increase if the tariffs are maintained or expanded, aligning with Biden’s goal for a carbon-free grid by 2035. Similarly, US companies involved in the production of wind turbine components and other renewable energy technologies, such as Generac Holdings (GNRC) and Bloom Energy (BE), could see a boost from tariffs that reduce the influx of cheaper foreign products.

Historical performance of fossil fuel and green stocks

Historically, fossil fuel companies have tended to perform better under Democratic administrations, while green energy stocks fare better under Republicans. This trend can be attributed to the differing policy approaches of each party towards energy and environmental regulation.

- Fossil fuel companies under Democratic administrations: Democratic policies often focus on restricting fossil fuel activities to address environmental and climate concerns. For instance, the Biden administration has pursued policies like rejoining the Paris Agreement, imposing stricter emissions standards and increasing regulations on drilling and fracking. These restrictions typically reduce the supply of fossil fuels, leading to higher prices. As a result, companies like ExxonMobil and Chevron benefit from increased revenues due to higher oil and gas prices.

- Green energy stocks under Republican administrations: Republican administrations typically ease regulations on fossil fuels, potentially leading to lower prices due to increased supply. While this might seem disadvantageous for green energy companies at first glance, it actually provides an indirect boost. With fewer regulatory hurdles and potentially lower fossil fuel prices, green energy companies can position themselves as cost-effective and sustainable alternatives. During the Trump administration, for example, the focus on deregulation and tariffs on Chinese imports inadvertently helped US clean energy stocks by creating a more favorable market for domestic manufacturers.

According to Doomberg, a popular finance and energy commentator, the current push towards green energy often overlooks the complexities and challenges associated with completely phasing out fossil fuels. Doomberg argues that a balanced approach, including the continued use of nuclear energy and strategic deployment of renewable energy sources, is crucial for a stable energy transition. This perspective underscores the need for policies that support both traditional and renewable energy sectors, potentially benefiting green energy stocks even under administrations that favor fossil fuels.

Stocks like First Solar (FSLR), Enphase Energy (ENPH) and SunPower Corporation (SPWR) have shown resilience and growth potential under tariff protections and favorable policies. Additionally, companies in the battery production sector, such as Freyr Battery (FREY), could also benefit from reduced competition with Chinese manufacturers, making them attractive investments in the green energy space.

Subnational and market forces

State-level initiatives and market dynamics continue to propel the clean energy transition forward, independent of federal policy shifts.. Many states have their own aggressive renewable energy targets and incentives. Additionally, the economic viability of renewable energy is improving, driven by declining costs and technological advancements. These factors ensure continued growth in the sector regardless of federal policy shifts.

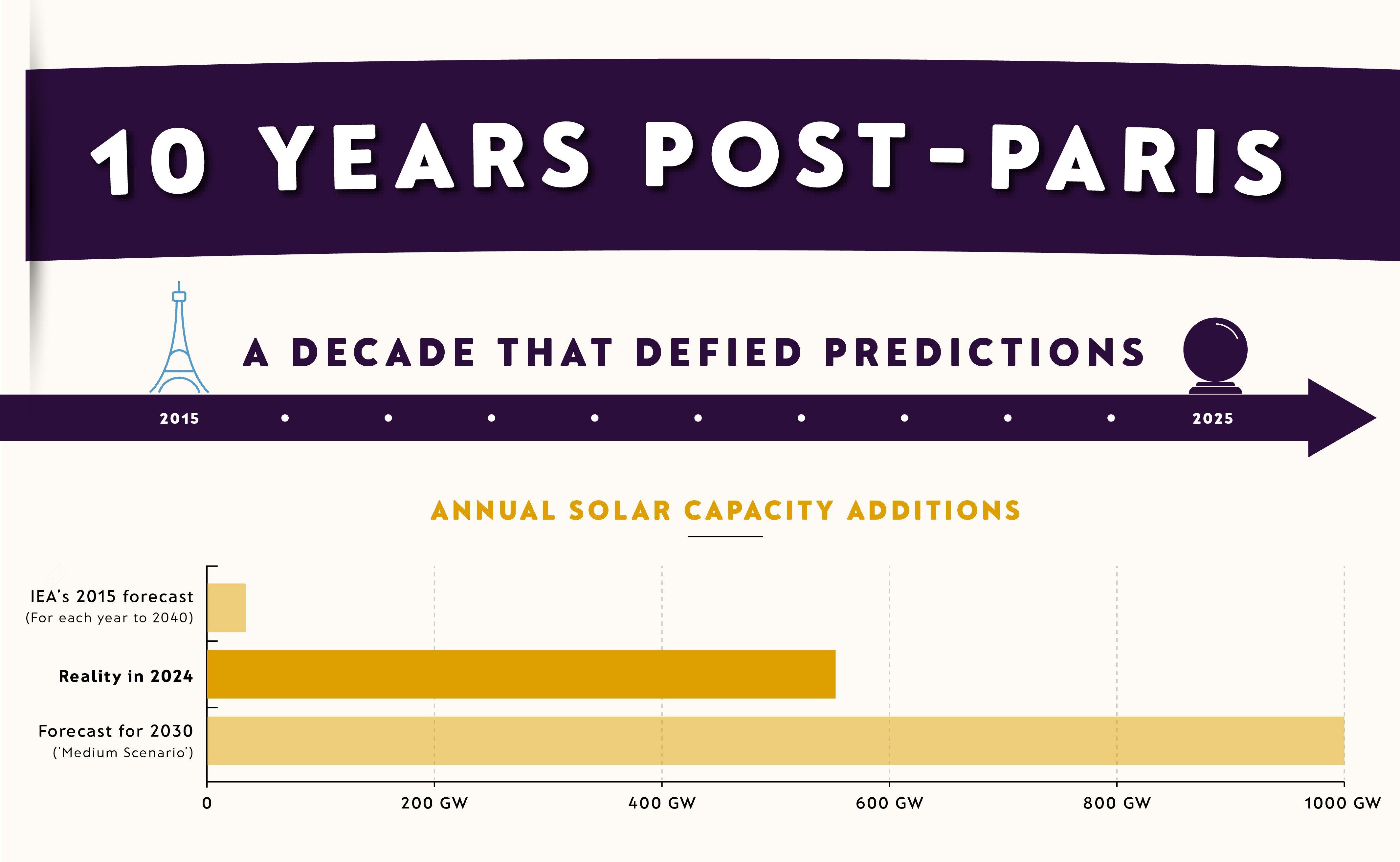

- The cost of solar PV technology has dramatically declined over the past decade, from around $4.00 per watt in 2010 to approximately $1.10 per watt by 2020. This reduction of over 70% makes solar power increasingly competitive with traditional fossil fuels.

- Wind energy has also experienced a substantial cost reduction, from about $85 per MWh in 2010 to approximately $35 per MWh by 2020. This nearly 60% drop has made wind power one of the cheapest sources of electricity in many parts of the world.

- The cost of battery storage, essential for balancing intermittent renewable energy supply, has decreased significantly. In 2010, the cost was around $1,100 per kWh. By 2020, this cost had dropped to $250 per kWh, a reduction of over 75%, making energy storage more economically viable.

- CCS has also seen a notable decline in costs. In the early 2010s, capturing a ton of CO2 cost around $100-$150. Recent advancements have reduced this to approximately $50-$65 per ton, with projections indicating further reductions to below $30 per ton by 2030. This makes CCS a more feasible option for reducing greenhouse gas emissions from fossil fuel power plants and industrial processes.

Declining costs are driving continued investment in renewable energy. Even for stakeholders who may not prioritise climate change, the economic benefits of renewable energy are compelling. Lower costs translate to lower electricity prices, making renewables an attractive option for both consumers and utilities.

Many US states have implemented their own renewable energy standards and incentives, independent of federal policies. For example, California aims to achieve 100% clean electricity by 2045 and New York has set a target of 70% renewable energy by 2030. These state-level policies ensure that progress continues regardless of federal policy changes.

Advancements in technology, particularly in AI, are expected to further accelerate the transition to renewable energy. AI can optimise the performance and efficiency of renewable energy systems, predict maintenance needs and manage energy storage more effectively. As the US strives for energy abundance, investments are likely to flow into all forms of energy, including nuclear, which provides a reliable and low-carbon power source.

Conclusion

While a second Trump term might pose challenges to the clean energy transition, the repeal of major policies like the IRA is unlikely to be straightforward. Tariffs could benefit domestic green stocks and historical trends suggest green equities might perform well under a Republican administration. Combined with strong state-level initiatives and market forces, the clean energy transition is likely to continue its march forward.

Rahul Bhushan

Share "Will Trump halt energy transition progress?" on