A Trump victory and the energy transition

Rahul Bhushan

15 years: Structured Products and Sustainability

What does the U.S. election result mean for clean energy?

Donald Trump’s recent win in the U.S. presidential election is stirring concerns over the potential slowdown of the energy transition, but such fears may be overstated. The shift to clean energy has advanced beyond policy dependency, becoming deeply embedded in market dynamics, consumer demand and decentralised innovation. Although federal support influences the speed and scale of certain projects, the economic foundation for renewables and technology-driven energy solutions has grown resilient, showing the ability to progress regardless of administration shifts.

Corporate America and consumer expectations

Renewable energy has outpaced fossil fuels not just on environmental grounds but economically, as the cost of solar, wind and battery storage has decreased, making them competitive with traditional energy. Investments in clean energy are less tied to government support and increasingly driven by market forces, with institutional funds prioritising ESG-aligned assets. While federal initiatives like the Inflation Reduction Act (IRA) have accelerated growth, the clean energy sector’s foundation is strong enough to withstand potential policy changes.

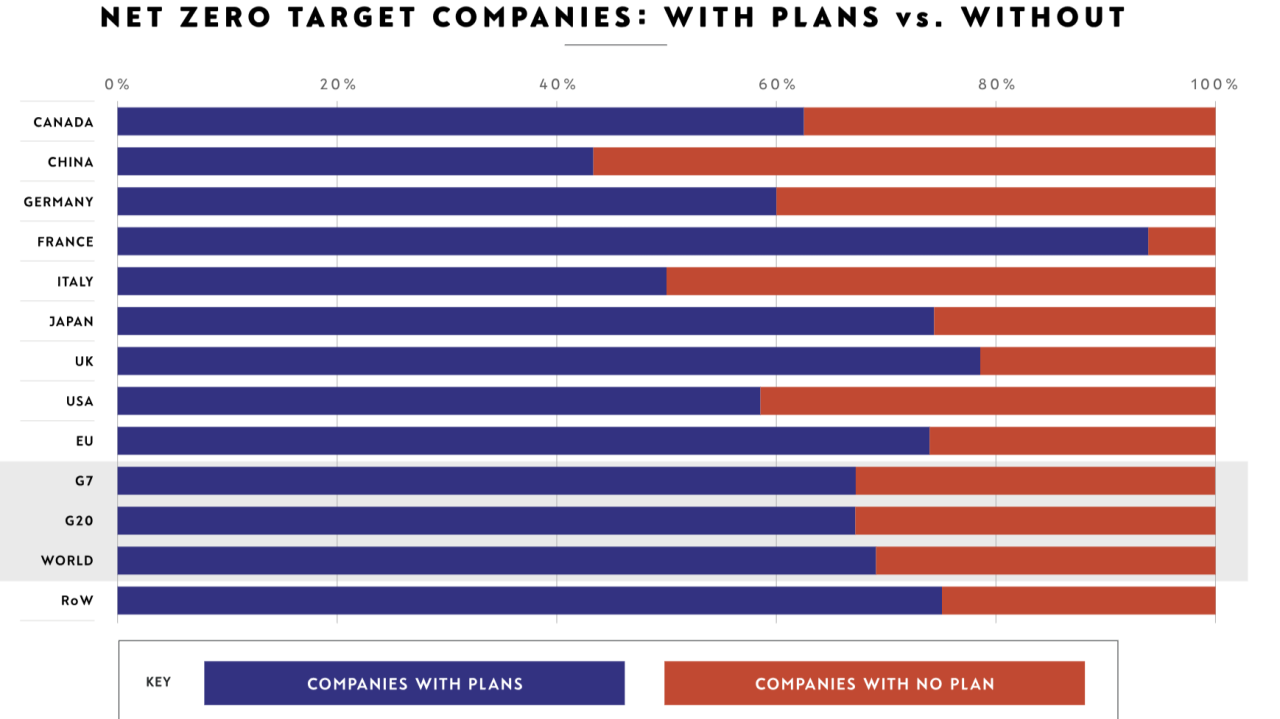

Major U.S. corporations have already embedded clean energy into their long-term strategies. Utilities and tech companies alike, driven by consumer expectations and competition, have committed to renewables through long-term Purchasing Power Agreements (PPAs). For these companies, sustainability is now integral to business competitiveness and brand value, a shift that has gained permanence beyond any single administration's tenure.

Despite his association with traditional energy, Trump’s stance on energy has evolved to embrace a broader “all-energy” strategy, including renewables alongside nuclear and natural gas. This approach aligns with his pro-business orientation, advocating for a competitive, diverse energy sector that enhances American energy independence. Although Trump might reduce clean energy incentives, the significant funds already allocated through the IRA would be difficult to fully reverse, allowing for continued momentum in clean energy investment.

Technology is transforming cost structures

Technological innovations in battery storage, electric vehicles and green hydrogen production have made the energy sector less reliant on federal incentives. Clean technologies are becoming economically viable, with costs nearing or reaching parity with traditional energy sources. Under Trump’s free-market stance, the emphasis on competitiveness could even foster innovation by pushing for more efficient, cost-effective clean energy solutions, ensuring that private capital continues to flow into renewables.

State and local governments hold considerable influence over energy policy, as demonstrated in Trump’s first term. States like California and New York continue to drive ambitious renewable energy goals, accounting for over half the U.S. economy in the U.S. Climate Alliance. Meanwhile, global demand for renewables is rising, with Europe and China committing to green energy on a massive scale. U.S. companies, recognising the competitive advantage in a global market increasingly oriented toward sustainability, are expected to stay the course in clean energy investment.

Under a Trump administration, the energy transition might prioritise a more diversified mix of traditional and renewable sources, while a Harris administration would likely have further accelerated the clean energy shift through robust federal incentives. Yet, both approaches operate within a market where clean energy is already an economic imperative, driven by consumer expectations, technological advancements and private capital.

Market dynamics drive the transition

Today’s clean energy momentum is powered by decentralised, market-driven forces resilient to political change. The transition is rooted in strong economic fundamentals, with innovations across green hydrogen, battery storage, solar and wind continuing to shape the future. Whether under a Trump administration’s broader energy approach or a more targeted clean energy push, the path forward is set by economics, technology and demand, suggesting that clean energy will continue to thrive regardless of politics.

Rahul Bhushan

Share "A Trump victory and the energy transition" on

Latest Insights

Lights in the fog: Positive signals for sustainability investment

2nd October 2025 • Henry White