Introduction to Natural Capital

James Clifton

25 years: Sustainability strategy

In this video, James introduces the five key questions that must be considered when exploring natural capital. He defines what natural capital is, why it is important and what implications the decline of natural capital is already having and will have in the near future. He delves into why natural capital is currently misvalued and finally, what we can do to move to a more nature positive economy.

In this video, James introduces the five key questions that must be considered when exploring natural capital. He defines what natural capital is, why it is important and what implications the decline of natural capital is already having and will have in the near future. He delves into why natural capital is currently misvalued and finally, what we can do to move to a more nature positive economy.

Natural capital is the essence of all goods and services and it plays a pivotal role in all of our lives. Natural capital is broadly split into two categories: non-renewable assets and renewable natural assets. It is estimated that these two categories underpin much of the world economy, with $44 trillion highly or moderately dependant on nature and its resources. Traditionally, natural capital has not been taken into account on corporate balance sheets and was not factored into decisions that have caused significant damage to natural resources. This needs to change to preserve the Earth for future generations.

Key learning objectives:

Understand what three activities are primarily contributing to a decline in natural capital

Understand different types of reporting and disclosure that are enabling organisations to identify their direct and indirect impacts on natural capital

Understand the different mechanisms that can be used to slow the loss of biodiversity

Comprehend the avenues to transition to a natural positive economy

Now free to watch

This video is now available for free. It is also part of a premium, accredited video course. Sign up for a 7-day free trial to watch more.

What is natural capital?

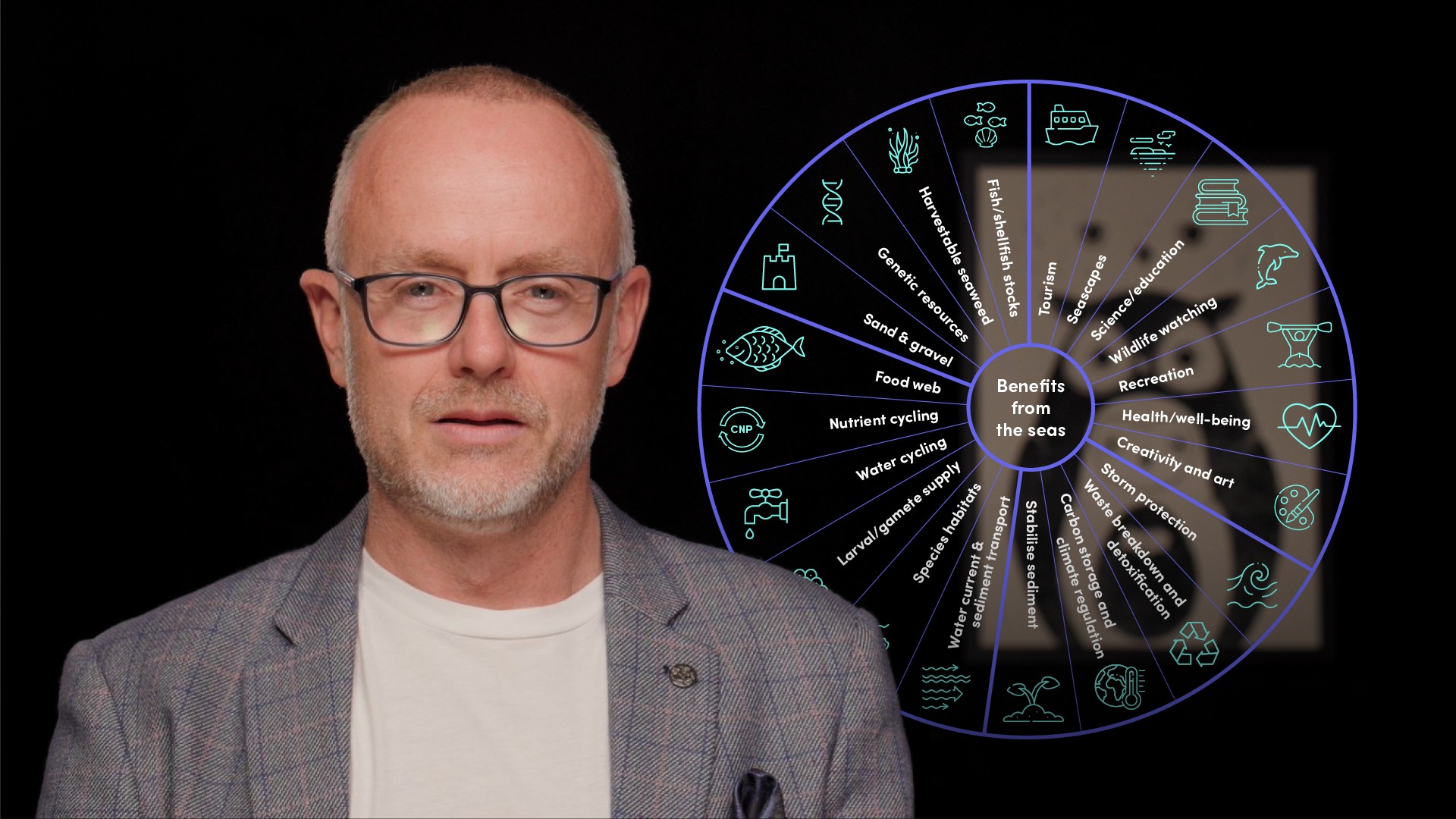

Capital consists of assets used for the production of goods and services. “Natural capital” is defined as the world's stocks of natural assets. Natural capital can be divided into two categories, non-renewable assets, such as gas and minerals and renewable assets, such as forests and farmland. There is a critical threshold with renewable assets, if the stock is depleted too much then certain assets will not be able to regenerate and will disappear. The benefits that natural assets provide are often referred to as ecosystem services.

How important is natural capital?

Natural capital is in decline, and trillions of dollars of global GDP (around half of all GDP) is highly or moderately dependent on nature. Estimates suggest that natural capital has declined by 40 per cent in only two decades. Every financial firm will be exposed to transition and reputational risks. The exploitation of natural capital is now having adverse effects on the climate.

Is the decline of natural capital an imminent concern?

The depletion of natural capital is causing a triple crisis in climate change, biodiversity loss and water. One of these areas is climate change. The recent IPCC report gave a ‘code red for humanity’. 50 degree temperatures are 3 times more likely to occur per year than they were 30 years ago. The ability of tropical forests to absorb carbon has declined by one-third since the 1990s from the effects of warmer temperatures and drought. The second concern is biodiversity loss. Our current actions could cause the loss of an estimated 1 million species. Wildlife populations have already declined by 60 per cent since 1970. This biodiversity loss has a huge knock-on effect on harvests and food supply, as insects and pollinators contribute heavily to the reproduction of crops. Finally, the water crisis, which is already impacting 2.3billlion people who live in water-stressed countries.

How do we value natural capital?

The Dasgupta review published in February 2021 was a landmark report commissioned by the UK Treasury, and urged the world’s governments to come up with a different form of national accounting that includes the depletion of natural resources. The Taskforce for Nature-related Financial Disclosures (TNFD), launched in June 2021 and provides a framework for organisations to report and act on evolving nature-related risks. The TNFD will complement the Taskforce for Climate-related Financial Disclosures (TCFD) which has become the global standard for reporting climate-related risk and opportunities.

The Capitals Coalition (made up of 380 global initiatives and businesses), is championing 'The Natural Capital Protocol' - a decision-making framework for organisations to identify, measure and value their direct and indirect impacts and dependencies on natural capital.

What is a nature-positive economy and how do we move towards it?

Nature-positive means enhancing the resilience of our planet and societies to halt and reverse nature loss. It is crucial that we invest in natural ecosystems that are biologically diverse as it is healthier and proven to provide a greater flow of ecosystem services and offer more climate resilience.

Both public and private markets need to understand the drastic consequences of not accounting for the true value that biodiversity and nature provides but also the economic opportunity of a nature-positive world.

Now free to watch

This video is now available for free. It is also part of a premium, accredited video course. Sign up for a 7-day free trial to watch more.

James Clifton

There are no available videos from "James Clifton"